Holiday home insurance is similar to standard home insurance in that it covers the building or structure of your holiday home or second home and its contents from the same risks as home insurance i.e. fire, storm, theft or attempted theft, flood, malicious damage, escape of water or oil.

A holiday home represents a significant investment and holiday home cover will offer complete peace of mind that you are covered for damage while you are not there.

Table of Content

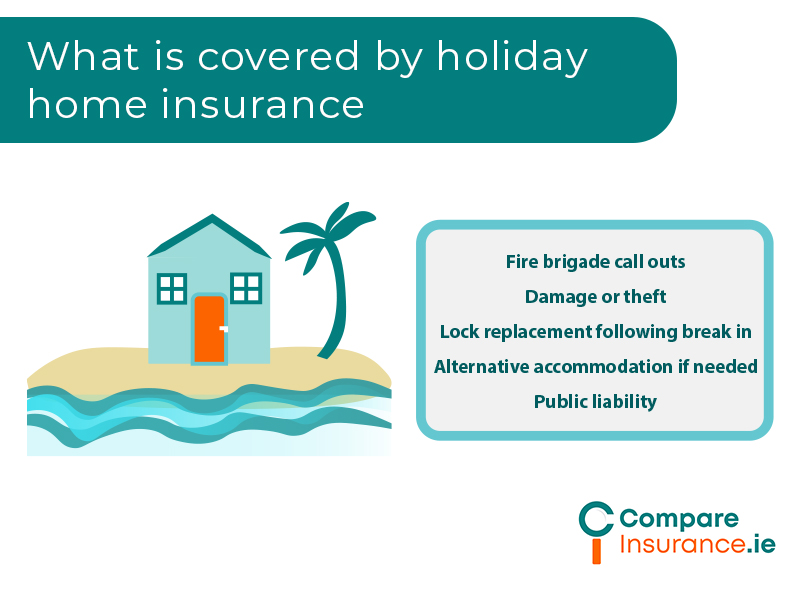

What is covered by holiday home cover?

Many holiday home insurance policies will offer a 24/7 emergency assistance service which will make your holiday home secure following an insured risk occurring. this will not affect your no claims discount.

Fire brigade charges are included as standard in most policies and cover local authority fire brigade charges should there be a fire in the holiday home.

Most holiday home policies offer lock replacement following a theft or attempted theft.

Some holiday home insurance policies cover alternative accommodation should the holiday home be uninhabitable following an insured risk.

Public liability is standard in holiday home policies should someone have an accident whilst staying in the holiday home.

Free Service

All information is provided free of charge to the public, we do our best to keep all the information up to date and accurate.

Unbiased Information

Our information is provided free of charge and without any bias. Unlike other comparison sites we do not have preferential deals with any particular insurance company.

Vetted Insurance Partners

Our Central bank regulated insurance partners are vetted for customer service and expertise, so you know you’re always getting the best advice possible.

Who offers holiday home insurance in Ireland?

Compare

holiday home

providers.

Compare holiday home insurance today with Compare Insurance. Take our online home insurance assessment to find who the most suited holiday home insurance provider is for you.

AXA Holiday Home Insurance

AXA offers a 15% discount for insuring a second home as well as having a home insurance policy with them, and a 5% discount for having a car insurance policy. AXA also offers optional accidental damage cover as part of their holiday home policy.

Allianz Holiday Home Insurance

Allianz covers clean up expenses for an oil or water leak up to €2,000 as well as new for old cover.

AA Holiday Home Insurance

AA will pay up to €3,000 for the contents of any outbuildings.

OBF Holiday Home Insurance

OBF offer holiday home insurance for holiday homes of non standard construction.

Liberty Holiday Home Insurance

Liberty offers additional accidental damage cover as well as new for old contents cover.

How is holiday home insurance different from standard home cover?

Holiday home insurance differs from standard home and contents insurance in that it allows for the house to be unoccupied for greater periods than the standard 30 days a year that standard home insurance allows.

When the holiday home is left unattended, there is a greater risk of damage, especially from leaks eg. a burst pipes storms, flooding, fire, break ins and vandlism.

Holiday home premiums may have restricted cover for these risks as well as higher excesses.

An excess is the amount you will have to pay out of pocket for repairs or rebuilding following an insured risk before the insurance company will cover the damage.

Insurance for Short Term Letting

Holiday home insurance covers the holiday home for family holiday use but can also be arranged to cover short term letting of the holiday home.

It is important to check conditions surrounding short term lettings as some insurance companies will not cover Airbnb lettings and there may also be a limit on the number of lettings allowed per year.

How do I lower the cost of the premium?

In order to minimise claims and to keep your no claims discount to keep your premium at an affordable price, it is important to keep the property in good repair, have burglar and smoke alarms fitted, and have locks in place.

It is a condition of some holiday home insurance policies that water in the property be turned off and the heating system drained between October and March each year to protect from leaks.

Get holiday home cover today.

Take our online assessment today and a member of our team will be in touch with the best quote on the market for you.

Get a FREE home insurance quote today with Compare Insurance.