Employers liability insurance offers your business protection in the event that an employee is injured or becomes ill as a result of their work for your business.

Employers liability is not a legal necessity in Ireland, unlike in the UK, but it is an essential form of business insurance to protect your business and its finances.

Table of Content

What is Employers liability insurance?

Employers liability insurance offers protection should an employee have an accident causing injury or suffer a disease as a result of their employment at your business.

Although employers liability insurance is not compulsory, as an employer you have a duty of care towards your employees. You are responsible for the health and safety of your staff.

Under health and safety at work legislation in Ireland, employer obligations are outlined and breach of these obligations could leave you legally liable for any breach which causes injury, property damage, or disease in your employees.

If you are found to be liable, you may be required to compensate employees for injury or illness that arose while they were in your employment as a result of their employment. Included would be injuries or illnesses that may become apparent after they have ceased to work for your business, but are found to be as a result of working for your business.

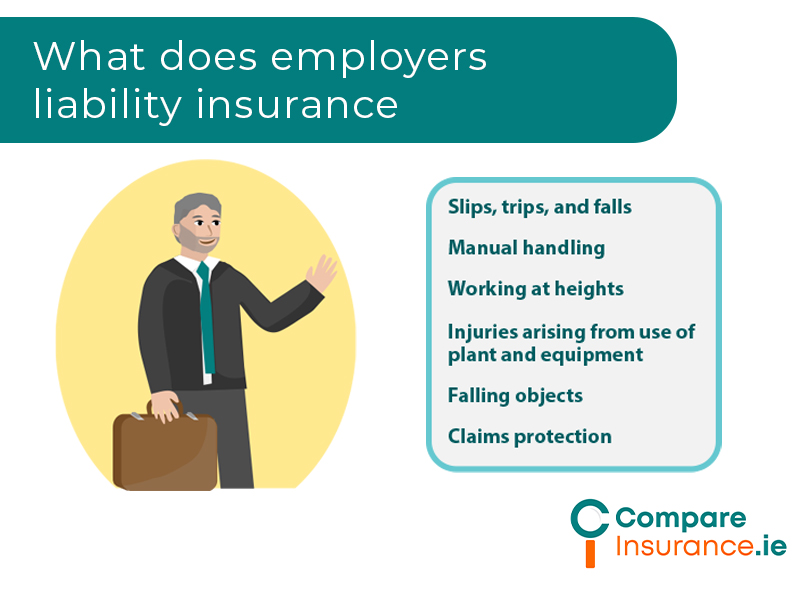

What does Employers liability insurance cover?

Employers liability insurance offers protection for your business in the event that you are found liable for the injury or illness of an employee in the course of their employment in your business.

Cover for any award of compensation and the legal and other costs of the claimant would be included in your employers liability insurance, should you be found liable for their claim. Also included would be cover for the legal and other costs associated with defending your business.

The limit of indemnity is the maximum amount that would be paid out by your employers liability insurance. A standard limit of liability would be €13 million, but your insurer will tailor the amount of cover they offer you based on the unique nature of your business.

Businesses excluded from employer liability insurance

It is worth noting that some business operations are specifically excluded from employers liability insurance, most notably claims arising from road traffic accidents. These claims would need to be covered by a motor insurance policy.

Generally, also, only work carried out in Ireland, or sometimes another EU state, is covered, although insurers may cover overseas work if the nature of your business demands this.

Claims covered would be limited to the period of insurance, so it is essential that you have employers liability cover in place prior to taking on any employees.

Insurers offering employers liability insurance may work with your business to tailor your risk management, targeting and controlling the individual risks associated with your business to employees.

Who offers Employers liability insurance in Ireland?

Generally, employers liability insurance is offered to businesses as part of a combined package of insurance tailored to your business, based on the unique risks it presents.

Business insurance required by the business will vary depending on the size and nature of the business.

Employers liability insurance is available from the following insurers in Ireland:

Who should have Employers liability insurance?

All businesses that have any employees will, realistically, need employers liability insurance. As an employer, you have a duty of care to your business and to your employees and this includes having appropriate insurance cover should one of your employees be injured or fall ill as a result of working for your business.

It is worth ensuring that your employer’s liability insurance includes cover for all staff, apprentices, students on work experience, or volunteers depending on who is employed by your business or supervised by one of your employees.

Even if you have an occasional, casual employee, you are responsible and ultimately liable should they have an accident or become ill as a result of their employment.

How Compare Insurance Works

We compare all insurance options so you can be sure you’re always getting the best deal.

1. Select Your Product

Simply select the insurance product you need a quote for e.g. life, home or health insurance.

2. Online Quote Form

Fill out one of our simple online assessments with your insurance details.

3. Free Quote Consultation

A qualified financial advisor will call you back for your free insurance quotation.

Benefits of Employers liability insurance

All businesses face risks to their employees, depending on the nature of their business. Health and Safety legislation also places numerous obligations on the employer to provide a safe place to work for employees.

Claims for illness and injury arising from the following are more prevalent, although these examples are by no means exhaustive.

Get a FREE Employer liability insurance quote today

Although employers liability insurance is not a legal requirement, it is essential to your business that you have this type of insurance cover in place.

You have worked hard to establish your business and the financial protection offered by employers liability insurance will give you peace of mind that you have sufficient cover if such a claim were to arise as well as the support of your insurer in managing the risk to your employees.

Call us today or fill in an online assessment and we can guide you to the best employers liability cover for your business at the best price.