Travel insurance offers financial protection for unforeseen events whilst travelling or while on holiday. Having financial protection in place will give you peace of mind that many expenses arising from these events will be covered by your travel insurance policy.

Table of Content

What is travel insurance?

Travel insurance offers financial protection if you require medical assistance while on holiday. It will cover emergency medical treatment abroad. It will also offer cover if you need medical evacuation to a local healthcare facility or repatriation home in a medical emergency.

Disruption to your travel arrangements is also covered, in varying degrees,by travel insurance. Additional expenses due to cancelled flights, delays, or lost baggage should be covered. If you need to cancel your holiday due to illness of a close family member, for example, travel insurance will offer financial protection.

Personal liability cover is generally included in travel insurance ie. if you cause an accident or injure another person while on holiday.

Who offers travel insurance in Ireland?

When choosing a travel insurance provider in Ireland you should consider the following providers.

Compare Travel Insurance Providers

There is a huge range of protection offered by the travel insurance providers and the types of cover and extent of cover can also be different between insurers.

A number of non-traditional insurance companies such as An Post have entered the market in recent years.

AIG Travel Insurance

AIG offers a wide range of policies to cover single trip, multi trip, long stay, winter sports, family holiday, backpacker, and golf insurance policies available.

They also offer car hire excess policies.

AIG’s premier plus level policies offer unlimited medical expenses cover, giving you complete peace of mind.

An Post Travel Insurance

An Post offers single or multi trip cover for families, couples, or individuals.

They offer good cover for families with up to seven children under 18 covered on one policy, as well as young adults aged 18-22 who are in full time education.

An Post gives an up to 30% discount if you purchase travel insurance online.

Blue Insurance Travel Insurance

Blue insurance offers single, multitrip, and backpackers travel insurance.You can also include winter sports cover as an additional option.

Blue insurance also offers car hire excess and gadget insurance so it might be worth getting additional cover from the same provider if you wish to purchase additional cover for car hire, or gadgets etc.

Multitrip.com Travel Insurance

Multitrip.com offers cover for single, multitrip, backpacker, family and skiing holidays.

Multi trip.com also offers specialised cover for weddings, cruises, over 70’s, and business travel.

Over 70’s travel insurance is available to those with pre-existing medical conditions and offers this age group up to €20 million in medical expenses cover.

Allianz Travel Insurance

Allianz offers a comprehensive range of travel insurance products with cover at Bronze, Silver, and Gold levels.

Allianz offers insurance specifically for business travellers with additional protection such as cover for business equipment and gadgets, as well as assistance towards travel for a business associate to complete your trip should you have to come home early.

Aviva Travel Insurance

Aviva offers travel or holiday insurance at two levels – Holiday and Holiday Plus, as well as Backpacker insurance.Winter sports cover and car hire excess cover are available as optional extras.

Aviva offers unlimited Chubb assistance in association with Chubb European Group which offers emergency medical assistance, evacuation, and repatriation when needed as well as interpreter services and legal advice abroad.

How to compare travel insurance?

Having paid for that expensive trip or holiday, nobody wants to have to fork out a lot for travel insurance on top but travel insurance will more than pay for itself if something goes wrong.

It is important to consider other factors as well as price also so that you get the best cover for you:

How Compare Insurance Works

We compare all insurance options so you can be sure you’re always getting the best deal.

1. Select Your Product

Simply select the insurance product you need a quote for e.g. life, home or health insurance.

2. Online Quote Form

Fill out one of our simple online assessments with your insurance details.

3. Free Quote Consultation

Simply select the insurance product you need a quote for e.g. life, home or health insurance.

What do all travel insurance policies cover?

Below are some features that are common to almost all travel insurance. When comparing travel insurance, it is a good idea to look at these features of the policy first as they are the things that often go wrong when you are travelling.

Travel insurance add ons

It is important to tailor your cover to the trip you intend to undertake as you may need more specific protection. Here are some of the types of additional cover available with travel insurance.

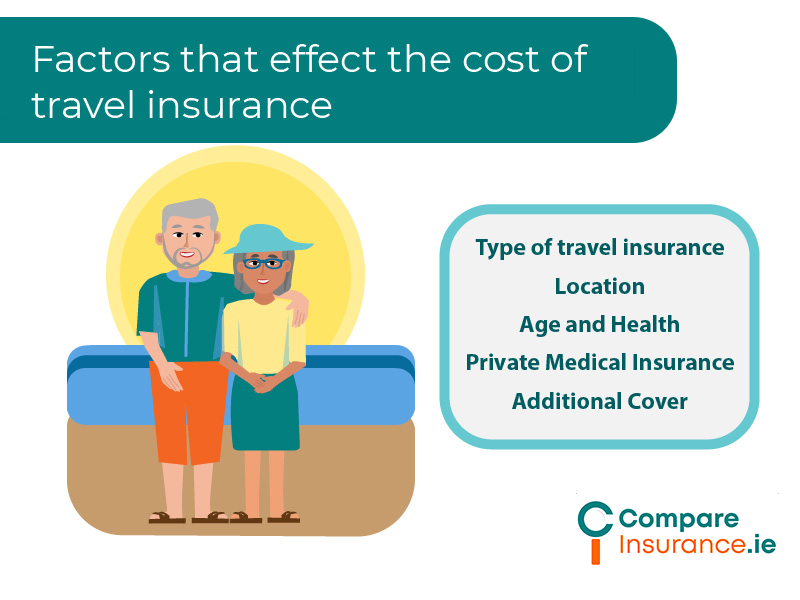

What factors affect the price of travel insurance?

It is a good idea to be aware of the different factors that affect the price of travel insurance policies so you will be able to compare between them.

Get a travel insurance quote today.

Holiday time is precious and you want to get away with the minimum of stress and hassle but things can go wrong and expenses can mount up quickly when they do!

Get in touch today and find the best travel insurance for your trip to give you peace of mind so you can relax and enjoy your time away.