Business interruption insurance is a form of business insurance which offers financial protection where a business cannot operate in certain circumstances.

Business interruption insurance, also known as consequential loss cover or loss of profit cover, allows your business to continue trading where it has been affected by an event such as fire, theft or attempted theft, storm, flood, or vandalism.

Table of Content

What is Business interruption insurance?

Business interruption insurance, or consequential loss cover, allows your business to continue to operate, despite the occurrence of an insured event which causes the business to cease trading.

The financial protection of business interruption cover will mean that your business can recover from, for example, a fire, break-in or weather event.

Business interruption cover is usually sold as part of a wider insurance package tailored to the needs of specific businesses such as shops, salons, offices, surgeries, restaurants, pubs, manufacturing,or wholesale businesses.

It is usually offered in conjunction with other forms of business insurance relevant to that particular business such as buildings and/or contents cover, public liability, product liability, or employers liability.

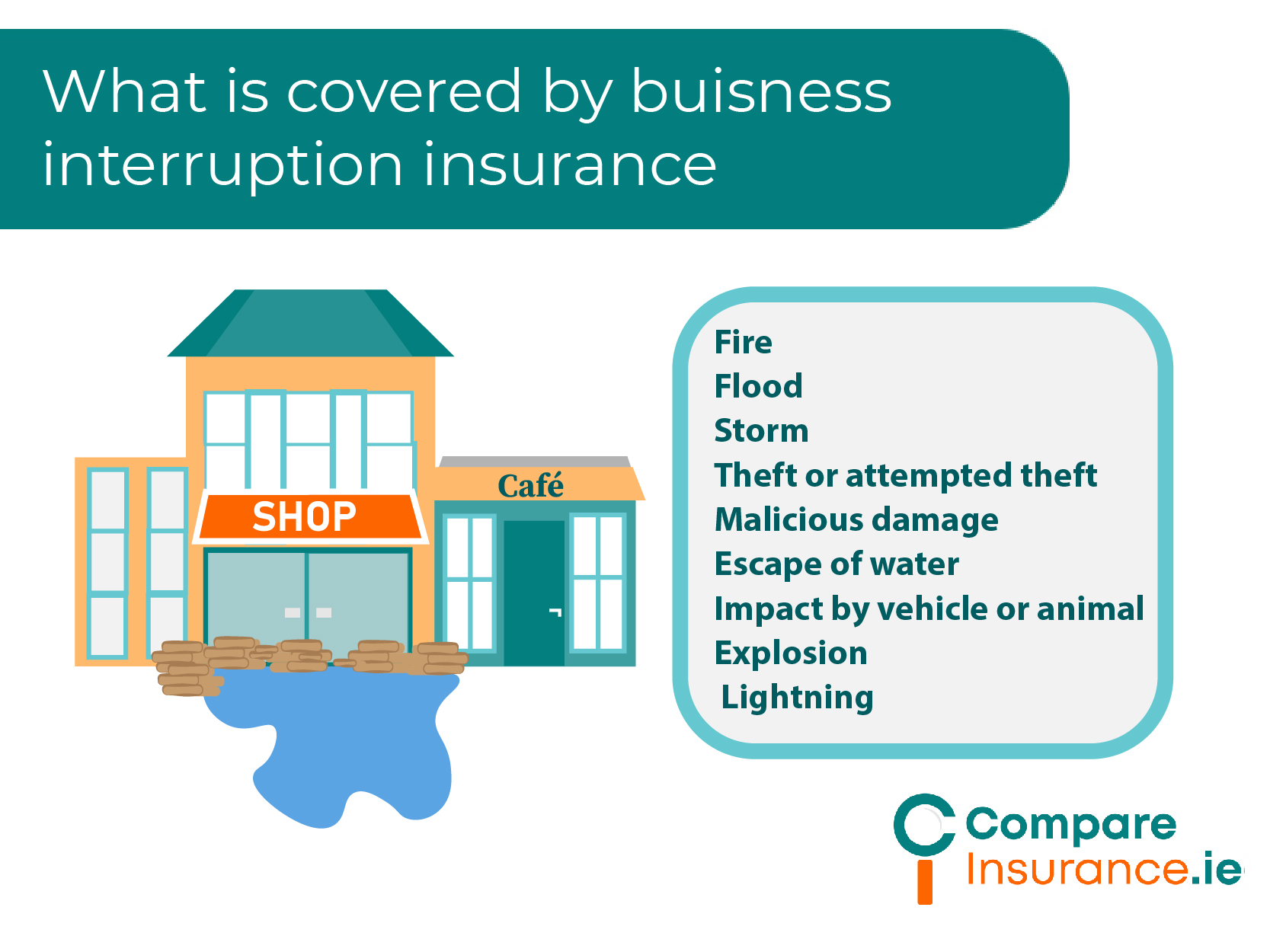

What does Business interruption insurance cover?

Business interruption cover offers protection for the financial aspects of the business following:

It is usually offered alongside commercial property insurance which offers protection for damage to the building, contents, fixtures and fittings of a commercial premises following one of the listed events.

Where the business can no longer trade or operate, business interruption insurance will offer your business protection so that it can meet its financial obligations and continue trading.

Business interruption insurance protections against loss of profits or income

Business interruption insurance will protect the business against loss of gross profit or a reduction in its income while it cannot trade due to the unexpected event.

It may cover the costs of relocating your business to another premises, or any increased operating costs as a result of the move. Some business interruption cover may offer protection for the cost of upskilling or retraining employees following a relocation.

Salaries or wages may be covered by business interruption insurance until your business is in a position to resume trading and can generate an income.

Loss of rent may be covered by business interruption insurance where the policy covers a commercial property. Loss of rent cover will allow a commercial landlord to maintain their cash flow while they rebuild or repair property damaged in an insured event.

The period of indemnity is the length of time your business will be offered financial protection under the business interruption element of your business insurance. Some insurers offer a period of indemnity of up to 3 years.

It is essential that you choose a period of indemnity that will allow you time to continue trading and rebuild your business. If the period of indemnity is not long enough, you may find that your business will not survive, despite having business interruption cover in place.

Business interruption insurance providers Ireland

Business interruption insurance is generally offered as part of a wider business insurance or commercial property insurance.

Several of these insurers offer business interruption insurance as part of an insurance product offered to small or medium businesses by sector e. shop, office, surgery, salon, restaurant etc.

The type and level of insurance cover appropriate to your unique business will depend on the size and nature of the business. The amount of business interruption your business will require depends on the gross profit of your business and the nature and extent of risk it faces.

Examples of Business interruption insurance claims

There are many instances where business interruption cover will protect your business should the unthinkable happen.

If a fire were to make your shop unusable, business interruption cover would offer protection to rent an alternative premises, and/ or pay wages and rates while you were unable to use your shop or it was being rebuilt.

If a water leak in your restaurant kitchen meant that you could not open until repairs had been carried out, you could claim on your business interruption insurance for lost income for the time period that you were closed and for wages and overtime to pay employees in order to get the business reopened

If your salon were broken into or vandalised, business interruption cover would compensate you for lost income and cover ongoing expenses until you were able to reopen.

A commercial landlord who was unable to rent out a premises following a flood would be able to claim loss of rent as part of their business interruption cover.

How Compare Insurance Works

We compare all insurance options so you can be sure you’re always getting the best deal.

1. Select Your Product

Simply select the insurance product you need a quote for e.g. life, home or health insurance.

2. Online Quote Form

Fill out one of our simple online assessments with your insurance details.

3. Free Quote Consultation

A qualified financial advisor will call you back for your free insurance quotation.

What businesses should have Business interruption insurance?

All businesses could benefit from the peace of mind that business interruption insurance brings.

If your business is based in a premises or has equipment, plant, or machinery then you should consider business interruption insurance whether you are a sole trader, small or medium enterprise.

FAQs

Learn more about Business interruption insurance today

You have worked hard to build up your business. If an unforeseen event were to occur, would your business be able to withstand the additional financial burden of operating with possibly increased expenses and a loss of profit or income ?

Rather than hope for the best, talk to us today about the right business interruption insurance for your business so that you are prepared for the worst. We can find you the best cover at the best price for your business.