Over 50s life insurance is a life insurance policy which is usually whole of life cover intended to cover funeral costs, pay outstanding bills, or to leave a gift or bequest to a loved one or for charity.

Whole life cover is life insurance cover which is guaranteed to pay a lump sum payment when you die as long as you continue to pay monthly premiums.

Table of Content

What is over 50s life insurance?

Over 50s life insurance is life insurance which is available with guaranteed acceptance. This means that you will not be required to provide medical information when you purchase a policy.

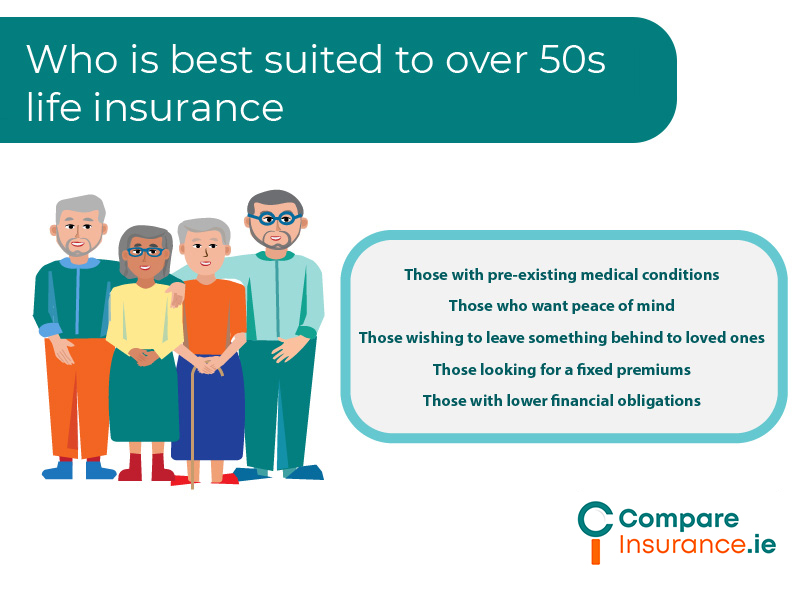

This type of insurance cover is suitable for those who are over 50 years of age who may have pre existing or chronic medical conditions.

Over 50s life insurance may offer lower levels of cover than other forms of life insurance and monthly premiums may be higher. This is due to the inherently higher levels of risk to the insurer in providing cover without medical information.

If you stop paying premiums, some policies will cease to offer cover. Over 50s insurance does not usually have an investment element and will usually not allow you to cash in your policy ie. the policy does not have a cash value. With some policies, you may end up contributing more than you receive in benefit.

This type of life insurance plan will generally offer fixed premiums for the life of the policy with premiums paid monthly.

However, there is very limited availability of specific over 50s life insurance in the Irish market. An Post and the Credit union offer funeral insurance policies that are the only policies that do not require medical questions.

Options for Life Insurance for Over 50s

A life insurance provider that offers whole of life or term life insurance may offer life insurance policies without you having to undergo a medical but you will need to provide medical information on purchasing a life insurance policy for almost all life insurance in Ireland.

You may be refused cover or be offered a policy with exclusions, depending on your medical history. For example, cancer survivors face challenges in obtaining insurance cover.

Depending on the amount of cover you choose, it may still be possible to purchase relatively affordable life insurance policies over the age of 50 which may be used to pay funeral costs or for other expenses, provided you can obtain cover with your medical history. It is also possible to take out a policy with joint cover for you and your spouse.

Laya do not require health information on setting up a new policy. However, the cover amount available decreases with age and they will only offer term life protection up to age 80, so all cover would cease at that time.

Life Insurance Providers Who Offer Life Insurance to Over 50s

Age Limits on Life Insurance.

Zurich offers life insurance to new customers up to the age of 75 and offers life insurance plans up to the age of 90.

Depending on the amount of protection you require, Zurich have varying requirements regarding undergoing a medical, depending on your age and the amount of cover that you require.

You will have to provide health information at the time of purchasing a life insurance policy, however.

Irish Life offer new customers health insurance up to the age of 82. Again, you will have to provide health information to purchase life insurance with Irish Life.

Royal London offer new policies to customers up to the age of 85 with life insurance cover offered up to the age of 91.

Laya life insurance is a term life insurance product which will accept new customers up to age 70.

What does over 50s life insurance cover?

Life insurance is a form of personal protection which offers a lump sum payment on the event of your death.

Term life insurance covers a specific time period and will pay out the lump sum should you die during the term of the policy only.

Whole of life insurance pays out a guaranteed lump sum when you die, whenever that may be, as long as you continue to pay premiums.

Specific over 50s policies tend to offer a lower level of cover than other forms of life insurance.

However a term or whole of life policy may offer more benefit with lower repayments, depending on availability or exclusions due to your health.

Many life insurance companies now offer additional benefits as part of the life insurance policy such as:

Benefits of Over 50s Life Insurance

Life insurance will pay a lump sum death benefit when you die, depending on the terms of your life insurance. Term life insurance will offer financial protection should you die during the term of the policy.

Whole of life insurance is guaranteed to pay a lump sum when you die, provided you continue paying premiums.

Although your family may be older and less dependent when you are over 50, many will have spouses, older, dependent children, or elderly parents who rely on them for financial support.

Life insurance is a way to replace your lost income for your family and a lump sum will provide some financial security for them.

Peace of Mind

Over 50’s life insurance offers peace of mind that you will not leave any outstanding debts or expensive bills behind for loved ones when you die.

Depending on your levels of debt, life insurance provides your dependents with a lump sum death benefit which can be used to pay off outstanding debts.

Over 50’s life insurance can be used to pay for funeral costs and expenses so you are not leaving loved ones with an expensive debt.

Free Service

All information is provided free of charge to the public, we do our best to keep all the information up to date and accurate.

Unbiased Information

Our information is provided free of charge and without any bias. Unlike other comparison sites we do not have preferential deals with any particular insurance company.

Vetted Insurance Partners

Our Central bank regulated insurance partners are vetted for customer service and expertise, so you know you’re always getting the best advice possible.

How much is over 50s life insurance?

Over 50s life insurance is generally more expensive than other forms of whole life insurance as the risks for the insurer are higher in providing cover with no medical evidence required.

However, there is very limited availability of Over 50s life insurance of this kind available in Ireland.

Typically, also, the amount of financial protection paid out on this type of policy is much lower than other types of life insurance.

Over 50s life insurance, for example, would be unlikely to cover an outstanding mortgage unlike other forms of life insurance.

How much is funeral insurance?

Who should have over 50s life insurance?

Over 50s life insurance is suitable for anyone who:

How Compare Insurance Works

We compare all insurance options so you can be sure you’re always getting the best deal.

1. Select Your Product

Simply select the insurance product you need a quote for e.g. life, home or health insurance.

2. Online Quote Form

Fill out one of our simple online assessments with your insurance details.

3. Free Quote Consultation

A qualified financial advisor will call you back for your free insurance quotation.

Funeral Cover

Funeral insurance is a very specific type of insurance plan which offers whole of life cover for a fixed premium. This plan will pay a fixed lump sum on your death to meet funeral expenses. In Ireland, the Credit Union and An Post offer specific funeral insurance plans.

Over 50s Life Insurance Indexation

Indexation is a protection against inflation which can be built into insurance policies with the level of financial protection increasing year by year, in return for an increased premium, to offset inflation.

Indexation is generally an additional option available when purchasing an insurance policy. Generally, when this option is chosen, premiums will not be fixed for the lifetime of the policy.

Over 50s Serious Illness Cover

Serious illness cover pays a lump sum should you be diagnosed with a specific serious illness. All insurers who provide serious illness cover have slightly different rules and will offer cover for different medical conditions, so it is wise to check what is covered before you take out a serious illness policy.

Serious illness cover may be purchased alongside a life insurance policy or as a standalone policy.

You can also purchase accelerated serious illness cover, where your serious illness cover is paid out as a proportion of your life insurance benefit should you be diagnosed with a specific serious illness.

Many of the insurers who offer life insurance to over 50’s will also offer serious illness cover.

Get a quote for over 50s life insurance today.

Life insurance offers peace of mind that your loved ones will be protected financially in the event of your death. The benefit they receive can also be used to pay for your funeral or for outstanding debts so that you do not leave them a financial burden.

Although life insurance is cheaper if you take out a policy when you are young, you can still avail of the security brought by having a life insurance plan in place when you are over 50 and even over 60 or 70.

Take our assessment today and see what your options are, we can find the right Over 50s life insurance policy for you.