For more information on how your data is used, please see our Privacy Policy.

Pet insurance offers financial protection for unexpected expenses in owning a pet. Unexpected vets bills or an accident involving your pet will result in bills that can be substantial.

Pet insurance is a form of personal insurance that covers your pet(s) should they have an accident or be ill and need veterinary care, at a minimum.

Different insurers offer different types and levels of cover, some cover your pet for 12 months and some are lifetime plans.

Who offers pet insurance quotes in Ireland?

How much are pet insurance quotes in Ireland?

Quotes for pet insurance can vary widely. Factors such as the type and breed of pet, as well as their age and health will affect the quote you receive. Below are some examples of prices for pet insurance.

Pet Insurance Quote 1

Small dog, mixed breed, 1 year old, female, neutered, microchipped.

| Insurer | Quote | |

|---|---|---|

| Blue Insurance | Essential €8.33 – Excess €125 Premier €13.64 Premier Plus €16.44 |

|

| Allianz | €16.70 – Excess €100 |

Pet Insurance Quote 2

Cat, mixed breed, 1 year old, neutered.

| Insurer | Quote | |

|---|---|---|

| Allianz | €12.75 – Excess €100 | |

| Agria Petinsure | Accident Only €10.00 – Excess €90 Care Plan €11.94 – Excess €150 Care Plan Plus €13.98 – Excess €90 |

Pet Insurance Quote 5

Dog, Pedigree Bulldog, 4 years old, neutered male, microchipped.

| Insurer | Quote | |

|---|---|---|

| Allianz | €44.19 – Excess €100 | |

| Blue Insurance | Essential €30.20 – Excess €125 Premier €55.04 Premier Plus €67.04 |

How to reduce the cost of pet insurance?

Pet insurance can seem expensive but there are ways to lower the cost. Bear in mind though that it is important to have a sufficient level of cover as well as just comparing different pet insurance plans on price alone.

It is possible to find more affordable pet insurance if you shop around.

Here are some ways to bring down the cost of pet insurance:

How Compare Insurance Works

We compare all insurance options so you can be sure you’re always getting the best deal.

1. Select Your Product

Simply select the insurance product you need a quote for e.g. life, home or health insurance.

2. Online Quote Form

Fill out one of our simple online assessments with your insurance details.

3. Free Quote Consultation

A qualified financial advisor will call you back for your free insurance quotation.

Is there pet insurance excess?

Pet insurers offer different levels of pet insurance excess with their pet insurance plans. An excess is the amount you pay out of pocket for your pet expenses before you are offered protection by your pet insurance.

Allianz

Allianz has an excess of €100 on their pet insurance policy. With Allianz, you may choose a higher or lower voluntary excess which will affect the premium you pay for pet insurance.

Blue Insurance

Blue Insurance has an excess of €125 on their policy. Blue Insurance also add 15% excess for treatments for pets over 5 years old.

Agria Petinsure

Agria Petinsure has a Care Plan and a Care Plan Plus which offer the same cover but with different excesses on the plans. Agria Care Plan has an €150 excess, and Care Plan Plus has a €90 excess.

It is important to remember that with pet insurance excess, you will pay once per condition, per year. If you have a pet with multiple health issues, you may find that your expenses will add up quickly.

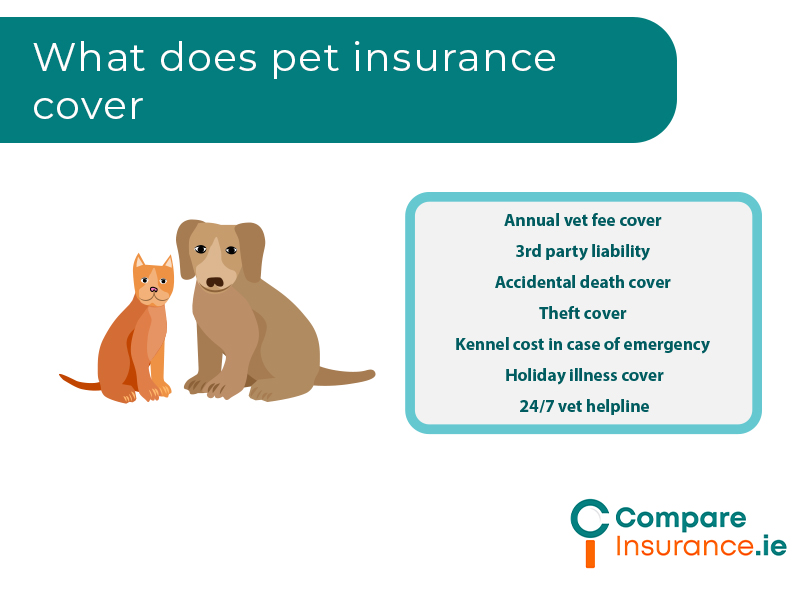

What is included in all pet insurance quotes?

Generally, veterinary care will be covered up to the limit specified in your pet insurance policy in all pet insurance plans. In accident only plans, vets bills will be covered in the event of an accident only. All other plans will cover veterinary care for an accident or for illness.

Pet insurance for dogs always includes cover for third party liability should your dog cause an accident or injury to another person or their property.

Unless you buy an accident only plan, all pet insurance also offers benefit if your pet should go missing, be stolen, or stray. Most pet insurance will offer protection if you are hospitalised in an emergency and your pet needs to go to a kennel or cattery.

If your pet dies in an accident or through illness, most insurers pay some benefit.

Pet insurance quote add ons:

Blue Insurance offers a veterinary helpline with their pet insurance. Blue also offers cover for complementary treatments for your pet.

Agria Petinsure offers €1,000 benefit should you need to have your pet euthanised or cremated.

Allianz offers holiday cancellation cover, where you are protected if you have to cancel your holiday due to your pet going missing or being ill.

Only Blue Insurance and Allianz offer protection for your pet overseas, this is an optional extra with Blue Insurance.

What pets can be covered by pet insurance?

In Ireland, pet insurance is available for cats and dogs only.

Insurance for cats tends to be a little bit cheaper as pet insurance for dogs often includes third party liability cover should your dog injure someone or damage their property.

There are instances where the age, breed, or health of your pet may mean that they are offered pet insurance with exclusions or you may be unable to be covered by pet insurance. If you have an older pet it may be sufficient to choose a 12 month plan.

Get your best pet insurance quote today!

We love our pets but keeping them healthy and safe can throw up unexpected expenses and bills associated with your pet can add up quickly should the unexpected happen.

To find the best pet insurance and protect your pet, take our online assessment and find the best cover at the best price for you.