Health insurance, dental insurance, or health cash plans can offer protection against unexpected medical expenses and can also offer some cover for everyday medical expenses.

Insurance can help you to plan and budget for routine medical, or dental expenses so that you are less likely to be caught out with an unforeseen expense.

You can benefit from income tax relief on the premiums that you pay each month making health, medical, or dental insurance a little bit more affordable.

Table of Content

Tax relief on insurance premiums

If you have a health, dental or medical insurance policy in Ireland, you may be entitled to tax relief on your health, medical or dental insurance premiums. This may be available on either:

Approved insurers

In order to qualify for tax relief, you must purchase the health or medical insurance policy from an approved insurer. The HIA lists registered insurers with open membership as:

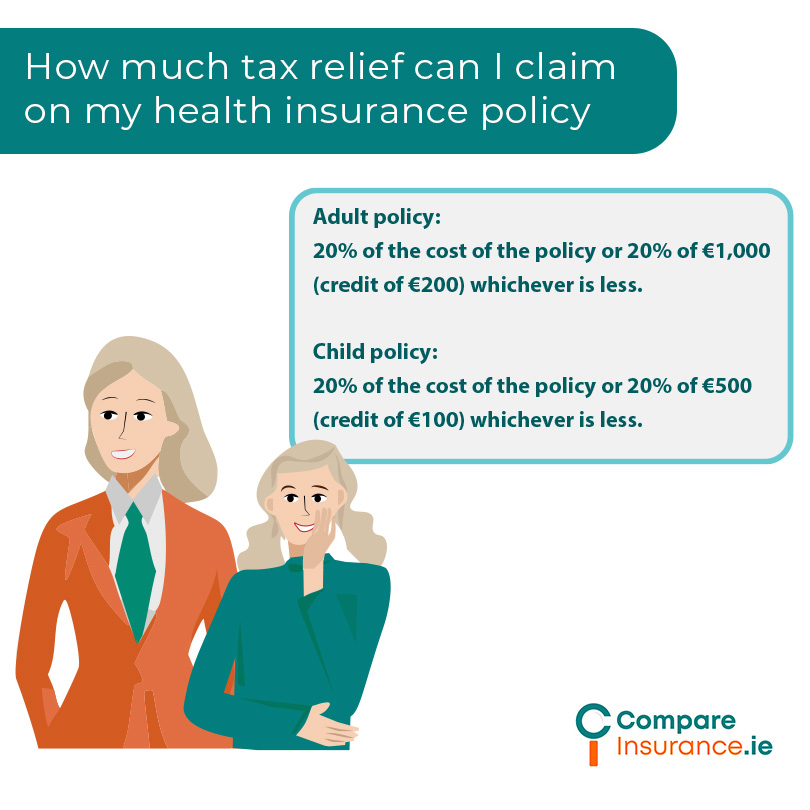

How much tax relief can I claim on my health insurance policy?

The tax relief to which you are entitled is different for an adult health insurance policy and a child health insurance policy (up to 21 years) and is as follows:

Tax relief on health insurance that you pay for yourself or your family.

If you pay for health insurance yourself from an approved insurer, you are entitled to tax relief. However, you do not need to claim this tax back as it is given as a discount on your policy i.e. tax relief at source (TRS).

This means that the tax relief is already applied to your health, dental, or medical insurance premiums before you pay them.

Tax relief on health insurance paid for by your employer.

If your employer pays for your health insurance policy, the rules are slightly different.

As this is a benefit in kind, you will be taxed on the gross value of the health, dental, or medical insurance policy or policies.

You will then need to claim the health or medical insurance tax relief yourself from Revenue as it is not taken from the premiums. This means that the premiums are not net of tax relief, unlike health, dental, or medical insurance premiums that you purchase and pay for yourself.

This applies to 2019 and subsequent years, and you can claim for any of these years if your employer paid for your health insurance in those years. You can do this online with Revenue using myAccount or Revenue Online Service (ROS).

You must include details of:

If your employer pays for a proportion of the cost of the policy, you can only claim tax relief from the proportion that your employer pays for. You will already have received tax relief at source (TRS) or a discount on the proportion of the policy that you pay for yourself.

Income tax on medical expenses

If you have medical expenses in any year that are not covered by health, medical, or dental insurance you can also claim tax relief on those medical expenses.

Your health, or dental insurance may pay a portion of your medical expenses, but most policies will leave a shortfall between what is covered and the amount you pay and you can apply for tax relief on the portion that you pay.

If you pay for certain medical expenses for yourself or for another person, you can claim income tax relief, usually at 20% (nursing home charges can be claimed at your marginal tax rate i.e. highest rate of income tax).

These expenses may include:

If any of these expenses can be claimed from another source, such as health insurance, then only the portion that has not been refunded can be claimed. If a treatment is not covered in full by health insurance or dental insurance or a health cash plan, you can claim 20% tax relief on the portion that you pay yourself.

You can claim for expenses from four years after the year in which you paid for it (i.e. received the treatment), so you may be able to claim a tax rebate from 2019. You can claim through MyAccount or Revenue Online Service (ROS). You will need to keep receipts for all treatment for which you are claiming, and your dentist may need to provide a Med 2 form as a receipt.

How Compare Insurance Works

We compare all insurance options so you can be sure you’re always getting the best deal.

1. Select Your Product

Simply select the insurance product you need a quote for e.g. life, home or health insurance.

2. Online Quote Form

Fill out one of our simple online assessments with your insurance details.

3. Free Quote Consultation

A qualified financial advisor will call you back for your free insurance quotation.

Treatment benefit scheme.

Your medical, health, or dental insurance may pay some benefit towards dental, optical, hearing, or hair replacement services.

You may also be entitled to some contribution towards these expenses if you pay PRSI contributions (pay related social insurance).

The Department of Social Protection will pay a minimal contribution towards these expenses if you have made enough qualifying PRSI contributions.

Dental benefit

You may be entitled to a contribution of €42 towards the cost of a scale and polish and periodontal treatment every year.

Optical benefit

You may be entitled to a free eye test every two years, as well as a contribution towards the cost of glasses or contact lenses.

You may also be entitled to a grant of €500 (per eye) if you are prescribed medical contact lenses every two years.

Hearing benefit

You may be entitled to a grant of €500 (per ear) every 4 years towards the cost of a hearing aid.

Hair replacement

If you suffer hair loss due to cancer or alopecia, you may be entitled to a grant of €500 for a hairpiece or wig.

You must have paid certain classes of PRSI contributions, as well as made a certain number of contributions depending on your age to qualify for the treatment benefit scheme.

You may be able to claim the treatment benefit from the dental, optical, hearing or hair replacement provider, depending on your eligibility.

Contact us today.

You can choose a health insurance, dental insurance, or health cash plan that will offer you protection against or cash back on your everyday medical expenses and it may not cost as much as you think. You may also benefit from tax relief on your premiums.

If you have any questions about health insurance, dental insurance, or health cash plans, give us a call or fill out our online form and we can help you to find cover that is appropriate for your circumstances and that is affordable.

Our qualified financial advisors can discuss your options with you.