Being self employed can be very rewarding, you are self directed and the success that your hard work brings belongs to you alone.

The CSO estimates that in 2022 there were 309,000 self employed persons in Ireland, that is 13% of workers, so you are not alone in recognising the benefits of self employment.

However, leaving paid employment means that you forgo employee benefits such as sick pay and illness benefit, meaning that you have to create your own safety net.

That’s where income protection insurance comes in for the self employed.

Table of Content

How does income protection work?

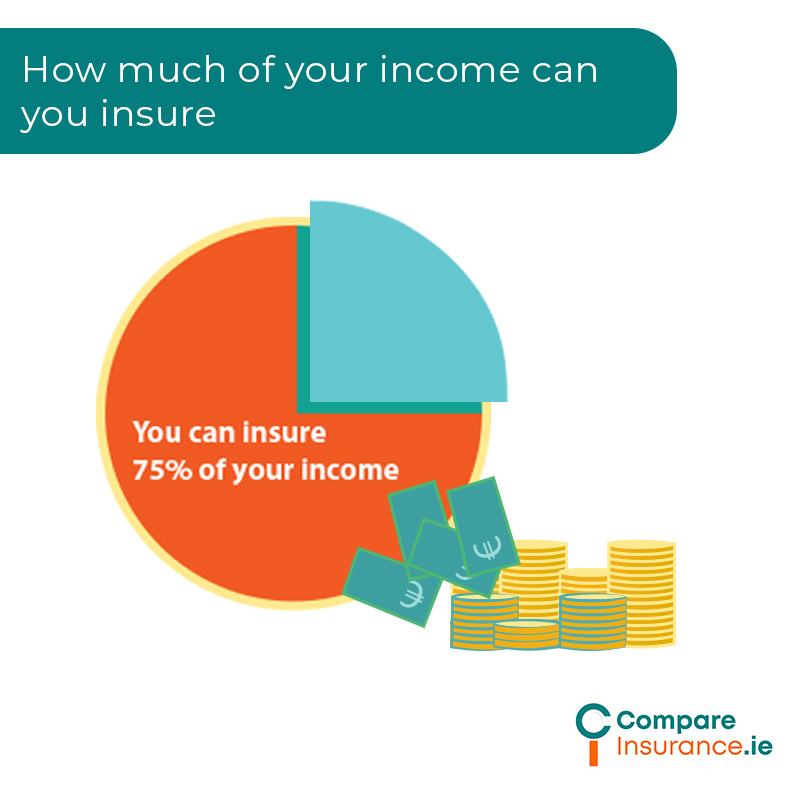

Basically, in exchange for a monthly premium, that is subject to tax relief, you will insure up to 75% of your regular monthly income.

This means that, after a certain length of time known as the deferred period, you will be paid a monthly benefit to replace your earnings if you are unable to work due to illness or injury.

Income protection insurance will pay a benefit for any illness that prevents you from carrying out your job or business until you can return to work or until the end of the policy term if you are unable to return to work.

The price that you pay for income protection depends on your age, your income, your health, and your job.

Do self employed qualify for income protection?

Not everyone qualifies for income protection. If you have preexisting health issues, you may pay a little more or face exclusions in cover. Or if your job is considered risky by an insurer they may decline to cover you.

It can really help to speak to an income protection insurance advisor, as they have an excellent insight into the income protection market and the different insurers’ qualifying criteria and may be able to help you to get income protection cover.

Compare income protection insurance quotes from every insurer.

Take our 90-second online assessment and get the best income protection insurance quotes on the market. Our vetted income protection insurance partners are regulated by the Central Bank of Ireland and will outline the various options available to you.

Benefits of Income Protection for the self employed

Income protection is essential if you and your family rely on your income from self employment. How would you meet your regular outgoings such as mortgage payments, bills, groceries, or costs of education or healthcare if you were unable to work?

Although you are probably looking to cut costs when setting out on your own or setting up your business, income protection is an invaluable form of financial protection and should not be overlooked.

Here are some of the benefits of income protection for self employed persons:

Who offers income protection insurance in Ireland?

The following insurers offer income protection in Ireland:

There is some variation between the different insurers in terms of their eligibility criteria and in the occupations that they will cover. It is always worth getting several quotes before purchasing an income protection policy.

You can use our eligibility test to see if your job qualifies for income protection cover and to get quotes from multiple income protection insurers.

Income protection quotes

To give you an idea of how much income protection insurance costs, here are some quotes from various income protection providers to compare.

All of the quotes included are for guaranteed premium income protection. Guaranteed premium income protection means that premiums are fixed for the term of the policy, unless you choose to increase your cover periodically to allow for inflation.

Reviewable premium income protection means that your premiums may be adjusted periodically during the term of the policy. While you may save money initially, these types of policy may mean that your premiums increase dramatically as you age meaning that your cover becomes unaffordable.

Contact Insure your Income today

Income protection is essential for those who are self employed as it provides important financial protection should you be unable to work due to illness or injury, along with a host of other benefits.

Insure your income offers 100% free quotes from 5 insurers. Avail of a complimentary phone consultation or use our online eligibility test to see if you qualify for income protection insurance today.