Compare Life Insurance Quotes

The purpose of this article is to clearly demonstrate the differences between the various life insurance policies and providers. We compare each company’s unique offerings which differentiate them from one another and their pricing for 2 sample insurance candidates.

Once you have reviewed this information, you can enter your details and be connected with one of our vetted Central bank regulated insurance partners who will get you quotes from all major life insurance providers.

Our goal is to connect you with the best value and quality life insurance policy for your needs.

Table of Content

Who offers life insurance in Ireland?

| Insurer | Example 1* | Example 2** | |

|---|---|---|---|

| Zurich | €37.24 | €112.45 | |

| Royal London | €41.03 | €96.07 | |

| Aviva | €43.41 | €129.51 | |

| New Ireland Assurance | €43.41 | €114.34 | |

| Irish Life | €43.41 | €142.31 | |

| Laya | €44.74 | €110.69 | |

| VHI | €51.63 | €129.38 |

* Example 1 – Life Insurance – Joint Life – 31yrs, 32 years, non smokers – term 34 years, €300,000, no serious illness cover. Accurate as of 12/04/23. Accurate as of 12/04/23.

** Example 2 – Life Insurance – Dual life – 45 yrs, 46 yrs, non smokers – term 20 years, €400,000, no serious illness cover. Accurate as of 12/04/23. Accurate as of 12/04/23.

Quote data accurate as of April 12th 2023

Differences Between Life Insurance Companies

Free Service

All information is provided free of charge to the public, we do our best to keep all the information up to date and accurate.

Unbiased Information

Our information is provided free of charge and without any bias. Unlike other comparison sites we do not have preferential deals with any particular insurance company.

Vetted Insurance Partners

Our Central bank regulated insurance partners are vetted for customer service and expertise, so you know you’re always getting the best advice possible.

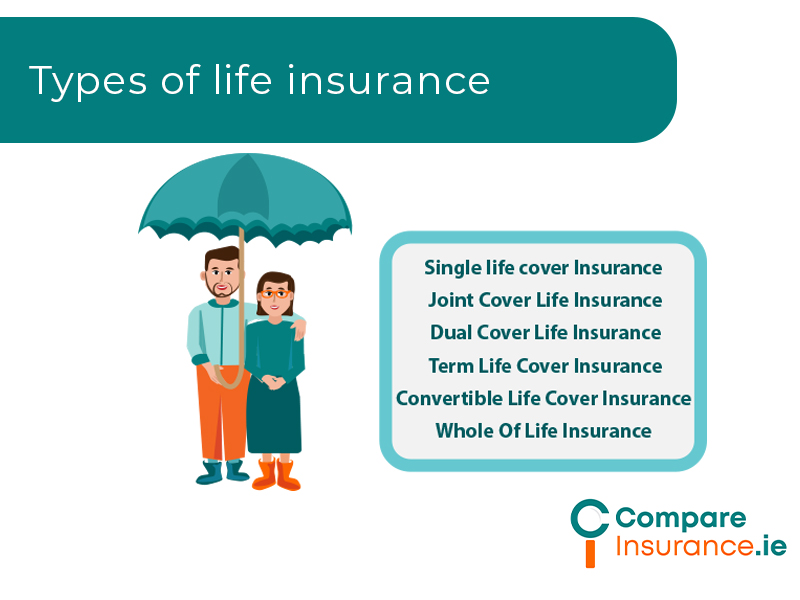

Types of Life Insurance

When comparing life insurance policies there are 6 main types of policies you need to consider:

Single Cover Life Insurance

Single Cover covers the life of the policyholder only and will pay out a lump sum to their beneficiaries on their death.

Joint Cover Life Insurance

Joint cover covers the life of the policyholder and their spouse or partner and pays out a lump sum on a first death basis.

Dual Cover Life Insurance

Dual cover covers the life of the policyholder as well as their spouse and will pay out twice if both spouses die. It is generally more expensive than the first two options.

Term Life Cover Insurance

Term life cover offers cover for the specific time period stated in the policy. When the term of the policy has elapsed you are no longer covered by this policy.

Convertible Term Life Cover

Your policy can be extended or altered without providing new medical information with this type of cover.

Whole of Life Cover

Whole of life cover means that you are covered as long as you are alive while you are paying premiums and is guaranteed to pay out on your death. This type of life insurance is sometimes referred to as life assurance.

How to Compare Life Insurance

Life insurance is highly individualised and complex with many factors affecting the premium you pay as well as the protection and benefits that are right for you.

The amount that is to be paid out will affect the price of cover as well as the lives covered on the policy, be it single life cover, joint or dual life cover.

It is best to tailor your cover to your unique circumstances. Factors you may want to consider include:

When you have considered all of these factors you can compare life insurance policies on a like for like basis as you can compare policies based on their levels of cover and features as well as just on monthly price.

How often should I shop around for life insurance?

It is worthwhile to get quotes for life insurance and compare them to your current insurer. However, it is important that you do not compare policies solely on price as the features of the various policies can vary.

Make sure you are comparing like for like and that you are not losing levels of protection that you currently have, eg. levels of cover, additional benefits etc.

Policies are generally more expensive as you get older. It is also worth considering whether you have had any illnesses and your current health or new medical conditions as these may affect the price of your new cover.

We compare the life insurance market so you don’t have to.

Life insurance products are complex and there are many factors in choosing and comparing life insurance as well as price.

Compare Life Insurance to get the best possible deal for you.

Let us do the legwork and offer you a range of policies that are right for you.