Life insurance is one of the most important decisions you can make for your family’s financial security.

Taking out a life insurance policy ensures your family is protected financially in the event of your death. Make sure you’re covered by speaking to Compare Insurance for the best value life insurance on the market.

Types of life insurance cover

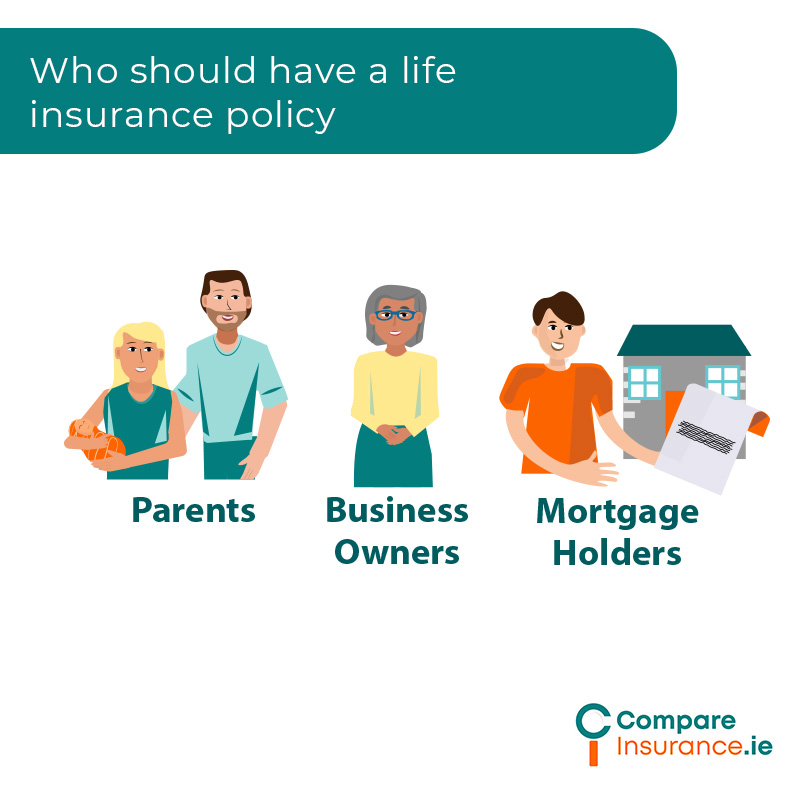

Who should have a life insurance policy

While life insurance is not a legal requirement, it is recommended that certain people have a policy to protect those around them in the event of their death.

Who provides Life insurance in Ireland?