Health insurance, also known as private health insurance, is a form of insurance cover that offers financial protection should you, or a family member included on your policy, fall ill and need hospital or other medical treatment.

Public healthcare is available to all in Ireland, however, if you wish to ‘go private’, or be treated as a private patient, in either a public, private, or high tech hospital you will, realistically, need health insurance. Health insurance can also mean that you have quicker access to treatment by choosing to be treated privately.

Table of content

What is private health insurance?

Health insurance will cover hospital accommodation and associated consultants and other fees, as well as day patient, outpatient, and sometimes every day medical expenses also.

In Ireland, there are public, private, and high tech hospitals and you may see other healthcare professionals eg. consultants and specialists publicly or privately. You may also, if you choose, be treated privately in a public hospital, although this may change in the future.

The public healthcare system is available to all, but if you wish to be treated privately or stay in a private or high tech hospital to avail of treatment, you will realistically need health insurance.

Who offers private health insurance in Ireland?

Health insurance is provided by three providers in the Irish market:

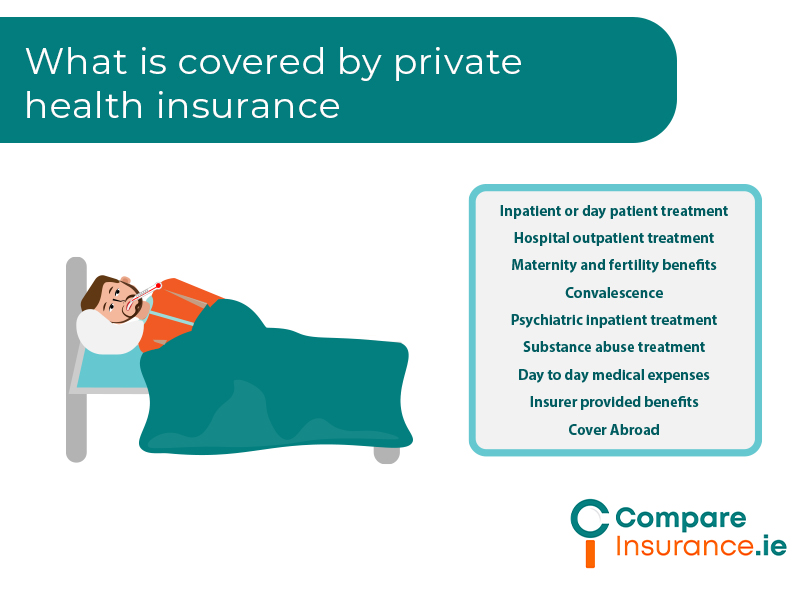

What is covered by private health insurance?

There are minimum types of cover that health insurers are obliged to cover. However, many health insurance policies offer many more forms of health insurance cover at different levels.

These include:

Private health care hospitals and clinics

Private hospitals in Ireland offer access to private care. These include:

High tech hospitals offer more specialised care. These include:

Your health insurance also offers cover for being treated privately in a public hospital. Public hospitals are located in all cities and many major towns.

Choosing the right health insurance policy

In choosing a health insurance policy, you will be guided by a number of factors.

Cost of health insurance in Ireland

Health insurance costs vary widely as there is such variety in plans available. It has been estimated that there are upwards of 300 health insurance plans available in the Irish market.

The HIA estimated in 2022 that the average cost of an Irish health insurance premium was €1,466 but this is likely out of date.

Since that time, most health insurance policies have been subject to several price increases.

Also the provision of free inpatient public hospital care may have meant that lower priced premiums have become obsolete since that time, likely pushing up the average premium.

Get a quote for life insurance today with Compare Insurance.

Prices for health insurance

Here are some prices for fairly entry level health insurance plans for one adult aged over 26, with no loading (ie. purchasing health insurance for the first time aged under 35).

| VHI One Plan | €111.00 monthly |

| Laya Advantage 250 Explore | €119.59 monthly |

| Irish Life Benefit Access 300 | €84.05 monthly |

How Compare Insurance Works

We compare all insurance options so you can be sure you’re always getting the best deal.

1. Select Your Product

Simply select the insurance product you need a quote for e.g. life, home or health insurance.

2. Online Quote Form

Fill out one of our simple online assessments with your insurance details.

3. Free Quote Consultation

A qualified financial advisor will call you back for your free insurance quotation.

Switching private health insurance policy

Switching health insurance plans can become necessary as your health priorities change. A policy that you chose when you first started working or a family policy that you purchased a number of years ago may no longer be the right fit for your healthcare needs.

If you have allowed your health insurance policy to renew each year without comparing newer plans, you are likely also to be overpaying for your health insurance. A price increase will be factored into your premium each year automatically and the premium you pay may no longer represent the best value for money.

Switch at the end of current insurance period

It is best to wait until the end of the insurance period to switch health insurers as health insurance is purchased as a 12 month contract and you may have to pay a charge or pay for the remainder of the 12 month period. You may be able to switch products with the same insurance during the period of insurance without penalty.

Learn more about private health insurance today

Don’t put off buying private health insurance or delay switching your health insurance.

Health insurance offers you peace of mind that your family is protected should they be ill or need medical care.

We can find you the best health insurance for your needs, at a price you can afford.

If you already have health insurance contact us to see if you can avail of better value for money cover, without sacrificing the protection you need.