We carry so many gadgets around with us everyday and we increasingly rely on them for work, social, and day to day activities and for information. Shiny, new smartphones, and laptops in particular can also be worth thousands of euro.

Gadget insurance gives you peace of mind that the gadget you rely on is covered should something happen to it, you won’t need to pay a fortune to repair or replace it.

Take the Compare Insurance free online assessment to get the best quotes for Gadget insurance today.

Table of Content

What is gadget insurance?

Gadget insurance offers protection should your smartphone, laptop, tablet, smart watch, camera, headphones, games console, or Kindle be broken, stolen, damaged, or lost.

Gadget insurance will cover repair or replacement with a refurbished device and will also cover the cost of fraudulent use of your phone when it was lost or stolen.

Who offers gadget insurance in Ireland?

When looking for gadget insurance in Ireland the following providers should be considered:

What is included in the gadget insurance policies from each provider?

Protection offered by gadget policies varies by provider with some gadget insurance providers offering policies at different levels. It is important to be aware of what cover is included in your policy to ensure it is right for you.

Loveitcoverit.ie

Loveitcoverit.ie offers mobile and gadget insurance with Plus and Premium Plans that offer cover for:

Loveitcoverit offers worldwide cover with unlimited claims. They offer a 10% discount if you insure more than one gadget. They will also cover gadgets up to 3 years old and second hand gadgets (with some conditions).

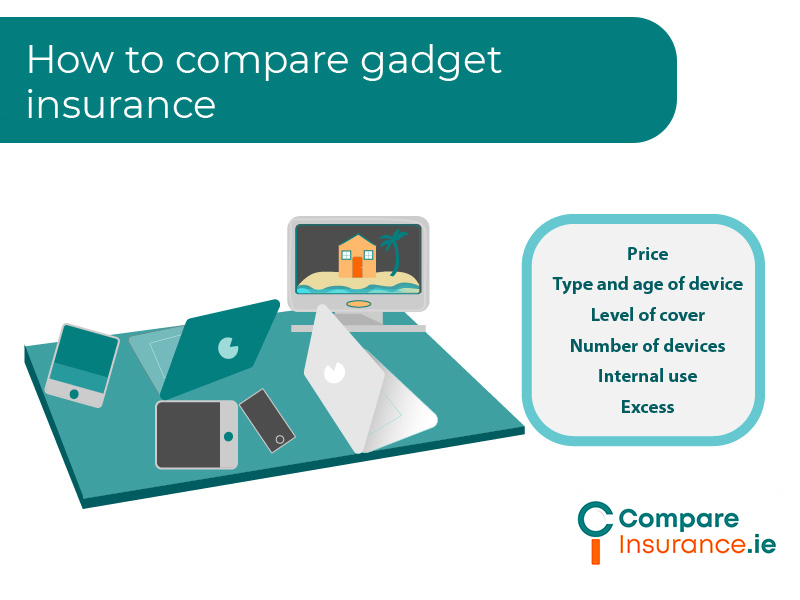

How to compare gadget insurance?

There are many factors that are important in choosing gadget insurance, bear in mind that gadget insurance premiums are based on the type, model, and value of the gadget as well as the amount of cover offered.

In comparing gadget insurance it is good to bear all factors in mind.

How Compare Insurance Works

We compare all insurance options so you can be sure you’re always getting the best deal.

1. Select Your Product

Simply select the insurance product you need a quote for e.g. life, home or health insurance.

2. Online Quote Form

Fill out one of our simple online assessments with your insurance details.

3. Free Quote Consultation

A qualified financial advisor will call you back for your free insurance quotation.

Gadget Insurance Policy Add-ons

There are limited add ons to gadget policies.

Blue Insurance and Gadgetinsurance.com offer cover for accidental loss as an additional cover.

Zurich Mobilecover and Loveitcoverit.ie offer a range of plans with different levels of cover available.

Case Studies

Here are some examples of where gadget insurance can offer protection:

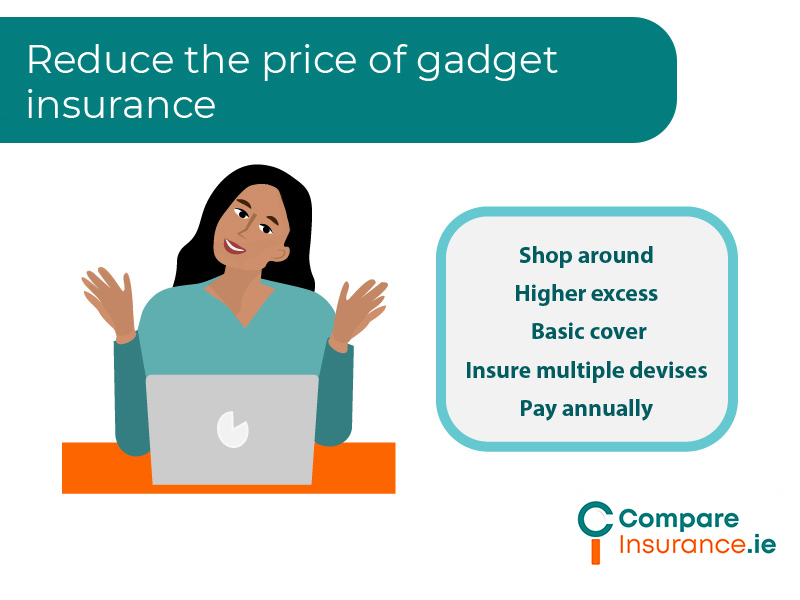

How to reduce the price of gadget insurance?

There are ways to reduce the cost of your gadget insurance:

Get a gadget insurance quote today.

Phones, devices and gadgets are essential to our lives and can easily be damaged, lost, or stolen. How would you manage without your smartphone, tablet or laptop?

Gadget insurance will protect you from the unexpected expense of repairing or replacing you gadget should something happen to it.

We can get you the best quote on the right gadget cover for you today!