Life insurance is an invaluable form of financial protection which can pay a tax free lump sum on your death to provide financial security for your loved ones.

In these times where you bills can seem to be going up daily, you may be looking at ways to save money on monthly bills and trim expenses where you can by finding low cost life insurance,

So how can you get low cost life insurance and is it always a good idea to go with a cheaper quote?

Why are some life insurance quotes cheaper?

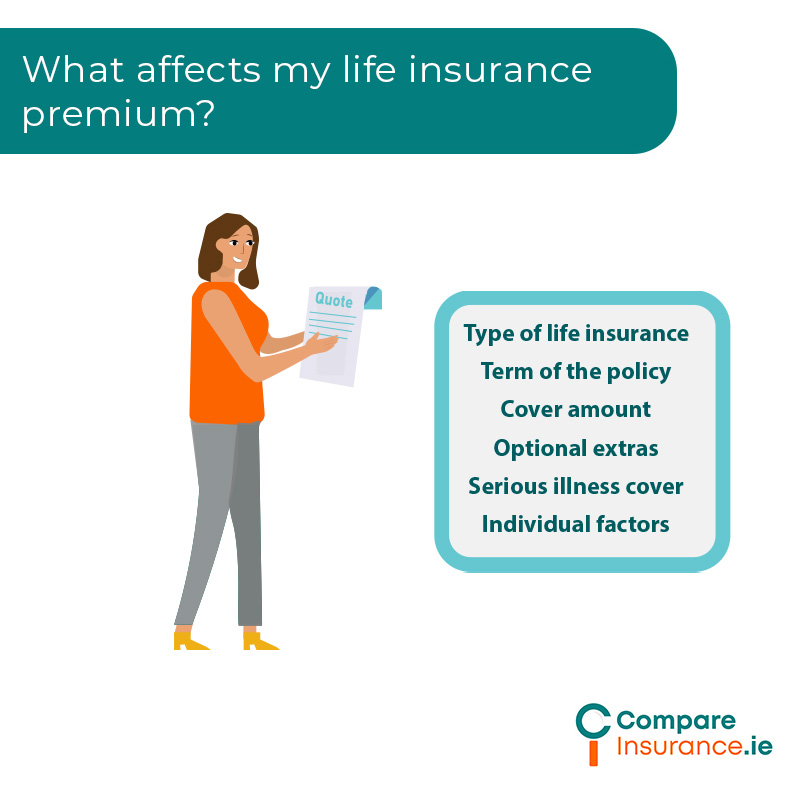

Although life insurance cover seems a straightforward product there can be price variations, with many factors affecting the monthly premium you pay for life insurance some of them related to the life insurance product you choose and some of them related to you as an individual policyholder.

While the essential principle of life insurance is that it pays a lump sum on the death of the policyholder applies to all life insurance policies, there are a number of different variables within each policy and also differences between life insurers and their prices and products.

What affects my life insurance premium?

There are various factors that affect your life insurance premium:

Single or joint life insurance?

Life insurance can be purchased to cover the lives of one or two policyholders.

Single life cover insures the life of one policyholder, the life insured.

Joint life cover insurers the lives of two policyholders, usually on a first death basis meaning that when one policyholder dies the benefit is paid then cover ceases.

Dual life cover also covers the lives of two policyholders but will pay a benefit if both policyholders die during the term of the policy.

A joint or dual cover life insurance plan will usually be more expensive than single life but is generally cheaper than buying two policies. Also, dual life cover may be more expensive than joint life cover, but will offer more comprehensive protection and may not cost significantly more.

Life insurance quotes

To give you an idea of how much you may pay for life insurance, here are some life insurance quotes for cheap life insurance in Ireland.

How to get cheaper life insurance

Ideally, you would buy life insurance when you were in your 20’s, had no health issues, and were a non smoker for a lifetime of low premiums. Life insurance is advertised as being available for as little as €10 per month and if those applied, you may get a quote this low.

However, you may only think about life insurance when you are a little older and your life has changed, such as when you buy a house or become a parent or you may have a health issue that makes it more expensive to purchase life insurance.

So, how to get the best value life insurance for your circumstances?

Cheapest is not always best when it comes to life insurance

Low cost life insurance may not always be the best choice for you, the policy that suits your circumstances best may not always be the lowest quote you get.

If you are primarily concerned with making sure that your family owns their home and feel that they will be able to earn an income then mortgage protection may be a better fit for your needs and may be more affordable than level term life insurance.

Again, it is best to get advice from a qualified insurance advisor who can discuss you needs with you and tailor your life insurance accordingly rather than just opting for the cheapest quote when purchasing a life insurance policy.

Switching life insurance

If you have previously purchased life insurance but are struggling to afford your monthly premiums, or your circumstances have changed and it may not longer be the best fit for you, then you may be able to changing your existing cover or switch life insurance provider.

It can be slightly tricky to switch life insurance but at Compare Insurance, we have helped customers to find life insurance that is affordable and fits their needs and, if you are considering switching your life insurance, we can assist you to do so.

Contact Compare Insurance

Talk to us about your life insurance today. We work with five insurers and will find you the policy that suits you at and works with your budget.

You may be able to switch life insurance and find a lower premium with the help of our insurance advisors.

Fill in our online assessment or call us to discuss your life insurance options.

Author: Séamus Ó Doirín | Chief Insurance Editor

Séamus Ó Doirín is a Donegal based QFA who has been writing about insurance since 2020. His main focus is getting people the best value for insurance in the Irish market. His writing covers all areas of insurance and is a valuable part of the Compare Insurance team.