Working in the busy and dynamic catering business means that you are always striving to produce amazing food and a top notch dining experience.

Whatever your type of catering business or your location, from fine dining corporate catering to catering for events such as weddings or conferences, to a coffee van in a scenic spot or a food market stall, you want to provide your customers and clients with the best.

But accidents can happen and things can go wrong, no matter how careful you are and you will need to protect your business with catering insurance. Catering insurance is a form of business insurance which is adapted to the needs of your industry and to your individual business.

Table of Content

Why do I need insurance for my catering company?

Working in an ever changing and fast paced industry brings specific risks and you need specialised insurance that protects your business.

Serving food and drink to customers can mean that your business is open to a variety of unexpected events and you will need to protect your business, your staff, and your equipment.

Accidents and damage can lead to stress, legal problems, and financial losses that could put you out of business, whether or not they are your fault and so it’s essential that you put cover in place for the risks faced by your catering business.

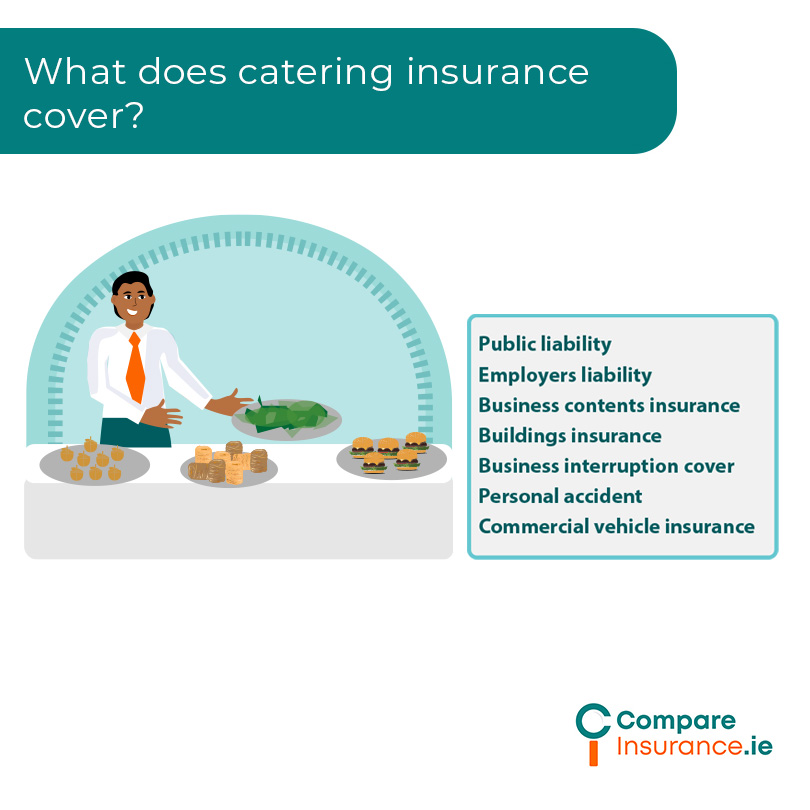

What does catering insurance cover?

Depending on the unique nature of your catering or food business, you may need some or all of the following types of business insurance in your catering insurance package.

How Compare Insurance Works

We compare all insurance options so you can be sure you’re always getting the best deal.

1. Select Your Product

Simply select the insurance product you need a quote for e.g. life, home or health insurance.

2. Online Quote Form

Fill out one of our simple online assessments with your insurance details.

3. Free Quote Consultation

A qualified financial advisor will call you back for your free insurance quotation.

Who provides catering insurance?

These companies provide business insurance in Ireland:

Offer food and beverage insurance for catering businesses.

Offer specific restaurant, cafe, and takeaway insurance.

Catering insurance specialist underwriters also offer catering insurance:

Dolmen – restaurant & mobile catering insurance.

Brady Underwriting – catering insurance.

Here at Compare Insurance, we work with business and specialist insurers to provide your catering business with the most comprehensive insurance package at a competitive price.

How much does catering insurance cost?

Catering insurance may not cost as much as you think. Like all forms of business insurance, your catering insurance premium is based on the nature of your individual business, its size, number of employees, relevant types of cover and any previous claims you may have had.

Safety measures such as building security, safety training for staff, fire safety measures and training, food regulation and legislation compliance measures, and high levels of cleanliness, tidiness, and maintenance all contribute to making catering insurance more affordable.

Contact us today

Whether you are dishing up chips and burgers from your catering van, Providing fine dining for weddings and corporate events, or providing that much needed caffeine hit from a coffee trailer, protect yourself and your catering business with catering insurance.

Compare insurance offers catering insurance from specialist insurers that understand the nature of your catering business and the pride that you take in providing high quality food and beverages to your customers.

Fill in our online assessment or call us and one of our specialist insurance advisors will contact you to discuss your business with you and find you the catering insurance cover that you need at the most affordable price.