A term life insurance policy is a form of personal insurance which, in its simplest form, will pay a lump sum to your family or beneficiaries if you die during the term of the policy.

You will pay a monthly or regular premium and, provided you maintain this payment, your dependents will receive the amount insured if you die during the term of the policy.

Life insurance in Ireland, in most cases, will pay a tax free lump sum, depending on who receives the benefit after you pass away.

Table of Content

What is term life insurance?

Term life insurance is a relatively straightforward, accessible, and affordable form of life insurance which will pay a lump sum should you die during the term of the policy.

The amount of benefit you receive will depend on the type of policy and the amount of cover you choose on purchasing the policy.

In choosing the right level of cover for you, it is helpful to consider the following factors:

Policy Term

Your age will determine the cost of your insurance premium as well as the term of your policy.

Life insurance on the Irish market is available for terms of 2 to 51 years, depending on your insurer and from age 18 to age 90. Generally, the older you are when you take out a life insurance policy, the more you will pay for insurance. The length of the term may also affect how much you pay.

You may choose to take out a life insurance policy to cover you until retirement age or the age at which your children may be financially dependent.

Amount of Cover

The amount of cover you choose will be determined by your individual circumstances. For example, the term remaining on any mortgage or the ages of your children or dependents as well as any debts you have may affect how much cover you choose.

You may choose level cover, decreasing cover, or increasing cover. Level cover means that the amount paid out will be fixed until the end of the policy. Decreasing cover is more often sold as mortgage protection where the amount of cover you have decreases as the term of the policy goes on and the outstanding balance of the mortgage decreases.

Increasing cover is usually an option where the amount of cover you have increases each year by a set percentage to keep up with inflation. Generally your premiums will not be fixed when you choose increasing cover as the premiums will increase in line with the increase in cover.

Who is covered by the policy?

Single life term life insurance covers the life of the policyholder only, Joint term life insurance covers the life of two policyholders, usually on a first death basis. Dual life term life insurance cover the live of both policyholders and will pay out twice, should both die during the term of the policy.

The amount you can afford to pay.

If you are looking for an affordable way to provide your family with financial security, term life insurance may be a way to leave them a lump sum with a relatively low monthly premium.

Who offers term life cover in Ireland?

When considering term life insurance in Ireland, the following providers should be considered. Compare all term life insurance providers to get the best possible deal.

When does term life insurance pay out?

Generally, term life insurance offers a cash lump sum on the death of the policyholder. Some term life insurance may pay out a monthly income on the death of the policyholder.

In the case of single term life insurance or joint term life insurance, the policy will cease on the death of the sole or first policyholder. With dual term life insurance, the policy will remain in place for the remainder of the term and will pay out a second time should the second policyholder die during the term.

Some term life insurance policies will pay the benefit if you are diagnosed with a terminal illness.

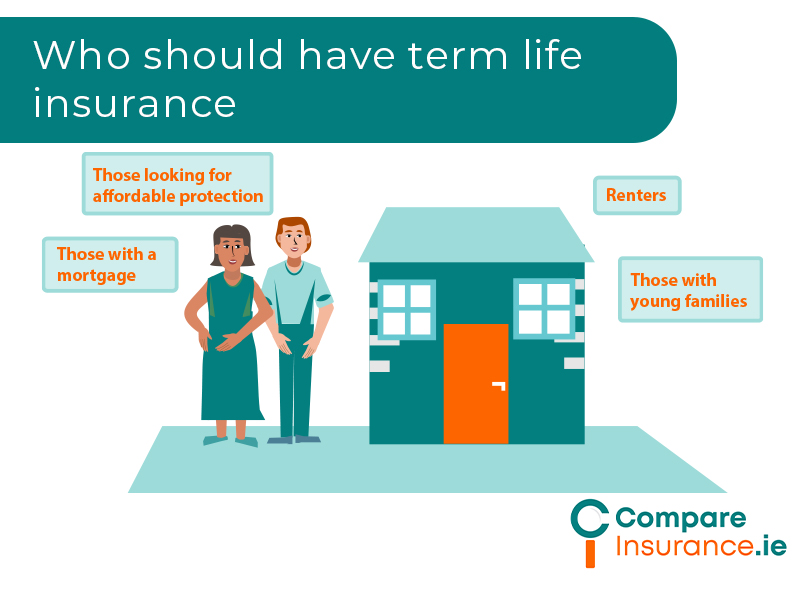

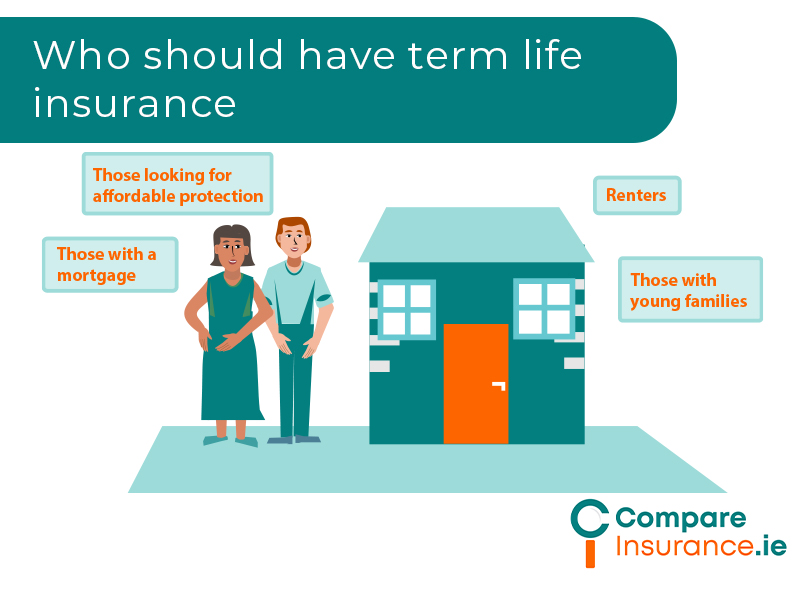

Who should have term life cover?

Those looking for affordable protection.

Term life insurance is relatively affordable when compared to, say, whole of life insurance. This makes it a good choice for anyone who wishes to have peace of mind without a high monthly premium.

Those with a mortgage.

For an affordable, fixed premium, level cover term life insurance will offer a lump sum for your dependents which will pay off the mortgage.

It offers higher protection than mortgage protection, however, as the payout will remain the same as the mortgage is paid off meaning that any benefit above the mortgage balance can be used to give your family additional financial security.

Renters.

As renting becomes a longer- term, more widespread way of housing families, those who rent may wish to have the peace of mind of having life insurance in place without owning property.

Term life insurance will offer your dependents a lump sum which will help them pay debts, bills, and provide accommodation should you die during the term of the policy.

Those with young families.

Should you pass away during the term of the policy, your family will receive a lump sum that can be used to replace your income, provide care for children, pay for education, and provide financial security as the children grow up.

Benefits of Term Life Cover

Term life insurance will pay out a tax free lump sum to your dependents, should you pass away during the term. It offers peace of mind and financial benefit to you loved ones.

You can choose term life insurance with a conversion option which offers a higher degree of flexibility as you can make changes to your policy during the term without providing new medical evidence should you wish to do so.

You can also choose term life insurance with specific or serious illness cover, which pays out a lump sum should you be diagnosed with one of a list of serious illnesses during the term of the policy.

Many life insurance companies offer health or support packages as part of their life insurance cover. For example, medical second opinion, counselling services, and therapy or rehabilitation following illness or accident.

How Compare Insurance Works

We compare all insurance options so you can be sure you’re always getting the best deal.

1. Select Your Product

Simply select the insurance product you need a quote for e.g. life, home or health insurance.

2. Online Quote Form

Fill out one of our simple online assessments with your insurance details.

3. Free Quote Consultation

A qualified financial advisor will call you back for your free insurance quotation.

What is the difference between term life and whole of life insurance?

Term life insurance lasts for the term of the policy. Any life cover ceases at the end of the time period which you selected on taking out the policy.

Whole of life insurance cover lasts for your whole life and offers a guaranteed payout on your death. It is, generally, much more expensive than term life insurance.

How much is term life cover?

| Insurer | Example 1* | Example 2* | Example 3* | |

|---|---|---|---|---|

| VHI | €13.17 | €37.10 | €148.93 | |

| Laya | €11.65 | €30.62 | No Quote | |

| Zurich | €10.00 | €27.44 | €129.25 | |

| New Ireland | €10.00 | €25.66 | €103.40 | |

| Aviva | €11.39 | €32.07 | €129.41 | |

| Royal London | €15.00 | €28.06 | €113.09 | |

| Irish Life | €15.15 Whole of life cover €143.41 monthly |

€37.51 Whole of life cover €361.26 monthly |

€160.47 Whole of life €837.95 monthly |

* Example 1 – Age 25, non smoker, €200,000 of cover over 20 years

* Example 2 – Age 32, non smoker, €415,000 of cover over 30 years

* Example 3 – Age 50, non smoker, €600,000 of cover over 20 years

Term Life Insurance Calculator

The factors which affect your life insurance quote:

Guaranteed or Reviewable Quotes

A guaranteed premium will be fixed for the life of the policy, a reviewable premium may mean that your insurer will review your premium during its term. A reviewable quote may mean that you face serious price hikes from your insurer over the life of the policy.

Get a term life insurance quote today.

Use our online tool to get the best life insurance policy for you at the most affordable price.

We compare all the insurers on the market so you can be confident that you are getting the best quote for term life insurance.