Income protection insurance is a form of insurance that protects your income if you have a serious injury or illness and are unable to work.

You can insure up to 75% of your income and receive a monthly payment to meet your essential financial commitments when you need to claim. You can even claim tax relief on your monthly premiums.

You may think that your sick pay entitlement or your savings would tide you over were you unable to work for a time, but what if you were out of work for months or even years due to a serious illness or an injury that lead to longer term disability?

Protect your income

If you are employed or self-employed and you have financial commitments, such as a mortgage or rent, to pay or you have a family or other dependents who rely on you financially then you should consider income protection insurance.

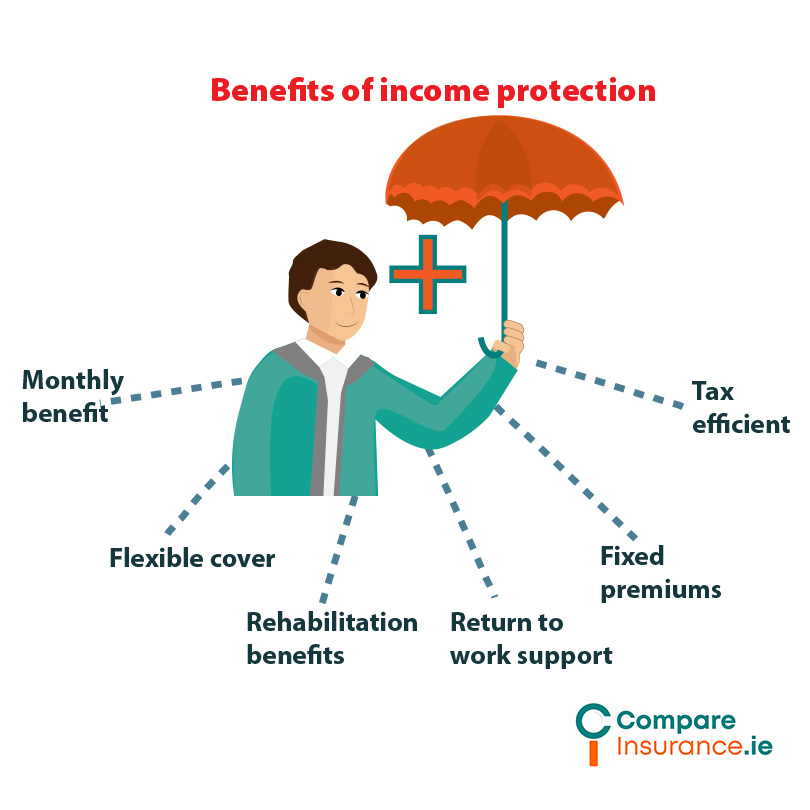

Here are the benefits of income protection:

Peace of mind

Protecting your income with income protection insurance gives you financial security and peace of mind. Times of illness or injury are stressful enough without having money worries on top of everything else you have to deal with.

If you are employed or self-employed and rely on your income, income protection is a really valuable safety net meaning that, if you are seriously injured or ill you will receive a regular monthly benefit to replace your income, rather than relying on State benefits or short term employer sick pay.

Having income protection cover in place can alleviate stress and anxiety and allow you to focus on your recovery.

Compare insurance online assessment

Take our online income protection assessment to see if you qualify for income protection insurance today.

Compare Insurance is Ireland’s leading insurance comparison website. We have loads of information and articles about income protection to give you the information you need.

You can compare income protection insurance quotes from Ireland’s leading insurers, saving you time and money, or speak to a Central bank regulated insurance advisor.

Author: Séamus Ó Doirín | Chief Insurance Editor

Séamus Ó Doirín is a Donegal based QFA who has been writing about insurance since 2020. His main focus is getting people the best value for insurance in the Irish market. His writing covers all areas of insurance and is a valuable part of the Compare Insurance team.