Life insurance is an invaluable way to look after and provide for your loved ones after you die. The lump sum provided by life insurance can mean that they will have financial security and can meet essential outgoings when you are no longer with them.

The amount that your family receives depends on the level of cover, or sum assured, in your life insurance policy and the type of life insurance policy that you purchase.

A life insurance trust could be a way to ensure that the process goes more smoothly and with clarity for those involved when the time comes to make a claim.

What is a life insurance trust?

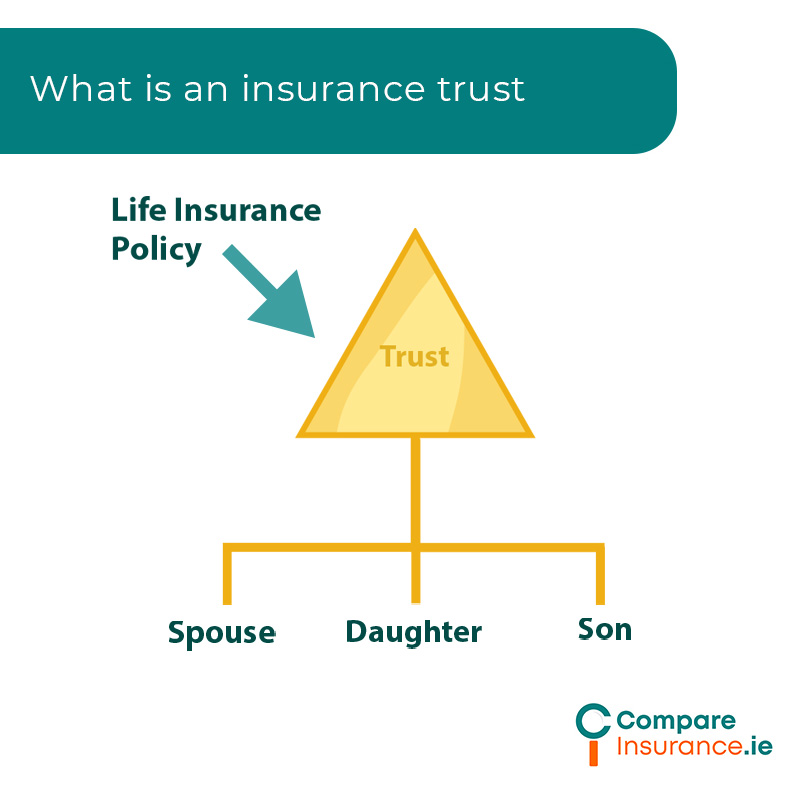

A life insurance trust is a legal document which allows you to allocate the benefit paid by the life insurance policy, i.e. the life insurance lump sum, to a specified person or persons when you die.

Putting your life insurance in trust essentially means that you transfer the ownership of your life insurance policy to the trust.

The settlor creates the trust, and pays the premiums of the life insurance. The trustee manages the trust and distributes the life insurance proceeds to the beneficiaries after you die. The beneficiaries are those who receive the asset or life insurance proceeds following your death.

Benefits of putting your life insurance in trust

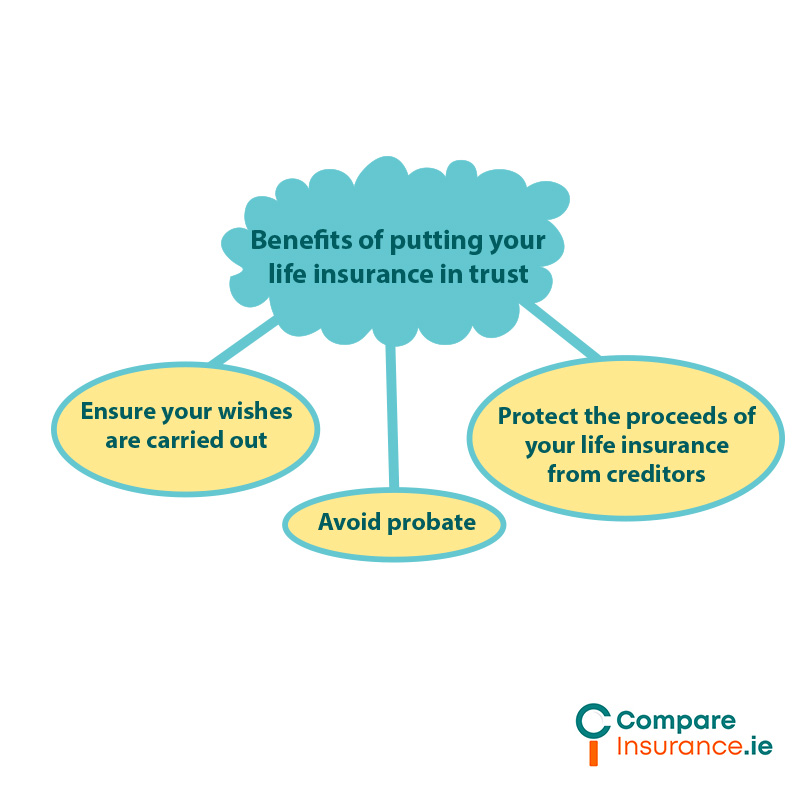

Some examples of the benefits of putting your life insurance in trust include:

How to put your life insurance in trust

You can put your life insurance in trust by obtaining a form from your life insurance company or by consulting your solicitor.

The first step is to name the beneficiaries of the trust, such as your children or grandchildren for example, then you transfer ownership of your life insurance policy to the trustee(s). The trustee(s) may be your spouse, another relative such as a sibling, or your solicitor.

After your death, the trustee will distribute the pay out from your life insurance to the beneficiaries of the trust, according to your wishes. Using a trust gives you control over how your life insurance lump sum is distributed.

Estate planning

Proper estate planning will ensure that your wishes regarding your assets or estate are carried out and will also mean that there will be less scope for complications or disputes.

Your estate means anything that you own such as property, savings and investments, even your vehicle. Your life insurance lump sum pay out is included in your estate.

It is essential that you get proper legal and financial advice when considering putting your life insurance in trust, and in making a will or provisions for your assets after your death.

It is also really important to note that inheritance tax may have to be paid by your beneficiaries on your estate. Again, it is essential that you get expert advice on inheritance tax liabilities when putting your life insurance in trust or making a will.

Disadvantages of putting your life insurance in trust

The key disadvantage of putting your life insurance in trust is that it cannot be used to protect a mortgage. You may need to arrange separate mortgage protection if you wish to protect a mortgage at a later date.

It is also worth noting that with significant life changes, such as marriage, divorce, remarriage, birth or adoption of a child or grandchild, or major health changes, for example, you may need to review your financial protection arrangements, including your life insurance.

Purchasing life insurance

A life insurance trust can ensure that your life insurance benefit is paid more quickly and will give you control over who benefits from the proceeds of your life insurance policy.

If you are considering purchasing life insurance, Compare Insurance can get you quotes from a range of life insurers to ensure that you and your loved ones will be financially protected in the event of your unexpected death.

Use our online assessment to compare quotes from Ireland’s leading life insurance companies. You can also speak to a qualified financial advisor with a phone consultation for advice and information on putting financial protection in place. All quotes and consultations are free of charge.

Author: Séamus Ó Doirín | Chief Insurance Editor

Séamus Ó Doirín is a Donegal based QFA who has been writing about insurance since 2020. His main focus is getting people the best value for insurance in the Irish market. His writing covers all areas of insurance and is a valuable part of the Compare Insurance team.