A Mobile home represents a significant investment and the cover provided by mobile home insurance protects that investment.

Mobile home insurance covers static mobile homes while they are in position. It is generally a condition of static mobile home cover that the structure is anchored or stayed to the ground.

Compare Insurance are here to get you the best quote for your home insurance. Get a FREE Quote with us today.

Table of Content

What is mobile home insurance?

Mobile home insurance typically covers damage or destruction of the main structure of the mobile home due to weather/ storm damage, fire, theft or attempted theft, accidental damage, malicious damage or vandalism.

The structure generally includes fixtures, fittings, aerials, satellite dishes, outside gas canisters, verandas, decking and a shed.

It is important to compare policies from all holiday home insurance providers to get the best possible quote for your holiday home.

Do I need a mobile home insurance policy?

The majority of mobile home now require that you have a comprehensive policy in place.

Parks are usually in exposed coastal locations with a higher risk of storm damage. Homes are usually unoccupied for the majority of the year so at a higher risk of break-ins etc.

Owners of a mobile home will need public liability cover in case someone is injured while in the mobile home. This is standard in mobile home insurance, although the amounts of cover can vary.

How much mobile home insurance do I need?

In addition to covering the home itself it’s a good idea to consider contents cover.

The contents of the mobile home may be covered. Contents would include household goods, personal effects, and luggage whilst contained in the unit.

As mobile homes are generally not as sturdy as a bricks and mortar home, valuables will not be covered by a mobile home insurance policy (although they may be covered under the owners home insurance policy).

Shed contents may be covered under the shed cover of the policy. The level of contents cover will be reflected in the mobile home insurance premium. Some policies will also offer new for old cover on contents.

How Compare Insurance Works

We compare all insurance options so you can be sure you’re always getting the best deal.

1. Select Your Product

Simply select the insurance product you need a quote for e.g. life, home or health insurance.

2. Online Quote Form

Fill out one of our simple online assessments with your insurance details.

3. Free Quote Consultation

A qualified financial advisor will call you back for your free insurance quotation.

What does mobile home insurance cover?

Policies vary though in what is included in the policy. Verandas, decking or awnings may not be included as standard.

A shed adjacent to the mobile home may also be covered but it is wise to check if the premium details to ensure is the shed covered.

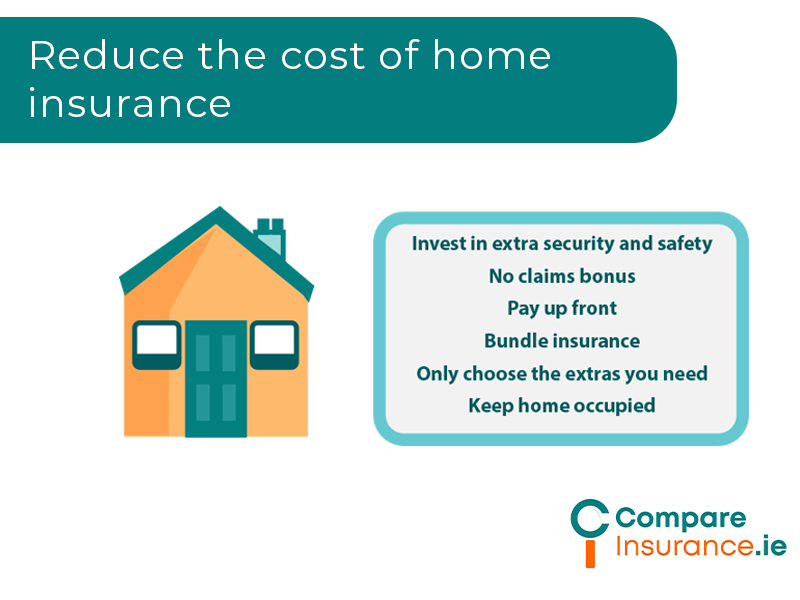

How to reduce the cost of mobile home insurance?

Mobile Home Inspections

To keep premium costs lower, it is important to regularly inspect the mobile home for maintenance issues eg. water leaks.

It is also very important that electrical connections are safe and there is generally a limit on the number of electrical outlets in use at any time due to the risk of fire.

Electoral Policy

If a mobile home is let, it is important to have an electrical policy to reflect this.

Having smoke or fire detectors that are in working order is important due to the higher risk of the structure being unattended as well as a carbon monoxide alarm.

Anchor Mobile Home

Having the mobile home anchored in a mobile home park will affect the premium price as there will likely be maintenance checks, as well as increased security in a mobile home park.

Keep Mobile Home Occupied

There may be an excess on the mobile home insurance policy where the mobile home is unoccupied due to the above risks.

It is usually a condition that between October 1st and March 31st that the water system is drained and turned off by a stopcock to minimise the risk of water leaks, especially when unoccupied outside of the holiday period.

Can I get caravan cover?

Touring Caravan insurance is similar to static mobile home insurance. It covers the structure of the caravan ie. fixtures, fittings, aerials, satellite dishes, outside gas canisters, verandas, awnings, decking etc. from storm damage, flood, fire, theft, malicious or accidental damage.

It can include cover for transport and towing of the caravan which is not covered by standard mobile home insurance or car insurance. Policies generally offer cover for up to 60 days in Europe.

Theft of the caravan and/ or its contents are included although it is a good idea to use an alarm or immobiliser, as many newer caravans have. Tracking devices can also be fitted to caravans. There may, however be restrictions on the age of caravans covered.

Get mobile home insurance today.

To get the best home insurance quote for your mobile home, take our online assessment quiz. A member of our team will be in touch with the best available quote for you.