A section 72 insurance policy is a type of life insurance which is a tax efficient way of ensuring that the beneficiaries of your will are not faced with paying a large tax bill on anything that you leave them.

Without advance planning, your family, or the beneficiaries of your will may face a tax bill of up to 33% of any inheritance they receive.

This tax bill will need to be paid promptly and, if those you leave behind are unable to pay this bill, penalties and interest on unpaid tax can mount up quickly. This may mean they may need to borrow or sell an asset such as the family home or holiday home to pay the tax bill promptly.

Table of content

What is section 72 policy insurance?

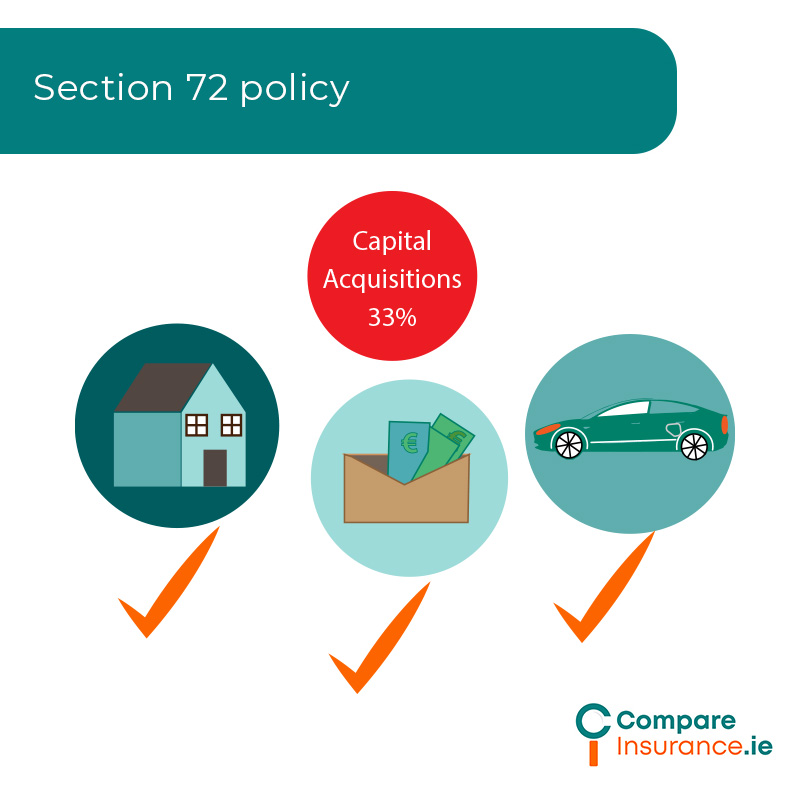

Section 72 policy insurance is a specific type of whole of life insurance (or life assurance or life long insurance) which is set up to pay the inheritance tax on any property, money, or assets which you leave in your will. This will allow you to leave your family home or other money or assets tax free.

It is called section 72 life insurance as it is provided for in section 72 of the Capital Acquisitions Tax consolidation Act 2003.

A section 72 policy is based on the inheritance tax liability that is estimated in advance meaning that the benefit paid should cover the inheritance tax bill that your children or beneficiaries face when you die.

Section 72 policy insurance is tax efficient as there is no tax liability on the benefit received after you die, as long as this benefit is used to pay inheritance tax.

What is inheritance tax?

Capital acquisitions tax (CAT) is a form of tax on inheritances and lifetime gifts in Ireland.

Inheritance tax, therefore, is due following a death where an inheritance in the form of property, money, or other assets is made to another and is based on the value of the inheritance and the relationship between the person leaving the inheritance and the person who receives the inheritance.

There are some exemptions and reliefs available, such as the inheritance tax treatment of a family farm or business.

How much is inheritance tax?

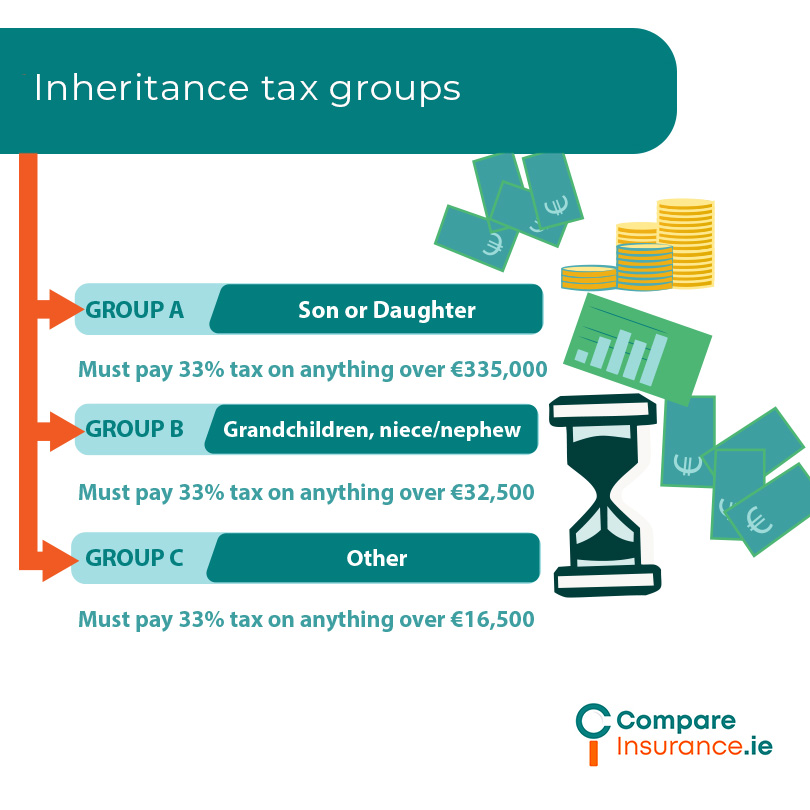

The tax is due on the inheritance above a certain threshold, which varies depending on the relationship between the disponer and beneficiary, and is currently at a rate of 33%.

There is no inheritance tax on an inheritance by a spouse or civil partner.

Relatives in Group A include your children who will be required to pay inheritance tax on an inheritance above €335,000.

Relatives in Group B include parents, siblings, grandchildren, nieces, and nephews and will be required to pay inheritance tax on an inheritance above €32,500.

Relatives in Group C include all other categories of relative or friends, including a partner unless they are your spouse or civil partner. This group will face tax on an inheritance above €16,250.

These thresholds include inheritances and also lifetime gifts of property, money, or assets.

Who qualifies for section 72 policy?

You can set up a section 72 life insurance policy up to the age of 75. Some insurers have lower age limits, for example, Zurich has a lower age limit of 45.

You must be resident in Ireland.

The person taking out the section 72 insurance policy must be the person who is leaving the inheritance. You can have a policy that covers the life of two policyholders that are spouses or civil partners.

The premium may be paid by the person who benefits from the inheritance e.g. a child, they may have to show that they are the will’s beneficiaries to take out a policy.

You must continue to pay the premiums for the policy to remain in place.

Who provides section 72 policy insurance?

As section 72 is a form of life insurance, it is provided by life insurers in Ireland. The insurers who provide section 72 life insurance are:

As this is a very specific form of life insurance it is generally advised that you obtain legal as well as financial advice in setting up a section 72 insurance policy.

Section 72 policy insurance and life insurance

Section 72 insurance is a form of life insurance and is provided by some life insurance companies in Ireland.

A section 72 policy is a specific type of life insurance policy which is set up for the purpose of paying inheritance tax on any property, money, or assets which you leave in your will.

As a section 72 insurance policy is a whole of life policy, it is guaranteed to pay out when you die, as long as you continue to pay your premiums.

Can the policy cover more than one life?

Like other forms of life insurance, section 72 life insurance can be taken out with one policyholder or with two policyholders.

This means that it will either pay out on the death of the single policy holder or it will pay out on the death of the second policyholder on a joint life second death basis.

With a joint policy, on the death of the first policyholder, any property, money, or assets they leave to their spouse or civil partner will be exempt from inheritance tax and so, the cover will transfer to the second policyholder. On the death of this second policyholder, the benefit will cover the inheritance tax due when property, money, or assets are inherited by the beneficiaries.

How much does a section 72 policy cost?

Due to the individual nature and specific cover offered by a section 72 policy, the price will vary considerably.

The policy is based on an advance calculation of the inheritance tax liability of those who are intended to inherit any property, money, or assets you leave to them in your will. This is the sum assured, or benefit that is paid when you die.

This will depend on the value of your home, other property, savings, investments, and possessions.

It will also depend on the relationship of the person who you intend to inherit to you, eg. your child, grandchild, sibling, friend etc, as this relationship will affect the amount of inheritance tax due.

Your age, health, and whether or not you smoke will also affect your monthly premium.

Can anything else affect the price of a section 72 insurance policy?

Generally, your premiums will be fixed when you purchase a section 72 insurance policy.

However, similar to other forms of life insurance, there are additional options which you can choose to purchase when you take out the policy. These may affect the monthly premium and include:

Contact us today

Section 72 life insurance gives you peace of mind that anyone to whom you leave an inheritance will not face a tax bill.

If you wish to keep a family home or holiday home in the family, for example, a section 72 policy is invaluable.

Contact us today and our insurance advisers can discuss life insurance and a section 72 insurance policy with you. We can give you information and advise you on insurance products that may form part of your inheritance planning.

Author: Séamus Ó Doirín | Chief Insurance Editor

Séamus Ó Doirín is a Donegal based QFA who has been writing about insurance since 2020. His main focus is getting people the best value for insurance in the Irish market. His writing covers all areas of insurance and is a valuable part of the Compare Insurance team.