On the 1st of May 2015, lifetime community rating (LCE) came into effect in the Irish health insurance market.

Lifetime community rating means that, if you are aged 35 or above when you first take out a health insurance policy, you will face a loading on your health insurance premium.

This means that you will pay more for health insurance for each year you are over 34 when you first take out a policy.

If you already have health insurance in place when you reach 35, you will not face any premium loadings.

Table of Content

Health insurance provision in Ireland

Health insurance provision in Ireland must adhere to three principles:

Exceptions to community rating

There are some exceptions to the principle of community rating, mostly around insuring children and young people.

Young adults (age 18-25) may pay a reduced premium for health insurance. This is intended to avoid younger people paying a steep increase when they start to pay adult health insurance premiums.

Children and newborn babies

Children (under 18) must be charged a premium of no more than 50% of the price of an adult premium.

Newborn babies or adopted children may be included in a parent’s policy for a short time following their birth or adoption, but this is not always the case so do not assume that your new baby or adopted child is included in your policy.

If you are a member of a group health insurance scheme, you may receive a reduction of up to 10% on your health insurance premium.

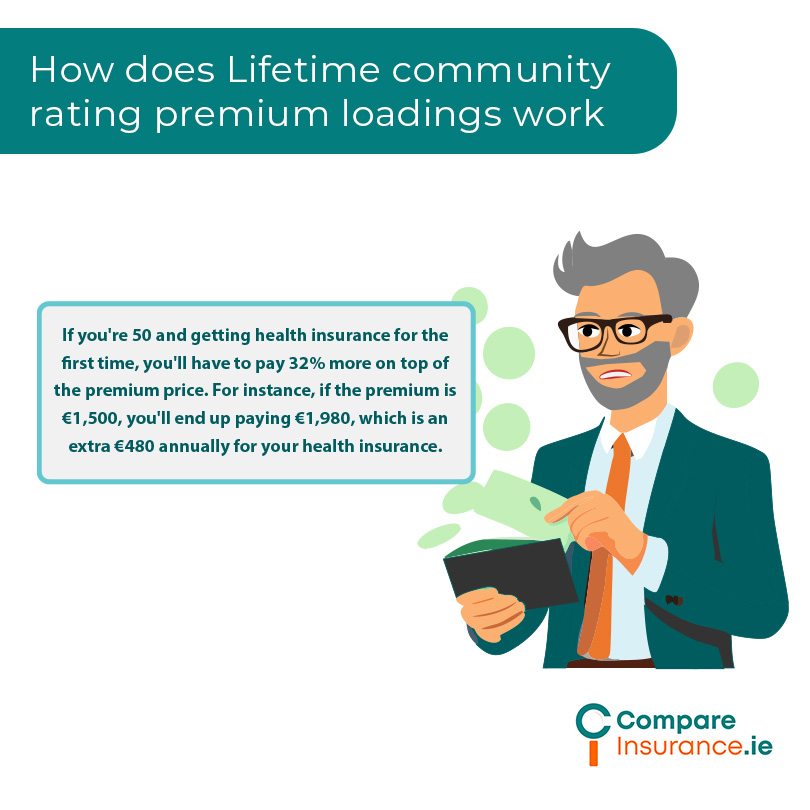

Lifetime community rating premium loadings

If you are aged 35 or over on first taking out health insurance in Ireland, you will face a premium loading.

A premium loading is an additional charge on top of your premium that you will have to pay for your health insurance cover.

The lifetime community rating premium loading is 2% added to the premium for each year that you are over 34.

If, for example, you were 50 on taking out a health insurance policy for the first time, you would pay an additional 32% of the premium price on top of the premium.

For a premium of €1,500 this would mean that you would pay €1,980 or an additional €480 per year for your health insurance policy.

What is the maximum lifetime community rating that can be applied?

The maximum loading that can be applied is 70%.

This would apply where you took out health insurance for the first time aged 69.

How long is the loading applied?

The loading is applied for ten years after you first take out health insurance cover.

If you were 45 on taking out health insurance for the first time, you would pay the additional loading on your premiums until you were 55.

Why is there lifetime community rating?

With the principle of community rating, everybody pays the same for health insurance regardless of age. This leads to younger members effectively subsidising older health insurance members as they tend to make less claims on their health insurance as a general rule.

With an ageing population, and as younger people were found to be increasingly less likely to take up health insurance, the Irish health insurance market was ageing.

This was leading to ever increasing premiums, which were further discouraging younger people from purchasing health insurance.

Lifetime community rating was introduced on 1st May 2015 in an effort to encourage younger people to take up health insurance early and maintain their cover.

Exemptions from Lifetime Community Rating premium loadings?

Yes, there are some situations where some or all of the loadings may not be applied.

If you have previously held health insurance for a period of more than 3 years and your cover has lapsed for more than 6 months, you may be credited with the time you spent covered by health insurance.

So, for example, if you are aged 46 on taking out a health insurance policy and held a health insurance policy from the age of 30 to 36, you would be credited with 6 years and would only face a LCE loading of 6 years.

If you have had a period of unemployment of more than 6 months, you may also be credited with up to 3 years ifyou were dependent on social welfare during that time.

Lifetime Community Rating for those moving to Ireland

If you move to Ireland from another country and it is your first time purchasing health insurance in Ireland, you have 9 months to purchase a policy before premium loading is applied.

Ireland must be your principal residence and you may be asked to demonstrate this to a health insurer. Evidence may include:

Application for a PPS number within the previous 9 months.

Lifetime Community Rating for those returning to Ireland

If you lived outside of Ireland on the 1st of May 2015, you have nine months to purchase a policy on your return to Ireland before premium loading is applied.

If you lived in Ireland on 1st May 2015 and you moved overseas on or after 1st November 2018, you may be given credit for the time you lived overseas provided you lived abroad for more than 6 months. You must also purchase a policy within 9 months of returning to Ireland.

If you have had multiple periods of time abroad that are more than 6 months and have also lived in Ireland and held Irish health insurance, you may get credit for previous periods of cover.

You may be required to show evidence of living abroad:

How Compare Insurance Works

We compare all insurance options so you can be sure you’re always getting the best deal.

1. Select Your Product

Simply select the insurance product you need a quote for e.g. life, home or health insurance.

2. Online Quote Form

Fill out one of our simple online assessments with your insurance details.

3. Free Quote Consultation

A qualified financial advisor will call you back for your free insurance quotation.

Do community rating loadings apply to health cash plans?

No. Community rating loadings are only applied to inpatient health insurance policies. Inpatient health insurance policies are provided by the following providers:

Health cash plans do not offer cover in the same way for inpatient hospital charges and community rating loadings are not applied at any age. These policies are provided by:

Laya Money Smart Cash Plan

Contact us today.

Lifetime community rating loadings mean that it is better not to delay finding health insurance cover for yourself or your family. Having timely health insurance cover that you can maintain is the best way to pay less for health insurance over your lifetime.

We can discuss your health insurance needs with you and have qualified insurance advisors to help you find a plan that will work for you and for your budget.

Fill in out online quote form and we will be happy to discuss health insurance with you in order to find you the right cover at the best price.