If you live in an apartment you will need to ensure that your home is protected by insurance just like every home.

Apartment insurance is a form of home insurance that offers various types of protection depending on whether you own or rent your apartment, or if you are a landlord.

Insurance for your apartment may cover the building or, more typically, the contents of your apartment in case of fire, theft, or weather event to protect you from unexpected expenses due to loss or damage.

Table of Content

What type of cover do I need?

Apartments are slightly different from stand alone homes from the point of view of insurance as the apartment building may be covered by management company or apartment block insurance, meaning that many apartment owners, tenants, and landlords may only need contents cover.

Buildings cover protects the structure of your home such as walls, windows, and doors, and is based on the rebuild cost to repair or replace the building following a fire or storm for example.

Contents cover offers financial protection in the event that your belongings within the home need to be replaced following an insured event. This may include furniture, appliances, decor such as carpets or curtains, electronics, and high value items such as jewellery or sports equipment.

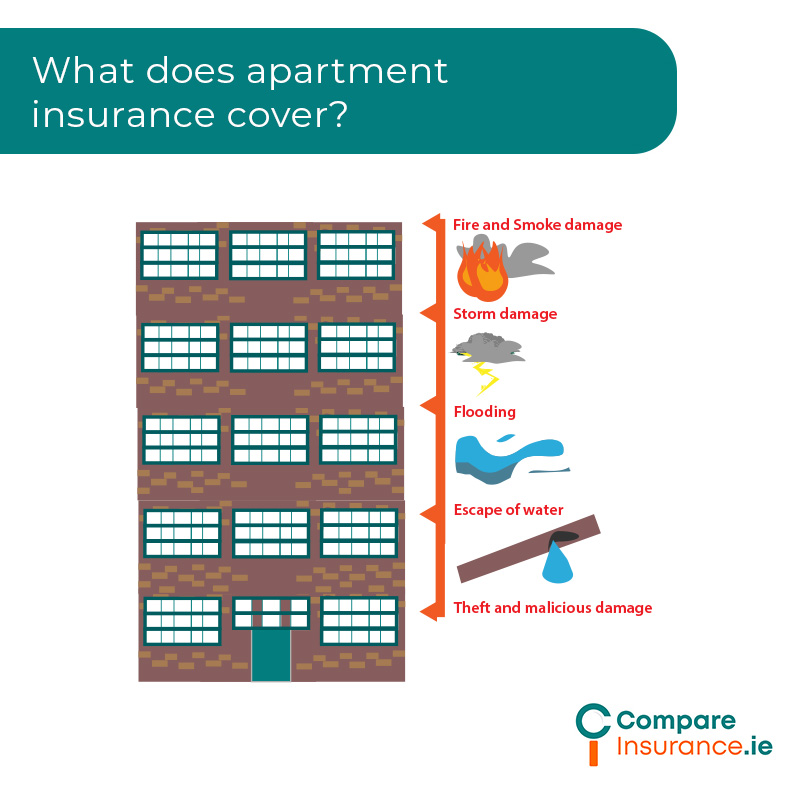

What does apartment insurance cover?

Apartment insurance is a type of home insurance and generally offers protection against:

Most apartment insurance offers a number of emergency home assistance call outs per year, where you will be able to call for assistance with a water leak, electrical or emergency heating repairs, to prevent further damage to the home.

Generally, the contents cover included in apartment insurance includes cover for fire brigade charges, and door lock replacement or repair and cover for stolen keys in the event of a break in or attempted break in.

Some apartment insurance offers free accidental damage cover for fixed glass, and audio and visual equipment as standard. Home office equipment may also be covered as standard.

Money and bank cards, and frozen food cover are usually standard as well as additional cover at Christmas and where there is a wedding in the home.

If you can try to purchase new for old contents insurance as this means that where your contents need to be replaced, you are covered for the cost of new items. Otherwise you will only receive a proportion of their replacement value.

Some apartment insurance will offer cover for alternative accommodation where your home is uninhabitable due to an insured event, this is not typically included in renters insurance though.

Apartment block insurance

Apartment block insurance is a specialised form of commercial insurance to protect apartment block owners, arranged by the management company of the apartment building.

It usually offers protection against building or structural damage, property owners liability, and employer’s liability for those working in the building.

As your apartment building is usually covered by this type of insurance, whether you are a landlord, tenant, or owner occupier, you will not usually need to purchase buildings cover.

Apartment owner’s insurance

Unlike when you purchase a house, when you are an apartment owner occupier you may only need contents cover to protect your furniture, appliances, your possessions, and possibly any high end fixtures and fittings you install such as kitchens, floors, and bathrooms.

Contents insurance will protect your possessions in case of fire, theft, escape of water such as a flood in the apartment upstairs damaging ceiling, and weather.

Your management company’s insurance policy should protect you as the property owner where you are legally liable, for example, a visitor trips on the stairs.

Your owner occupier’s apartment insurance, i.e. contents insurance, should offer legal liability cover to protect you where a visitor or domestic employee is injured, or has their property damaged in your home as a result of your occupation of the property.

You can add ‘all risks’ cover for high value items which you take outside the home such as jewellery, bikes, a laptop, or your phone.

You may also be able to add accidental damage cover to your home contents policy for an additional premium.

Tenants insurance for apartment renters

If you rent your apartment, you are responsible for your own possessions within your apartment and you will need to protect them with renters or tenants insurance.

Apartment block insurance only covers the building that your apartment is in and your landlord’s insurance will only offer protection for the landlord’s furniture and fixtures within the apartment.

This means that in the event of a fire, theft, storm, or flood, you will face the unexpected expense of replacing your belongings and you will need insurance to protect them.

You may also wish to cover some belongings outside the home such as your laptop, your smartphone, or your engagement ring or add accidental damage cover to your renters insurance policy for an additional premium.

Your renters insurance may also include some legal liability cover, for example financial protection where a visitor’s belongings are damaged in your apartment or where you have a bicycle accident outside your home, but this cover varies by insurer so check what is included in your policy.

Landlord’s insurance for buy to let apartments

If you let your apartment to residential tenants, you may wish to consider landlord’s insurance to protect your buy to let apartment or investment property.

Landlord’s insurance offers protection for your belongings within the apartment such as furniture, decor, and appliances if you let the apartment partially or fully furnished.

Landlord’s liability cover is also included in landlord’s insurance and protects you where your ownership of the property is responsible for injury to others or damage to their property, for example, a faulty electrical item causes injury to your tenant. You may also need to ensure that your legal liability to employees such as tradespeople, cleaners etc. is protected in case they are injured.

Landlord’s cover offers additional protection to standard contents type cover as it typically includes protection where you incur loss of rent as a result of an insured event. For example, where your property cannot be let due to property damage due to a flood or storm.

Who provides apartment insurance?

There are several insurers who offer home insurance in the Irish market, most of these insurers will protect apartment owners and apartment tenants.

(RSA)

Some insurers who offer landlord’s insurance include:

How Compare Insurance Works

We compare all insurance options so you can be sure you’re always getting the best deal.

1. Select Your Product

Simply select the insurance product you need a quote for e.g. life, home or health insurance.

2. Online Quote Form

Fill out one of our simple online assessments with your insurance details.

3. Free Quote Consultation

A qualified financial advisor will call you back for your free insurance quotation.

Cost of apartment insurance

This will depend on several factors, such as the type and address and security of the apartment, as well as the value of your contents and any specified valuables, and whether you are a tenant, owner, or landlord.

Here are some quotes for a two bedroom apartment in a Cork suburb, with €30,000 worth of contents and €250 excess. All quotes are annual prices.

Apartment Insurance FAQs

Arrange apartment insurance today

Compare insurance can ensure that you are protected by apartment insurance whether you own or rent your apartment or you are a landlord.

Apartment offers valuable protection for your apartment and may cost less than you think. For a low monthly premium you can ensure that your treasured belongings are covered by apartment insurance.

Our insurance specialists can advise and assist you to find the best apartment insurance for you from a range of insurers in the Irish market.

Call us or fill in our online form and one of our insurance specialists can contact you to discuss your insurance needs with you.