Installing solar panels to your home is a way to reduce your carbon emissions and lower your energy bills. The energy generated by PV solar panels is renewable energy and the increasing sight of rooftop solar panels on houses around Ireland shows that more and more people are investing in them.

What are the implications for home insurance? Installing solar panels is expensive and you will want to protect your investment as well as ensure that your home insurance offers protection should something go wrong.

Table of Content

How to insure your home solar panels in Ireland?

Most home insurance companies will include solar panels on your home insurance. If you install rooftop solar panels, they would be seen as a permanent addition to the fabric of your home and would be included in your buildings cover.

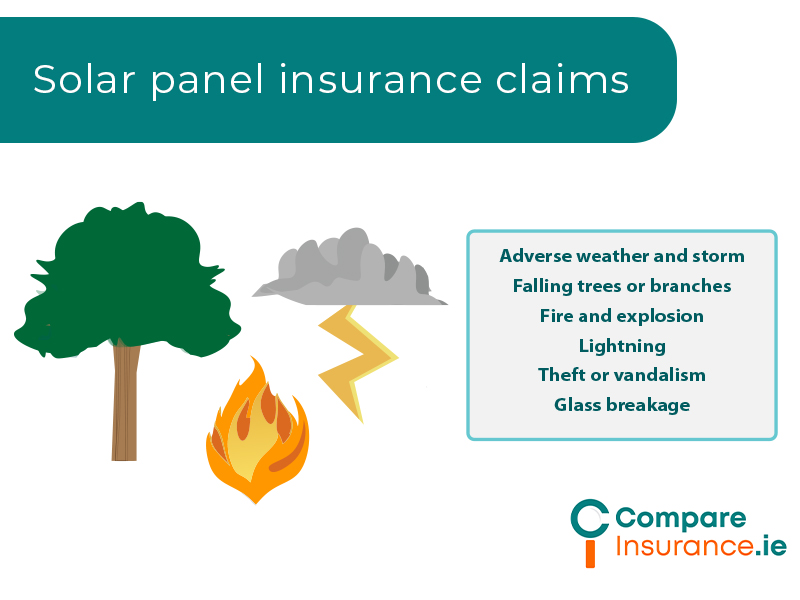

Your building’s cover will typically protect your solar panels in the event of damage due to fire, adverse weather, storm or a tree falling. Theft and vandalism would also be covered under your home insurance policy.

However, as with all renovations or extensions to your home, you will need to inform your home insurer before you carry out the installation as failure to do so may invalidate your home insurance. It is a good idea to check what cover is included in your policy also before you install solar panels.

Who offers home insurance with solar panel cover in Ireland?

The insurers who offer home insurance in Ireland are as follows:

(through brokers)

The cover available for solar panels as part of home insurance may vary between insurers. It is always wise to check the level of cover offered for solar panels with your insurer.

Insurance cover for accidental damage to your solar panels is not always offered as standard, for example, so it is a good idea to shop around.

How do solar panels affect the cost of home insurance?

Solar panels are expensive to install and will increase both the value of your home and your rebuild cost. This means that they may increase the cost of your home insurance.

The buildings cover in your home insurance are based on the rebuild cost of your home. This is not the same as the market value. In calculating the rebuild cost of your home, the cost of repairing or rebuilding the structure of the house, as well as any permanent fixtures and fittings is included, but not the value of the land on which your house is situated.

Solar panels may also be vulnerable to storm or weather damage as well as the risk of falling trees, so these additional risks may be reflected in your home insurance premium.

Qualified Installers

As with other forms of heating system, it is essential that they are installed by a qualified installer. There may be some safety issues with solar panels as they may increase your risk of fire and can have safety implications in the event of fire. This increased risk may also be reflected in your home insurance premium.

It is also essential to ensure that your solar panels are regularly maintained as wear and tear type damage will not be covered by your home insurance.

What types of solar products can be insured?

Generally, insurers will cover solar PV panels attached to the roof of your home as part of your buildings cover as these are a permanent fixture of the home .

If you have solar panels separate to the structure of your home such as on a mast or outbuilding or on the ground, you would need to discuss this with your home insurer to arrange cover.

Common solar panel insurance claims

Generally buildings cover on your home insurance will offer protection for damage to solar panels caused by:

How much does it cost to insure a home with solar panels?

Insurers vary in the price differences between homes with solar healing and gas boilers, the example below shows price differences for different insurers (annual prices).

3 bed semi-detached home in Cork suburb, built in 2003, rebuild cost €180,000, contents value €45,000, standard construction, excess €250

Solar panel insurance FAQs

Learn more about solar panel insurance today

If you have made the investment in solar panels for your home or are considering installing them, then you will want to ensure that they are insured and protected. Insurers vary in the cover they offer to protect your solar panels and it can be difficult to know which is the beat policy to choose.

Contact Compare Insurance, or fill in the assessment and we will go through your options with you and find the best insurance for your home to give you affordable peace of mind.