If you have been diagnosed with a health condition in the past or you have an ongoing health issue, you may have concerns around being able to purchase life insurance.

You will be asked about your health when purchasing life insurance, and other forms of financial protection such as mortgage protection, income protection, and serious illness cover.

Although your health can affect whether or not you are accepted for life insurance cover and how much you pay, life insurers are very likely to accept you for life insurance cover if you are open with them and provide the information they require.

Life insurance claims are very rarely declined but one instance where this can happen is when you fail to disclose a pre-existing health condition or you are not honest about your health history.

Why do you pay more for life insurance when you have a medical condition?

Life insurance, and other forms of financial protection such as mortgage protection, serious illness cover, and income protection, are all based on the principle that each member pays their premium into a common pool which is then available to pay out benefits to those who need to claim.

The more likely you are to make a claim, based on your perceived risk to the insurer, the more you may have to pay. For this reason, if you have a pre-existing medical condition you will most likely face a higher premium when paying for financial protection. How much higher will usually depend on the specifics of the diagnosis and prognosis i.e. future of your condition.

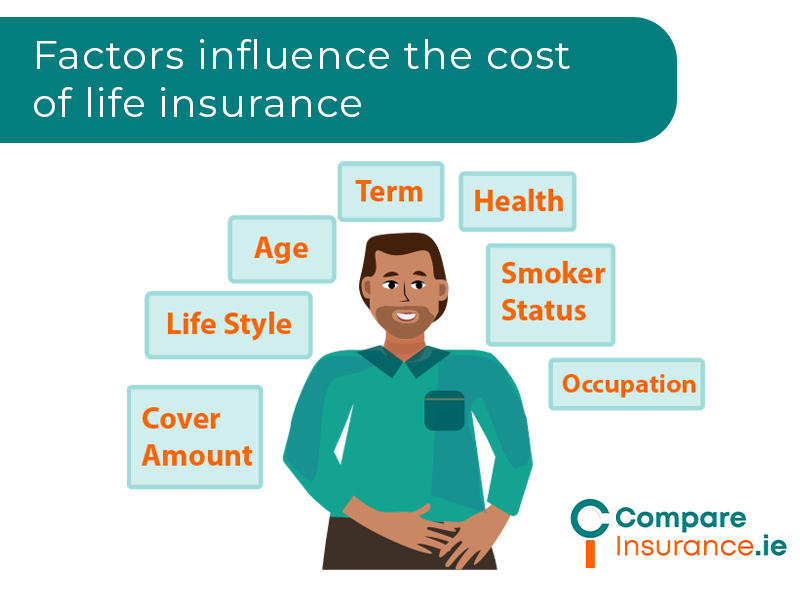

Factors affecting your life insurance premium

When you apply to purchase life insurance an insurer will consider:

Insurers use this information to determine whether to accept your application, and to determine how much you will pay in premiums. This risk assessment process is known as medical underwriting.

An insurer will need to know about your current health and any pre-existing conditions or previous health issues and illnesses, including whether you have recovered and how long you have been clear of any condition. A potential life insurer will need this information to decide whether you will be accepted for cover and at what terms.

Your insurer may be primarily interested in the last 5 to 7 years but you should disclose all information. If in doubt, tell your insurer so that they can decide what information is relevant.

Medical underwriting

Your insurer may require further information in the form of a medical questionnaire that you will need to complete and return to them. If you have disclosed a medical condition, they may send you a questionnaire specific to that condition.

The insurer may accept you on the basis of the questionnaire, or they may request a report from your GP, also known as a private medical attendant report (PMA). The GP’s report will focus on the history of your medical condition, its treatment, and its prognosis.

The insurer may alternatively ask you to undergo a Nurse Medical, with various tests required depending on your health condition.

On the basis of the health information that they have gathered, a potential life insurer may apply these underwriting decisions:

What happens if I fail to disclose a health issue?

It is really important to be as truthful and accurate as possible when giving your insurer health and lifestyle information as, if you fail to do so, a number of outcomes could occur such as:

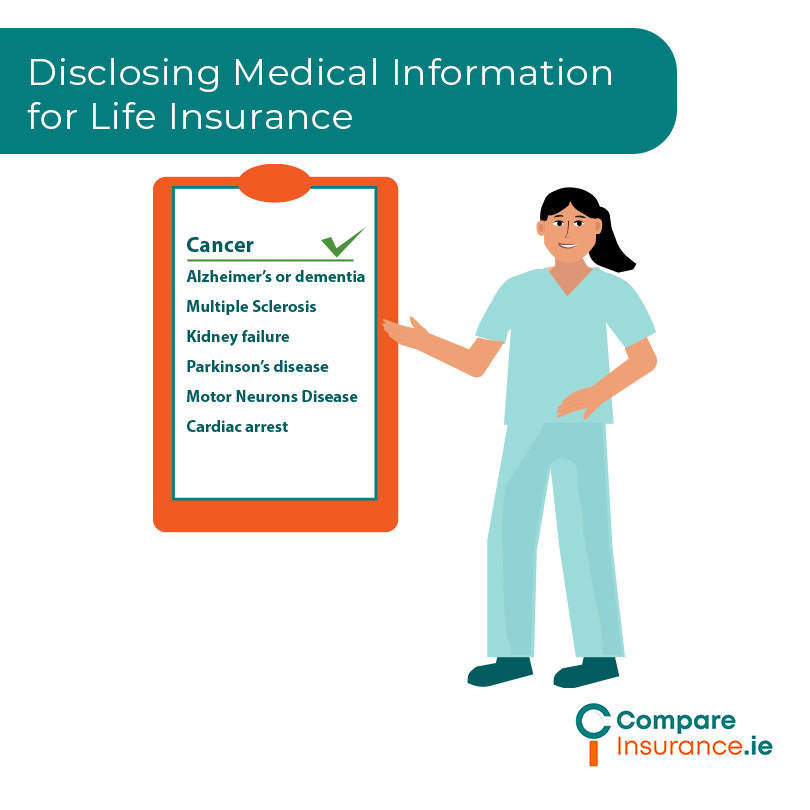

Pre-existing health conditions and life insurance

There are a number of health issues which may affect whether you will be accepted for life insurance, or whether you will face a loading on your premium. Some of these conditions may include:

The severity of any health condition you have been diagnosed with, how well it is controlled, and its likely future impact on your health will all be taken into account.

It’s really important to stress that the majority of life insurance applications are accepted really quickly at standard rates and are not subject to the medical underwriting process.

It is also important to note that working with an experienced insurance advisor may help you to obtain life insurance cover if you have health issues. An insurance advisor will have experience and insight into the different life insurers in the market and how they view different health conditions in order that you are accepted for cover at the best rates possible.

Cancer and life insurance

If you have been diagnosed with cancer, it can be particularly challenging to get life insurance cover. If you are currently undergoing cancer treatment, you may not be able to get life insurance cover until you have completed your treatment.

On applying for life insurance cover, you will likely be asked about your own medical history, and also your family medical history in terms of a cancer diagnosis. You will be asked about the type, stage and grade of cancer that you have been diagnosed with.

A potential life insurer may request a report from your consultant outlining details about your cancer diagnosis and its treatment.

Insurance Ireland has developed a code for its members, The Code of Practice for Cancer Survivors Seeking Mortgage Protection, in order to address the issue of cancer survivors seeking life protection on taking out a mortgage.

The code means that if you disclose to a mortgage protection insurer that you have previously been diagnosed with, and treated for, cancer then your diagnosis will be disregarded 7 years after treatment has been completed (or 5 years if your cancer was diagnosed under the age of 18).

Speak with the life insurance experts today

We understand that it is not always comfortable to think about or talk about your health. You may have a concern about being asked intrusive questions and poked and prodded at in order to get life insurance.

However, life insurance is a really important type of financial protection and you are more likely to be accepted for life insurance cover at standard rates than you might expect. Being sent for an insurer medical is also rare.

Our insurance advisors can discuss your life insurance application with you and we only ask the questions that are essential to getting you the best cover at the best possible price. The more accurate the information you provide, the speedier the whole application process can be.

It’s also a good idea to work with an insurance advisor as they have experience and insight into the criteria and policies adopted by the various life insurers and can help you to choose the insurer best suited to your circumstances to avoid your application being refused or a loading applied to your premium.

Life insurance gives you peace of mind that your family will have financial security should you no longer be there to look after them.

Don’t put off purchasing life insurance due to concerns about your health or being declined for cover.

Fill in our online assessment or call us to discuss life insurance today.

Author: Séamus Ó Doirín | Chief Insurance Editor

Séamus Ó Doirín is a Donegal based QFA who has been writing about insurance since 2020. His main focus is getting people the best value for insurance in the Irish market. His writing covers all areas of insurance and is a valuable part of the Compare Insurance team.