Specified illness cover, also known as serious illness cover or critical illness cover, is a form of personal insurance which offers financial protection should you receive a diagnosis of a specific, serious illness or require certain types of treatment for a serious illness.

Specified illness cover can be purchased in conjunction with life insurance, or as a standalone product.

Table Of Content

What is specified illness cover?

Specified illness cover pays a tax free lump sum if you are diagnosed with a serious illness from a specific list of illness covered by your insurer.

Depending on the condition with which you are diagnosed, you may receive full or partial benefit from your specified illness policy.

Being diagnosed with a serious illness is a stressful and emotional time. Although the medical aspects of diagnosis and treatment are much discussed at this time, a serious illness can have a devastating effect on your finances as well.

Having financial support can alleviate the impact of a serious diagnosis on your personal finances if you are diagnosed with a serious illness, giving your peace of mind and allowing you to focus on getting well.

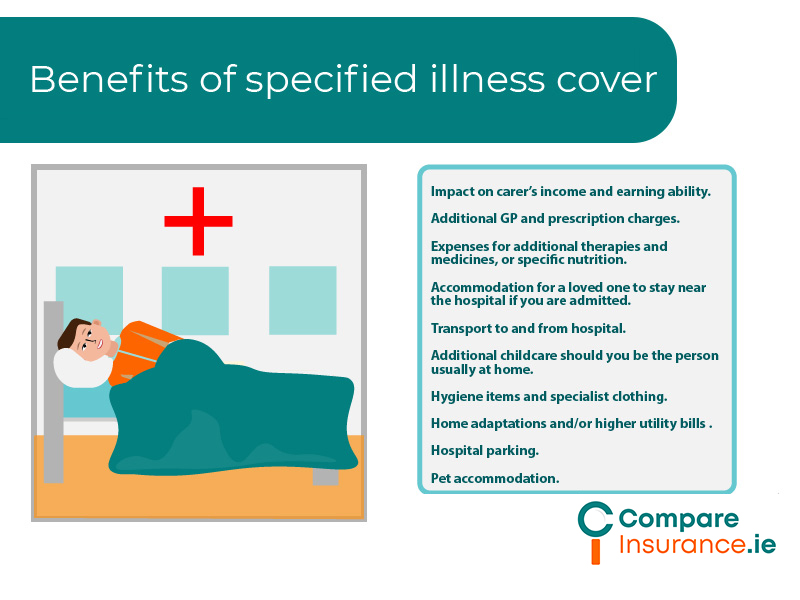

Benefits of specified illness cover

Undergoing treatment for a serious illness can involve some significant unforeseen expenses in addition to medical bills not covered by health insurance, often at a time when household income is already reduced.

Undergoing regular medical treatment or having regular hospital admissions is disruptive and brings a range of unforeseen bills such as:

The cash lump sum paid by specified illness cover can help to meet these additional expenses.

Specific illness insurance also allows you to choose how you spend the benefit you receive, depending on your own preferences and circumstances.

Some insurers offering specified illness cover offer additional supports such as nurse or GP services, as well as counselling, and access to additional therapies eg. bereavement support, physiotherapy etc. as part of their specific illness plan.

If you have children, they may be covered on your specified illness plan if they are diagnosed with one of your insurer’s list of specific illnesses. Children are generally offered 50% benefit upon diagnosis.

How does specified illness cover work and who provides it?

Specific illness cover is provided in Ireland from the following insurers:

Cancer Care only.

Generally, you will pay fixed payments each month, depending on your personal circumstances and the level of cover you choose. However you can choose to have the fixed lump sum increase in line with inflation (indexation) which will mean that your monthly payments will also increase each year.

You can also choose to add a conversion option to most specific illness plans, which means that if you choose to increase your level of cover or take out a further specified illness plan in the future,you can do so without supplying further medical evidence.

Similar to life insurance, you can purchase specified illness cover to cover the policyholder only (single cover),cover two policyholders on a first claim basis (joint cover) or cover two policyholders for potentially two claims should you both fall ill with a specified illness (dual cover).

Specified Illness Cover and Life Insurance

Specified illness cover can be purchased as a stand alone personal insurance product or purchased along with life insurance.

When purchased with life insurance, specific illness cover can offer a separate cash lump sum which is fixed at the time of purchasing the specified illness policy.

Specific illness cover can also be added to life insurance as an accelerated benefit meaning that the cash benefit you receive on diagnosis of a serious illness is a proportion of your life insurance benefit and is paid on the diagnosis of a specific illness.The balance of your life insurance protection amount is then paid when you die. This can be a more affordable way of purchasing specific illness insurance.

What illnesses are covered by specified illness cover ?

The illnesses most claimed for on specified illness insurance are heart attack, cancer, and stroke. All insurers offer benefits for these three illnesses.The conditions around qualifying for full benefit vs. partial benefit for these illnesses vary between insurers.

Since these three are the most claimed illnesses,it is reasonable to assume they are also the most common so it makes sense to compare insurers based on how they pay out for these illnesses.

All insurers cover a list of illnesses that are eligible for full benefit, and a further list of less severe illnesses that are eligible for partial payment ( usually 50% of your full benefit amount).

Some insurers, AIG and Zurich, offer Cancer Cover, which is a form of specific illness cover that only offers protection if you receive a diagnosis of cancer.

This may be more affordable than full specific illness insurance. The conditions around which forms of cancer are covered and the severity which is eligible for full or partial benefit varies.

How much is specified illness cover?

Example 1 – Life insurance cover for with and without specified illness cover for 40 year old couple, both non smokers, life cover of €150,000 for 20 years, dual life life and specified illness cover of €30,000.

| Insurer | With specified illness cover | Without specified illness cover | |

|---|---|---|---|

| Royal London | €53.65 | €25.02 | |

| New Ireland | €56.77 | €24.16 | |

| Zurich | €56.95 | €25.45 | |

| Aviva | €59.51 | €29.29 | |

| Irish life | €59.51 | €31.48 |

Example 2 – Cancer Care cover with AIG for 40 year old non smoker.

| Insurer | ||

|---|---|---|

| AIG | €10.25 per month for €32,000 cover €18.45 per month for €64,000 cover |

How much specified illness cover do you need?

In purchasing specified illness cover, ideally you will need to choose an amount of cover that could replace your income if it is necessary for at least a year.The amount of cover should take into account your regular expenses eg. mortgage costs or other debts, the amount of your yearly salary and your family situation eg. number of children and their ages etc..

However, realistically you may need to balance what is ideal with what you can afford on a monthly basis.Several factors will affect the cost of your specific illness cover:

What is the difference between Specific Illness Insurance and Health Insurance?

Specific illness insurance offers a different form of protection to health insurance., although both types of insurance will offer financial protection should you be diagnosed with a serious illness.

Whereas health insurance offers protection for the unexpected expenses of medical bills, health insurance covers the various forms of medical treatment only and is paid to health providers (or reimburses you for specific health expenses that you pay out of pocket yourself).

Health insurance offers no protection for the loss of income or additional expenses other than healthcare bills that you may incur following a diagnosis of serious illness.There may also be a shortfall in the amount your insurance will cover or medical bills that are not covered by health insurance. You will also be responsible for covering the cost of any excess on your health insurance.

Types of payments

Specific illness insurance provides protection in the form of a tax free lump sum which you can use to meet health expenses not covered by your health insurance, replace lost income, or meet additional expenses associated with your illness that are not healthcare related.

You choose how you use the financial protection offered by specific illness cover and it is paid directly to you.

Review your Specified Illness cover policy

It is a good idea to review your specific illness cover periodically. Insurance products evolve over time and there may be better protection available that better meets your needs as time goes on.

If you purchased specific illness insurance along with, say, mortgage protection or life insurance some time ago, it may be a good idea to review and ensure that the cover you are paying for is best for you as time goes on.

You will pay more for specific illness cover as you get older or develop health issues, so it’s always best to ensure that you have the best cover in place for you.

Learn more about specified illness cover today

Take our free online assessment to see what specific illness cover is best for you and your circumstances. Speak with a qualified financial adviser and let us take the hassle out of arranging specified illness cover.