Irish farming and agriculture is a rich tradition and is central to our national culture and economy.

Generations of skills and knowledge lead our farmers to produce world famous dairy products, exceptional beef, and grains.

Irish farmers are also keen to embrace new technology and develop new businesses alongside traditional farming.

However, farming is not without risk and, as a farmer, you will want peace of mind that your livelihood, livestock, and farm buildings and business are protected from all of the perils they can face.

Table of Content

What is farm insurance?

Farm insurance is a form of business insurance that offers types of cover that are common to all businesses and also specific to the risks faced by farms and farmers.

Your farm is your home as well as your business and will be a legacy that you leave to provide a livelihood and home for future generations so it is important to protect it with farm insurance.

Farm insurance is usually tailored to the needs of a specific farm, depending on the type and size of the farm, as well as the types and value of buildings, machinery and vehicles on the farm.

Farms are, by their nature, risky environments and farm insurance is complex and comprises a number of types of cover for a variety of perils.

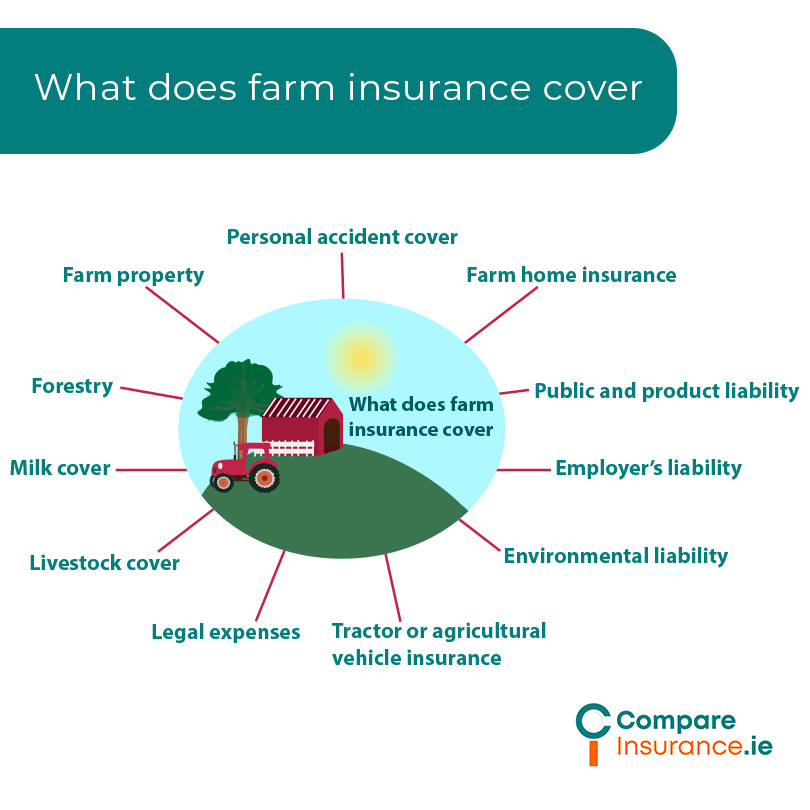

What does farm insurance cover?

Farm insurance consists of protection against a variety of risks, ideally farm insurance should cover the risks unique to your farm and any business that you run associated with your farm.

The following types of cover may be included in the package of insurances that cover your farm:

Farm property

Your farm outbuildings will require protection from perils such as fire, lightning, storm, and flooding as will their contents.

Farm property contents such as hay or straw, agricultural produce, farming implements and utensils, as well as trailered implements and vehicles can all be protected by farm insurance.

Farm property insurance should also include cover for fire brigade charges.

Theft of diesel or of tools and farm implements may be included in the farm property aspect of your farm insurance.

Farm home insurance

Your farm is not just your livelihood, it is also your home. Your home and contents should be covered by farm insurance. Farm insurance typically covers your home against fire, storm, explosion, escape of water, and theft or attempted theft.

Some farm policies will also cover accidental damage to your home, as well as ‘all risks’ cover for items that you use away from the home. If your home has an office, ensure that its contents are included in your cover.

Public and product liability

Public liability insurance offers protection where a third party is injured or has their property damaged as a result of your farming activities or while on your farm. This is an essential element of farm insurance and cover can be available for up to €6.5 million, depending on your liability.

Product liability will offer protection where a third party suffers injury or a loss due to a defect in products supplied by the farmer. This can include recreational use of your land.

Employer’s liability

The CSO estimates that the agricultural labour force numbers 278, 600 people. Your farm may have employees or you may rely on the help of family, friends, or neighbours at times.

Whether a paid employee or an unpaid volunteer, if someone is injured or killed or has their property damaged while working on your farm, you will need to have employer’s liability cover in place as part of your farm insurance.

You can purchase €13 million employer’s liability cover on some policies, but the cover you need will depend on the wages paid by the farmer to the employees as well as whether they are paid or voluntary. You may also need additional cover if you, or your family, engage in any agri contracting.

Environmental liability

If you are found to be legally liable for an environmental incident and its clean up, you will need to have environmental liability insurance in place.

Environmental liability cover will also protect you where a pollution incident causes injury or loss to a third party.

Tractor or agricultural vehicle insurance

If your tractor, jeep, van, or quad bike is driven on a public road, then it is legally required to be insured with third party cover at a minimum.

Farm tractor or vehicle cover may be available independently of a farm insurance package and will possibly also include cover for a trailer as standard.

Third party, third party, fire, and theft, and fully comprehensive cover is available on vehicle policies. Only comprehensive cover will include cover for damage to your own vehicle. Cover for a trailer may only be third party cover unless you purchase additional optional cover.

Open drive may be available on farm motor insurance which allows any qualified driver to drive the vehicle with your permission.

Livestock cover

Livestock cover may include protection for theft of livestock and injury or fatal injury to livestock by fire, flood, electrocution or storm. Cover for transportation of livestock, livestock on foot including straying, and attendance at a sale or show may also be provided.

Protection should your livestock be injured by collapse of slats may also be available as part of a farm insurance package.

Optional forms of livestock cover may be purchased in addition to standard livestock cover to protect against sheep worrying, accidental death, and pedigree cover to protect against accident or illness.

Milk cover

Milk cover includes financial protection should you experience loss of milk due to a number of factors such as inclement weather, contamination, or deterioration of milk in a bulk tank.

Failure of milk storage or bulk tank,or milking equipment may also be covered by farm insurance. Milk cover operates in a similar way to business interruption cover in that it covers against loss of income from milk.

Forestry

Forestry cover may be purchased as part of a farm insurance package to protect your investment in forestry plantation.

Forestry cover may offer protection against fire, storm, lightning, and wind damage, as well as fire brigade charges. Loss of timber income and replanting cost following an insured peril may also be included.

Legal expenses

Legal expenses cover is intended to offer protection for legal costs that arise in defending or pursuing a civil action.

Examples may include employment disputes, property protection, and legal defence.

Personal accident

Personal accident is intended to provide you with protection in the event that you are injured, disabled, or in the worst case killed, while working on your farm.

Nobody wants to think about worst case scenarios but it would be expensive to pay for labour to replace all the work that you do on your farm if you were out of action and you would also need to replace your own income so personal accident cover is essential.

How Compare Insurance Works

We compare all insurance options so you can be sure you’re always getting the best deal.

1. Select Your Product

Simply select the insurance product you need a quote for e.g. life, home or health insurance.

2. Online Quote Form

Fill out one of our simple online assessments with your insurance details.

3. Free Quote Consultation

A qualified financial advisor will call you back for your free insurance quotation.

Insurance for different farms and diversification

Not all farms will need all forms of farm insurance cover. Ideally, you will be able to find farm cover that is tailored to the nature of your farm be it beef, dairy, or tillage. Your insurance needs can also change over time so adding new buildings or buying new livestock, for example, may result in new insurance needs.

If you run another business from your farm or your farmhouse such as a farm walk, shop, holiday rental, or open farm it is really important that you put insurance cover in place for that business also as running another business from your farm will increase the risks associated with the farm and may also expose you to different forms of risk.

It is essential to keep reviewing your farm insurance cover to avoid underinsurance and as your business grows so that you are protected from any perils that may threaten your livelihood.

If you are letting any of your farm buildings or houses on your farm, you must check that tenants are covered for any activities that take place. Likewise, if you are letting any properties to residential tenants or tourists, you may need landlord’s or holiday home insurance.

Insurance for small farms vs large farms

Farms under 100 acres may be considered smaller farms. Farm acreage may be used to calculate your public liability cover.

However, farm size is not the only factor which determines the cost of farm insurance. Other factors include:

Who offers farm insurance in Ireland?

How much is farm insurance in Ireland?

There is a huge variety of farm sizes and types, as well as additional forms of cover available for farms and this is reflected in the price of farm insurance.

Generally, farm insurance is sold as a tailored package and you will need to discuss your requirements with a farm insurance specialist to ensure that you have appropriate farm insurance cover.

The following is an example of a relatively straightforward farm insurance quote:

AXA farm insurance for 80 acre farm, in mixed use, €100,000 outbuildings cover, €50,000 outbuildings contents cover, no farm house, no livestock, tractor worth €30,000, no previous claims.

€870.91 per year.

Common claims made for farm insurance compensation

Claims for farm insurance compensation come in many forms which reflects the diverse and complex nature of perils on farms and in farming.

Claims made may include:

Get a quote today

Get peace of mind that your farm is covered with the best and most cost-effective farm insurance for your farm and your farming activities.

If it has been a while since you reviewed your farm insurance cover, our specialists can go through your requirements and will guide you in ways that you could update your cover.

Call us or fill in our online form and our insurance advisers will discuss your farm insurance needs with you.