Congratulations, you are engaged !

Although not the most romantic topic, engagement ring insurance will protect that precious sparkler in case it is lost, stolen or damaged.

If you wish to insure your engagement ring, you have the option of purchasing specialist engagement ring insurance or including your ring in a home contents insurance policy.

Table of Content

What is engagement ring insurance?

Engagement ring insurance is financial protection for your engagement ring should it be lost, stolen, or damaged.

Your engagement ring is irreplaceable, and has a unique emotional attachment. However, with engagement ring insurance in place, you will have the option of repairing or replacing your ring if the worst happens. Engagement ring insurance will also give you peace of mind that your ring is protected.

What does engagement ring insurance cover?

Specific engagement ring insurance is available which protects your ring in Ireland and for 30 days abroad.

Your ring is covered for loss, theft or damage, including accidental loss. Your ring will be repaired or replaced under the policy with no excess.

Home insurance option

Protecting your engagement ring on your home insurance is another option. Your home contents insurance (or tenant’s insurance if you are renting) allows you to insure a high value item as a specified item on your home insurance policy. A specified item is a single item of high value that you include in your home insurance by arrangement with your home insurer.

Unless you specify the high value item, like your engagement ring, you may not be protected by your home insurance as a single item limit may apply in your policy. This means that if a single item above that value is the subject of a claim, your insurer will not pay out more than the policy limit eg. €1,500.

It is also essential that you ensure that your engagement ring is covered by your home contents insurance on an ‘all risks’ basis. This means that you will be protected when you wear the ring outside your home. You may also need to check with your home insurer whether your ring is covered for accidental damage as well as theft and loss.

Who offers engagement ring insurance in Ireland?

Voltaire Diamonds offer Diamond Guard which is specific engagement ring and jewellery insurance. This policy covers you for repair or replacement of your engagement ring by Voltaire Diamonds should it be lost, stolen or damaged.

Home insurers that will protect your engagement ring as part of a home contents policy include:

(through brokers)

How does engagement insurance work?

First off, it is essential that you have a receipt for a new ring or a current valuation for an older ring from a reputable jewellery valuer. You may also need an Irish valuation for a ring bought abroad. It is also a good idea to have photos of your engagement ring.

This will give you the current value of your engagement ring and your insurer may require it, especially for higher value pieces. It is important not to under-insure your ring and to ensure that you are protected for its full value.

If you are including your engagement ring on your home insurance, then as well as its value, you must check whether your ring is covered for theft, loss, and damage as well as ensure that you have all risks cover. It is also important to clarify if your ring is covered when you are abroad, and for how long.

It is also a good idea to check how much the excess is on your policy for your engagement ring. An excess is the amount you must pay yourself before you are protected by your home insurance. Specific engagement ring insurance may not have an excess.

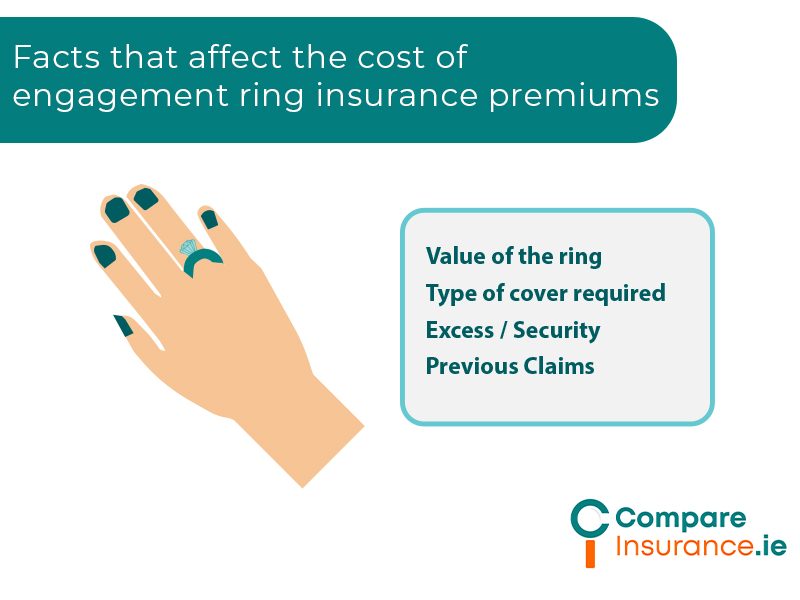

What factors affect the cost of engagement ring insurance?

The amount you pay for engagement ring insurance will depend on the following factors:

How much does engagement ring insurance cost?

Home insurance contents only quote for a rented 2 bed terrace house with €25,000 contents and €5,000 engagement ring added, accidental damage cover included, excess €250.

Engagement ring insurance FAQS

There are lots of questions about how to get the best cover for your engagement ring. We have answered the most important questions here.

Get engagement ring insurance today

Protect your precious engagement ring today with engagement ring insurance. You will have peace of mind that your ring can be repaired or replaced should something unexpected happen.

Contact Compare Insurance or fill out our online assessment and we can discuss the best option with you for your engagement ring insurance.