If you own a building as a landlord, homeowner, or a business that owns buildings, you should consider building insurance to protect your most valuable asset.

For the best quotes on the market for building insurance, speak to Compare Insurance today. We are Ireland’s leading insurance comparison website and will find you the best quote for you.

Take our online assessment today and find out how much you could save.

Table of Content

What is buildings insurance

Buildings insurance offers financial protection for the unexpected expense of rebuilding the structure of your home if it is damaged.

Buildings insurance covers the bricks and mortar, as well as the permanent fixtures and fittings, such as bathroom fittings and kitchen units, of your home if they are damaged by storm, fire, or theft, for example. Your buildings insurance will protect you for the necessary repairs and rebuilding of your home following such an event.

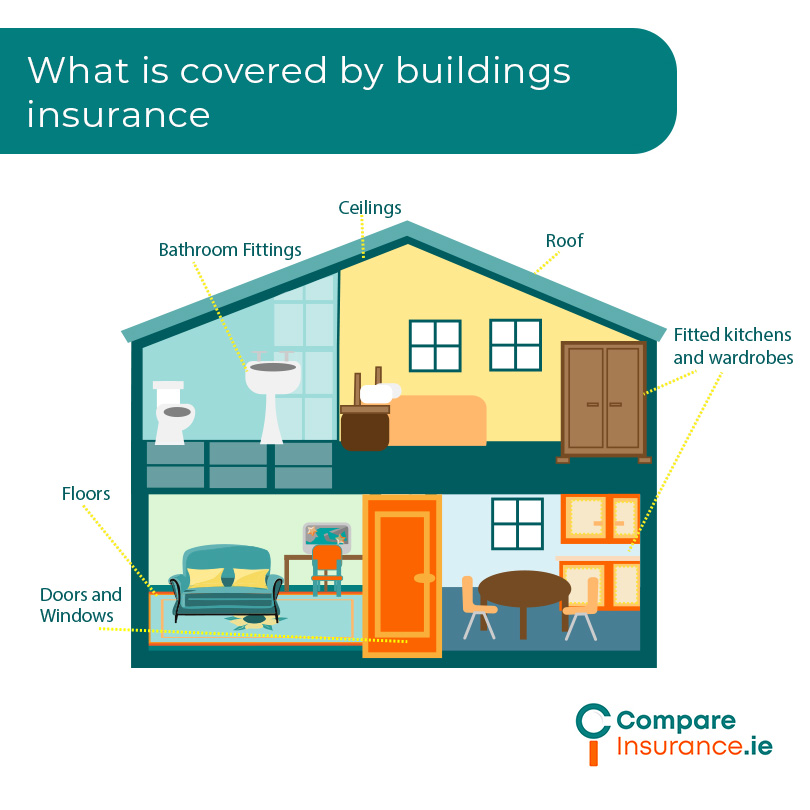

What is covered by buildings insurance?

Buildings insurance is usually only necessary if you own your own home and buildings insurance is sometimes referred to as homeowner’s insurance.

Buildings insurance will offer financial protection in the event of damage to the fabric and structure of the home, such as:

Generally, features outside the home such as boundary walls, sheds, outbuildings, and drives or paths would also be covered by buildings insurance.

Underground cables, pipes, septic tanks, and drain inspection covers should also be included in buildings insurance cover.

Your home’s contents are not protected by buildings insurance. This type of cover is solely to protect structural elements as well as permanent fixtures and fittings such as bathroom sanitary ware and taps, fitted kitchens and wardrobes.

Contents insurance offers financial protection if the homeowner’s possessions that are kept within the home such as furniture, clothes, electronic items etc. are damaged in an insured event.

Rebuilding costs

Your buildings insurance cover amount, or ‘buildings sum assured’, is based on a calculation of your home’s rebuild cost, not its market value (this would include the value of the site, for example).

The rebuilding cost of your home is the total cost of rebuilding the physical structure of your home following an insured event.

Rebuilding your home after a weather event, storm damage, or a break in can entail a huge cost and, in order to protect the investment you have made to purchase your home, and to provide a place for you and your family to live should something unexpected happen, you will need buildings insurance to meet the cost of unexpected repairs.

The Society of Chartered Surveyors Ireland provides information on rebuilding costs and a house rebuild calculator on their website.

Who should have buildings insurance?

Property owners or homeowners will need buildings insurance as it protects your property from risks which would entail significant expense to put right following an insured event.

Landlords will also need buildings insurance as their property will be protected should there be structural issues.

Apartment owners may not need buildings insurance as their building may be covered by a management company insurance policy, although this is not always the case.

Tenants usually do not need buildings insurance, although they may wish to protect their property with tenants insurance or contents insurance.

Landlord insurance

Landlords may purchase a specific form of buildings insurance tailored to their needs. Landlord insurance offers the protection offered by buildings insurance for the structure of the building that they have rented to tenants.

Landlords insurance offers protection from damage to the fabric of their property and rebuilding costs due to perils such as storms, lightning, floods, fire, and theft.

Landlord insurance may also offer additional cover for public liability, landlord’s contents cover,as well as financial protection against loss of rent due to an insured event.

Building damage covered by buildings insurance

Buildings insurance offers protection from the unexpected costs associated with rebuilding the fabric of your home following an insured event. Buildings insurance would usually include cover for:

You may also choose an additional form of buildings insurance cover:

Who provides buildings insurance in Ireland?

Buildings insurance is provided by these insurers:

(RSA)

It can be more cost effective to purchase a buildings only insurance policy than to purchase comprehensive home insurance as contents are not included in this type of cover.

How Compare Insurance Works

We compare all insurance options so you can be sure you’re always getting the best deal.

1. Select Your Product

Simply select the insurance product you need a quote for e.g. life, home or health insurance.

2. Online Quote Form

Fill out one of our simple online assessments with your insurance details.

3. Free Quote Consultation

A qualified financial advisor will call you back for your free insurance quotation.

Is there anything that is not covered by buildings insurance?

There are exclusions to buildings insurance. These may vary by insurer, so check what is covered by any policy before you purchase.

Depending on your home’s location or site, you may not be protected in the event of flooding or subsidence. There may also be a high excess for subsidence work included in your buildings insurance.

Homes are generally assumed to be of standard design, so timber framed houses, eco homes, period or listed buildings may not be covered by standard buildings insurance. Likewise, flat roofed homes may not be covered by standard buildings insurance.

Wear and tear type damage, damage caused by lack of maintenance or pests or vermin, or pet damage will likely not be covered by buildings insurance.

Unoccupied building insurance

Damage caused while your house is unoccupied for an extended period (usually over 30 days in a year), or while building work or renovations are being carried out would be excluded from most standard buildings insurance.

You may be able to maintain a very basic level of cover with your existing buildings insurer while the home is unoccupied or you may need specific insurance. Aivia offers ‘building in the course of construction’ policies for homes being built by contractors.

Contact us today

Your home represents a significant investment and you have worked hard to purchase your own home. Buildings insurance is an essential form of cover and may also be a condition of your mortgage.

Protect you and your family’s home with buildings insurance and avoid large unexpected bills should your home face storm, fire, a break in or other damage.

Fill out our online assessment or call us and we can discuss your needs with you so that your home is protected today.