Electric scooters have exploded in popularity in recent years and are seen as a convenient, eco friendly, affordable way to travel. Electric scooters are motorised meaning that you don’t have to pedal or push them on the road and folding e- scooters are portable and can be used in conjunction with public transport.

However, until very recently, it was illegal to ride an e-scooter on an Irish road. Legislation concerning their use was introduced in June 2023, however, and it is expected that regulations will follow. This will allow compliant e- scooters to be legally used on Irish roads.

Table of Content

Use of electric scooters & the law in Ireland.

A new category of vehicle, powered personal transporter (PPT) has been created under the Road Traffic Act 2023, which includes e-scooters designed to go at speeds of up to 25km an hour.

This category of vehicle is exempt from motor tax, vehicle or driver registration, and insurance. More powerful e-scooters and e-bikes will come to be treated as light mopeds and will need to be taxed, registered, and insured when regulations come into effect in late 2023.

It is not possible at present to buy specific e- scooter insurance in the Irish market. However, some scooter rental companies may provide insurance with an e-scooter rental and, given the peace of mind and other benefits of insuring your e-scooter it may just be a matter of time before this type of insurance becomes available.

Electric Scooters & Home Insurance

It may also be possible to avail of some financial protection for your e-scooter through your home contents insurance if you have a home insurance policy.

Home contents insurance allows for the addition of cover for sports equipment and/ or specified and unspecified valuables.

Usually there is a single item limit in claiming for unspecified valuables which may not offer enough financial protection for your e-scooter, however.

Cover for sports equipment and specified or unspecified valuables may also be available on an ‘all risks’ basis, which means that you may be covered for theft or damage to your e-scooter when using it outside the home.

Who offers electric scooter insurance in Ireland?

Specific electric scooter insurance is not currently available in Ireland, however, given the cost of e- scooters and the risks associated with riding an e- scooter, voluntary forms of insurance may be introduced.

New regulations due to come into effect in Ireland in late 2023, mean that more powerful e- scooters designed to go above 25km an hour, and more powerful e-bikes come under a new category of vehicle known as mechanically propelled vehicles (MPV) and will, like light mopeds require driver licences, registration for motor tax, and insurance to drive legally on Irish roads.

These new regulations may mean that insurance companies will introduce e- scooter insurance in some forms into the Irish market.

Currently, motorbike insurance is available to cover the use of light mopeds as well as more powerful motorbikes. Moped insurance is available in Ireland from following providers:

E-bike insurance designed to cover riding of e-bikes is available from the following provider:

E-bike insurance offers protection for assisted riders that travel up to 25km an hour. It offers a range of cover some of which includes:

Bikmo electric bike cover also includes family cover and a multi bike discount if you insure more than one bike with them.

How much is electric scooter insurance in Ireland?

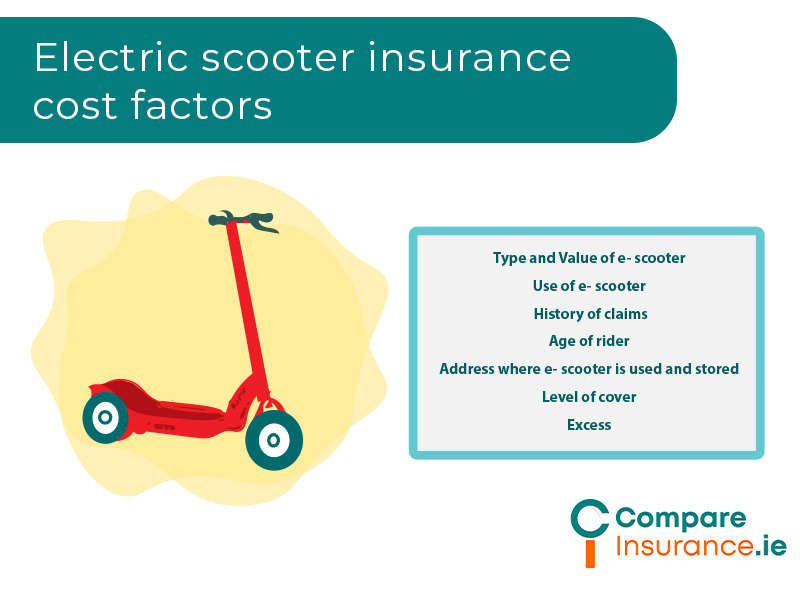

Electric scooter insurance is not yet available in Ireland. However, the benefits of financially protecting your e- scooter may mean that e-scooter riders will wish to avail of e-scooter insurance sooner rather than later. The price of e-scooter insurance is likely to be determined by the following factors:

Get electric scooter insurance today!

The Irish insurance market is very dynamic. Increasing popularity of e-scooters, along with the desire to have peace of mind and avail of financial protection for their e-scooter, may mean that increased demand for e-scooter insurance from riders will lead to its introduction into the Irish market.

It may also be possible to avail of home insurance cover that includes e-scooters.

Take the Compare Insurance online assessment, linked below to get a FREE Quote for your e-scooter insurance.