Serious illness cover is a form of financial protection that offers a cash lump sum if you are diagnosed with a serious illness or disease.

You may think that you will never need this type of insurance but it has been estimated that 42,000 people in Ireland will be diagnosed with cancer each year (Irish Cancer Society), and that there are 6,000 heart attacks each year in Ireland (croi.ie).

Serious illness cover, also known as critical illness cover or specified illness cover, is a valuable form of protection that offers financial security if you are diagnosed with one of the list of serious illnesses covered by your insurer leaving you unable to work and pay for your medical bills or essential expenses.

Table of Content

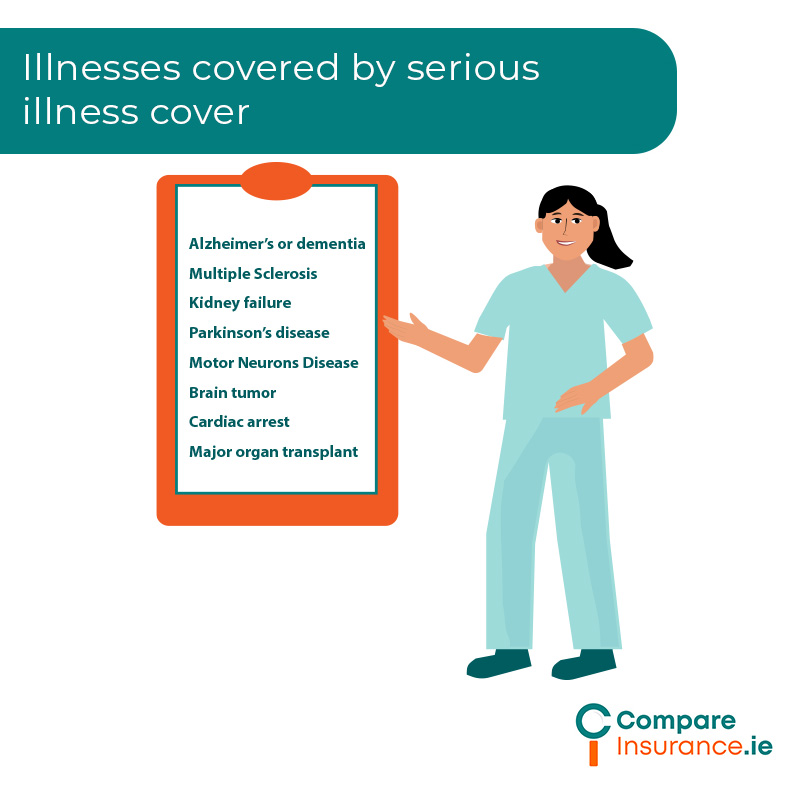

What illnesses are covered?

Most insurers offer full or partial payment for a range of illnesses including heart attack, stroke, and some forms of cancer.

The insurers who offer serious illness cover offer different levels of cover for different illnesses but all of them offer financial protection where you are diagnosed with:

Serious illness insurance offers a full payment of the agreed cover amount for more severe diseases or conditions that are listed in your policy. There is also a partial payment for less severe or life altering forms of illness eg. less severe or invasive forms of cancer.

Serious illness cover can be purchased as a standalone policy, or alongside a life insurance or mortgage protection policy. If you purchase serious illness cover alongside your life insurance, you may be able to choose serious illness cover as an additional form of protection or as accelerated serious illness cover.

Benefits of serious illness cover

There are numerous benefits of having serious illness cover in place:

Cost of serious illness cover

Your serious illness cover premiums are based on several factors such as:

Serious illness cover and life insurance

You can purchase serious illness cover as a standalone insurance product irrespective of any life cover you may have.

This type of cover may be more expensive but, if you do not have life insurance in place, or if the serious illness cover insurer you choose offers better protection for a condition or illness you have concerns about, for example, then you may wish to purchase standalone serious illness cover.

If you choose to purchase serious illness cover as part of a life insurance policy, you may choose additional cover or accelerated cover.

Additional serious illness cover, purchased with a life insurance policy pays out the agreed cash lump sum included on diagnosis of a serious illness in your policy irrespective of any life insurance sum assured ie.the amount of cover or sum assured is in addition to the sum insured in your life insurance.

Accelerated serious illness cover means that if you are diagnosed with a serious illness and your policy provides the cash lump sum, then your life insurance sum assured will be reduced by the serious illness lump sum paid. This form of serious illness cover is likely to be cheaper than choosing standalone cover or additional cover.

How Compare Insurance Works

We compare all insurance options so you can be sure you’re always getting the best deal.

1. Select Your Product

Simply select the insurance product you need a quote for e.g. life, home or health insurance.

2. Online Quote Form

Fill out one of our simple online assessments with your insurance details.

3. Free Quote Consultation

A qualified financial advisor will call you back for your free insurance quotation.

Who provides serious illness cover in Ireland?

Serious illness cover is provided by the five main life insurers in Ireland, It may be provided as specified illness cover, or as critical illness cover.

Cancer cover, which offers protection for a cancer diagnosis only, is provided by:

Other forms of insurance that offer cover for serious illness

You may be wondering about the differences between all of the types of insurance that offer financial protection when you have a serious illness. Here are the different forms of insurance which offer protection where you are diagnosed with a serious illness:

Contact us today

You never know what is around the corner for you or a family member. We all hope that we will stay well, but unfortunately statistics show that this may not be the case.

If you wish to put financial protection in place so that you do not have to worry about money at a difficult time, choose serious illness cover.

Our insurance experts can advise you on the best type of serious illness cover for your needs and find you affordable cover that suits you.

Fill out our online form, or call our advisers and put essential serious illness protection in place today.