Contents insurance is home insurance that covers only your personal possessions rather than the building they are housed in. It is perfect for renters and many insurance companies specifically offer contents insurance cover as renters insurance.

Personal possessions for the purposes of contents insurance are the items you would take if you were to move house.

Table of Content

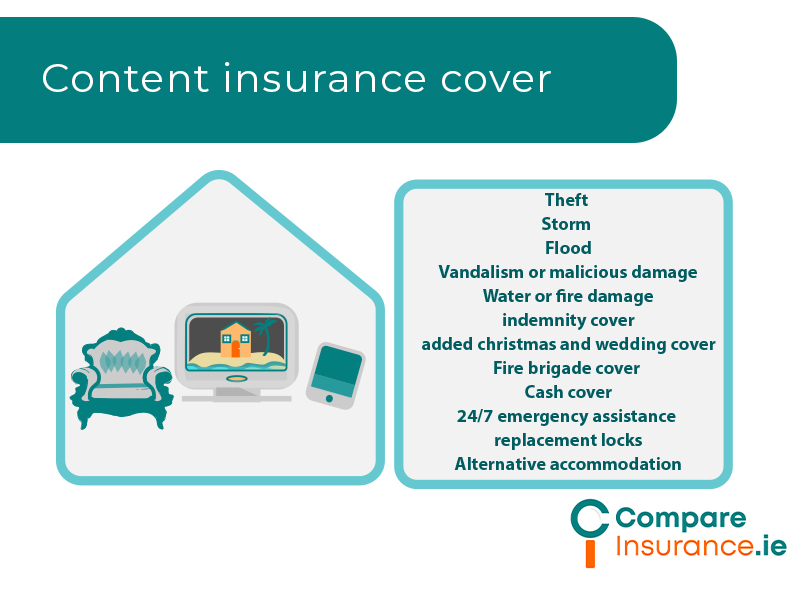

What does contents insurance cover?

Contents home insurance covers your personal belongings from damage or loss due to:

Personal possessions include clothing, furniture, decorative items, appliances, audio visual equipment, money, and can include sports equipment, bikes, jewellery, art, and musical instruments.

If your belongings are damaged, destroyed or stolen following an insured risk, then you can claim back some or all of their value. Some content home insurance policies cover home office equipment and also accidental damage to audio visual equipment as standard.

Contents home insurance also includes cover for personal liability should someone be injured in your home as a result of your possessions or for visitors belongings following an insured risk.

Some renters insurance policies cover tenant liability for accidental damage to the landlord’s building or for legal expenses in a dispute with their landlord.

Zurich offers cover for tenant liability ie. covers liability for damage to the landlord’s buildings.

Who offers contents insurance in Ireland?

What do content insurance providers offer?

Insurers differ in the levels of contents cover they provide. Most insurers have a minimum premium as well as a minimum level of contents home insurance cover they provide:

How to compare content insurance providers

Not all home insurance policies are the same and you will need to shop around to find the one that is right for you.

Apart from calculating how much cover you need, it is important to note any exclusions in the policy, as well as factoring in any excess which you will pay out of pocket before making any claim. Check whether the policy has new for old cover as you will need to replace items lost or destroyed.

Some insurers may allow you to protect your no claims bonus so that you can make a limited claim without affecting your no claims discount. AA Insurance offers a protected no claims bonus for claims up to €3000.

Accidental damage cover quote

It is worth getting a quote for a policy with accidental damage so you are covered if you damage electronics for example. Some policies will offer limited cover for accidental damage to audio visual items as standard. Allianz offers €1300 cover for accidental damage cover for audio visual items as standard and €4000 cover for home office furnishings and equipment.

Some other factors affecting price if the premium

The price of your contents insurance premium is affected by the value of your belongings and the level of cover you require (new for old/ indemnity cover) as well as any add ons you require. The type of rental property you live in will affect your premium also.

If you live in self contained accommodation or a shared accommodation will affect your premium and if you live in shared accommodation it is essential to let your insurer know this.

The security of the property eg. locks, alarms will affect your premium as will your ability to lock away your belongings in shared accommodation.

Claims history, the level of excess you are willing to pay and any individual items of high value will also affect the price you pay for contents cover.

Who is best suited to content insurance

Contents home insurance is often referred to as renters insurance and tenants insurance and is primarily suited to those who rent their homes or live in shared accommodation.The cover will give tenants peace of mind should the worst happen that their will be protections in place.

How much contents insurance do I need

In order to estimate the level of contents cover you require, take a walk around your accommodation and add up how much it would cost to replace all of your possessions should they be destroyed – this is the replacement value of your belongings.

Now factor in how much excess you would pay out of pocket should you need to replace those items. This is the contents value you need to insure and your contents home insurance policy should offer that level of cover.

It is also essential to specify any high value items and arrange specific cover for those items, whether inside or outside the home on an all risks basis.

Most insurers have a minimum premium and a minimum excess, although this varies. Zurich has a minimum sum insured of €10,000 contents only home insurance.

With cost of living increases, underinsurance is a risk as the replacement value of many items will have increased in recent months. It is important to be realistic about the value of your belongings should they need to be replaced.

What can you protect with content insurance

Contents cover can include:

Content insurance add ons.

Accidental damage cover for personal belongings or household items is not usually covered as standard but can be added to the contents insurance policy.

All risks cover, for personal effects that you carry with you outside the home can also be added as an optional extra on many contents insurance policies.

This would cover, for example:

Liberty insurance offers cover for bicycles and accessories up to €600 away from home as well as the option to increase cover to €1500 with additional pedal cycle cover.

Items of high value such as engagement rings, audio visual equipment, musical instruments, fine art or antiques, or high value sports equipment may need to be specifically covered as extras to your contents insurance, whether carried with you outside the home or not.

Content Insurance FAQs

Cover your contents today

If you want to have peace of mind that your most precious pieces of jewellery are protected whether at home, or when you are wearing them out and about, then it is essential to have them insured, either with specialist insurance, or on your home or home contents insurance.

Contact us today or take our online assessment to arrange cover for your jewellery and we will find the right cover at the right price for you.