GP surgeries can be busy and it can be difficult to access a convenient GP appointment, not to mention the expense involved. Virtual GP services have the potential to transform the way we access GP care.

Virtual GP visits may allow you to consult a GP quickly and remotely by phone or online face to face and ask advice, get prescriptions, or be referred for an in person consultation, or for further treatment.

Make sure your Health insurance includes cover for virtual GP visits. It can also be included in some financial protection insurance plans.

What is a virtual GP visit?

A virtual GP visit is a consultation with a qualified GP that you can speak to in confidence by phone or via a laptop, tablet, or smartphone. They are also called a digital GP visit.

With some virtual GP visit providers you can book and see the GP on the same day and they typically offer longer hours than traditional in person GP surgeries.

Virtual GP visits can be accessed by adults, children, or older adults although most providers do not see very young babies remotely and serious health emergencies usually require emergency treatment by calling 999 or 112 or attending your local A&E.

Health insurance and virtual GP visits

Cover for virtual GP consultations is included in many health insurance plans. It is also a feature that you might not even have realised was included in some financial protection plans.

Here are the insurers that provide access to virtual GP consultations including health and financial protection insurers.

Benefits of virtual GP visits

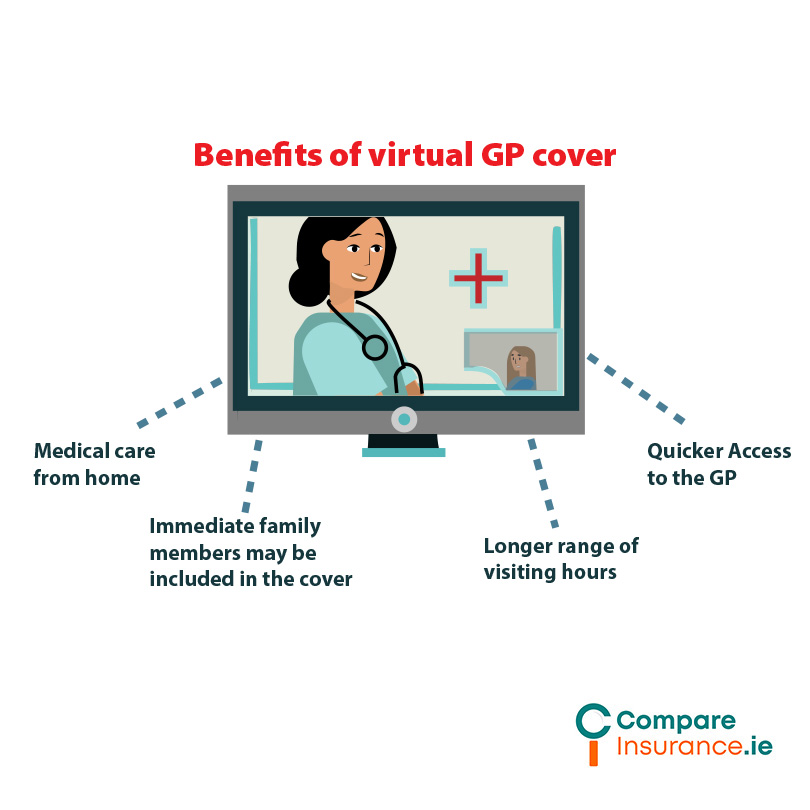

Virtual GP visits offer many advantages in terms of convenience as they usually offer quicker access to a GP consultation and they are often covered as part of your health insurance plan.

These services usually offer a wider range of hours than regular GP surgeries and you can attend your appointment from home or from work, without the hassle and time that travel to your appointment usually takes.

As well as this, policyholders and their immediate family members may be included in the cover for virtual GP visits.

For older people and people with mobility issues, virtual visits to the GP allow for medical care from the comfort of your own home.

Virtual GP visits are usually provided by private healthcare providers partnered with health or financial protection insurers and accessed either through your health insurance app or by contacting your insurer.

Are there limits to what can be treated remotely?

Yes. All of these services expressly state that they are not for use in medical emergencies, nor are they intended to replace your regular GP.

Medical emergencies such as the following would not be treated during a virtual GP consultation.

Young babies, such as babies under 6 weeks, or 12 months in some cases would need to be seen by your regular GP, or an out of hours GP or A&E in person, as might very elderly patients.

These services do not provide continuity of care or have access to your full medical history and so will usually not issue repeat prescriptions.

Where you would benefit from a physical examination such as with respiratory conditions, or where a sports or other injury limits your range of movement it may be better to see a GP in person.

Get insurance cover for virtual GP visits today.

When choosing health insurance or financial protection, virtual GP visits might not be the first thing that springs to mind but they are a useful extra to have.

If you wish to be covered for virtual GP visits, discuss your health insurance or financial protection needs with Compare Insurance today.

Our Central Bank regulated insurance advisors can discuss your insurance needs with you and advise you on the best insurance cover for your circumstances.

Fill in our assessment and get free low quotes from all the insurers on the Irish market today.

Author: Séamus Ó Doirín | Chief Insurance Editor

Séamus Ó Doirín is a Donegal based QFA who has been writing about insurance since 2020. His main focus is getting people the best value for insurance in the Irish market. His writing covers all areas of insurance and is a valuable part of the Compare Insurance team.