If you would like to purchase a health insurance policy, to avail of private treatment options and for peace of mind that you are protected from unexpected health expenses, there are affordable options available.

If your budget is already stretched due to cost of living price hikes, you may wish to see if you can purchase a basic health insurance policy to save money.

Why choose the cheapest health insurance?

With price increases across the board from all insurers, many are looking for cheaper health insurance. Switching or downgrading your cover may also feel like a better option to maintain health insurance cover in the face of ever increasing health insurance premiums.

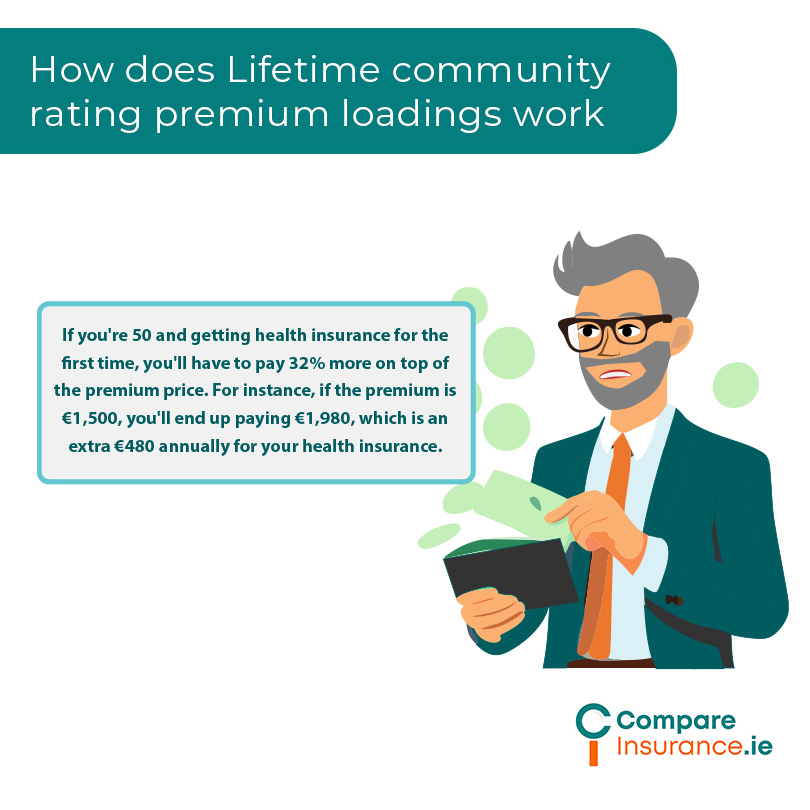

Lifetime community rating also means that loadings are applied to health insurance premiums if you first buy health insurance when you are aged 35 or older. You may not feel the need to purchase health insurance when you are younger, but you may wish to avoid higher prices when you are older by buying a cheaper option earlier in life and maintaining that cover.

Basic Health Insurance

If you are looking for an entry level health insurance policy, you can choose from the more affordable options available from the following health insurers:

You can buy inpatient health insurance from €41.92 per month. At this level, you will be choosing public hospital cover only. This means that your health insurance will cover semi-private or private accommodation and treatment in a public hospital. You will not be covered for accommodation or treatment in a private or high-tech hospital.

The most affordable health insurance policies do not offer a huge amount of cover for outpatient or everyday medical expenses either, although they do offer some benefits. Here are the cheapest inpatient health insurance policies for an individual looking for health insurance cover available and some of the benefits they offer.

Cheapest health insurance cover

Saving money on health insurance

Apart from purchasing entry level health insurance plans, are there any other ways to save money on health insurance cover?

Yes. You can choose a voluntarily high excess, or you can choose a health cash plan which is an alternative to inpatient health insurance cover.

Higher excess

If you would like health insurance cover for treatment and accommodation in a private or high tech hospital, or more generous cover everyday health expenses than entry level health insurance policies allow, you could choose a health insurance policy with a high excess.

This entails a certain level of risk as you will have to pay this excess every time you are admitted to hospital. But if you feel that this is unlikely, then you may choose a high excess to benefit from a higher level of inpatient accommodation or everyday expenses cover than basic plans typically offer.

Health insurance with a high excess

VHI First Care 500 Day to Day

Laya Precision 600 Connect

Irish Life Benefit Access 500

Health cash plans

Health cash plans, or outpatient only plans, offer cash reimbursement for healthcare expenses that you pay for yourself.

These plans do not offer inpatient cover, although some may offer a payment if you are admitted to hospital for a certain length of time.

It is important to note that these plans are not considered continuous cover for the purposes of lifetime community rating. This means that if you wish to purchase an inpatient health insurance policy and you are aged 35 or over then you will face a premium loading (2%) which increases each year you are over 34 when first purchasing health insurance.

Health cash plans (or outpatient only plans) are provided by the following insurers:

These plans offer cash back on a range of health expenses, depending on the plan, such as:

The plans all offer access to online/ digital GP consultations included in membership.

HSF and Laya both offer additional benefits:

HSF plans offer personal accident cover should you suffer an accidental death or be permanently disabled.

How much are health cash plans?

Prices for health cash plans (all are individual plans):

HSF OSD 1

€17.23 per month

Laya Money Smart 20

€14.34 per month

Irish Life Day to Day Most

€14.46 per month

Best cheap health insurance cover

If you wish to have the peace of mind and access to private treatment that private health insurance brings, but you are on a tight budget, there are cheaper health insurance options available.

If you are looking for the cheapest health insurance cover, you may consider choosing an entry level inpatient health insurance policy that fits your budget. These plans usually offer semi-private accommodation and treatment in a public hospital at a minimum. You may also be able to find limited cover for outpatient expenses on these plans.

If your priority is to be treated in a private hospital and you are willing to pay a high excess should you need to be admitted to hospital, then you can choose a policy with a voluntarily high excess which may offer a higher level of cover at a more affordable price.

Health cash plans offer an alternative to an inpatient health insurance policy and are much more affordable than even the cheapest inpatient health insurance policy. These policies do not offer access to private treatment however and do not cover inpatient expenses beyond a modest cash contribution.

Contact us today

It may be cheaper than you think to have the peace of mind of being protected by health insurance.

Whatever your reason for looking to save money on health insurance there are more affordable options available.

Fill in our online enquiry form or call us today and our insurance advisors can go through your options with you to find you health insurance that will work with your budget.

Author: Séamus Ó Doirín | Chief Insurance Editor

Séamus Ó Doirín is a Donegal based QFA who has been writing about insurance since 2020. His main focus is getting people the best value for insurance in the Irish market. His writing covers all areas of insurance and is a valuable part of the Compare Insurance team.