Hospitals in Ireland are generally categorised as being public hospitals and private hospitals. Public hospitals are largely funded by the State, whereas private hospitals receive no state funding.

Irish (and EU) residents are entitled to access public hospitals, where inpatient care and accommodation is free. Outpatient services are also available to Irish (and EU) residents but there may be some charges. If you are treated as a public patient, you cannot choose your consultant.

To find out what private health care plan is best for you, speak with compare insurance today and get the best quotes on the market.

Table of Content

Private care in a public hospital

You can also be treated as a private patient in an Irish public hospital, where you may be treated by a consultant of your choice. You will have to pay for your private hospital accommodation (in the public hospital) and treatments which will be carried out in the public hospital.

Care in private (or independent) hospitals comes with charges for the patient and you will have to pay for hospital accommodation and treatments, either as an inpatient or outpatient. You can choose your consultant if you are treated in a private hospital.

Private hospitals

There are a number of private hospitals in Ireland, mostly located in cities and larger towns. There are fewer private hospitals than public hospitals, and they are concentrated in the Dublin area with some regional hospitals and clinics.

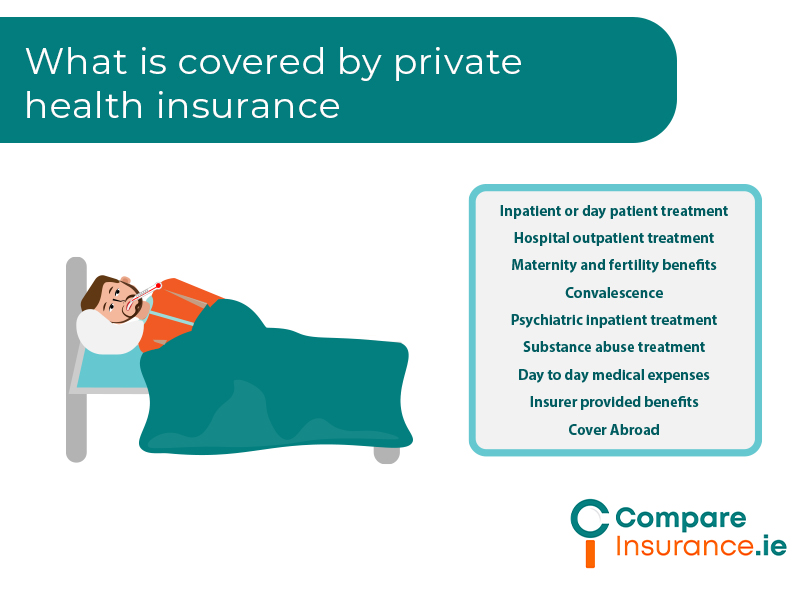

Realistically, you will need health insurance to access care or treatment in the private hospitals as all care, treatments, and services are charged to the patient. Care and treatment in private hospitals may be on an inpatient, day patient, or outpatient basis.

Private hospitals and health insurance

If you are an inpatient in a private hospital, you can avail of either semi- private or private accommodation which will affect how much you pay for hospital care. Hospital accommodation may be in smaller rooms with one (private) or two (semi-private) beds rather than the larger rooms available in public hospitals.

Private treatment may offer faster access to consultant visits, diagnosis, and treatment than the public health care system and is one of the key perceived advantages of having health insurance.

Health insurers offer various types and levels of cover for treatment and accommodation in private and high-tech hospitals, and this factor is one of the key determinants of the price you pay for health insurance.

High-tech hospitals

High-tech hospitals are private hospitals with more advanced equipment and treatments available. These hospitals are generally more expensive than other private hospitals and their charges reflect this.

High-tech hospitals offer more advanced cardiac, orthopaedic, cancer, and ophthalmic procedures, for example.

High-tech hospitals are all located in Dublin, the Beacon, the Mater Private, and the Blackrock Clinic are high tech hospitals.

All inpatient health insurance plans will offer cover for treatment as a private patient in a public hospital, most also some cover for private hospitals, but not all will cover high-tech hospitals.

Where can I receive private hospital care in Ireland?

There are a number of private hospitals and high-tech hospitals in Ireland, offering a range of inpatient, day patient, and outpatient care and treatments.

Generally, private medical care in Ireland is consultant led and requires a letter (or referral) from your GP to access these services although some may be direct access.

Beacon Hospital, Dublin, and Limerick

The Beacon Hospital is considered a high-tech hospital.

There is a full acute hospital in Sandyford, Dublin with over 300 consultants and inpatient and day patient beds, as well as 8 operating theatres. The Beacon Hospital provides cancer care, cardiology, orthopaedics, as well as paediatric care. The hospital also operates an emergency department and rapid access cardiology centre.

Beacon Limerick provides diagnostic imaging and health screening.

Blackrock Health

The Blackrock clinic is considered a high-tech hospital. The Hermitage Clinic and The Galway Clinic are classed as high-tech hospitals in some Irish Life plans.

The Blackrock Health group includes The Blackrock Clinic in Dublin, The Galway Clinic, The Limerick Clinic, as well as The Hermitage, Lucan.

The Blackrock Clinic offers advanced cardiac and orthopaedic care, surgical and medical treatments, and diagnostic and imaging services.

The Galway Clinic offers cardiac care, oncology, orthopaedic care, as well as diagnostic and imaging services.

The Hermitage Clinic, Lucan, offers neurosurgery, orthopaedic surgery, cardiology, oncology, urology, and has an Intensive Care Unit.

The Limerick Clinic is an outpatient diagnostic facility.

Bon Secours Health System

Bons Secours Health System has acute hospitals in Cork, Dublin, Limerick, Galway, and Tralee.

Bon Secours Cork has a Medical Assessment Unit for emergency care, as well as a Paediatric Assessment Unit. Bon Secours Cork also offers a Specialist Breast Care Centre and a Rapid Access Prostate Clinic.

The Cork Cancer Centre has advanced facilities for private cancer care including chemotherapy, immunotherapy, hormone therapy, clinical trials, and palliative care.

The Cork Care Village has a long-term care home, as well as independent living units.

The Bon Secours Dublin offers private endoscopy, cardiology, and orthopaedic care.

Mater Private Network

The Mater Private in Dublin is considered a high-tech hospital.

The Mater Private network has hospitals in Dublin and Cork, as well as a Radiotherapy Centre in Limerick.

The Mater Private Dublin specialises in Cardiac Care and has a 24/7 Urgent Cardiac Care Unit, as well as a private cancer centre and emergency department.

The Mater Private Cork has inpatient private rooms, as well as an emergency department and Urgent Cardiac Care.

The Cork Centre for Women’s Health offers women’s health services e.g. gynaecology, urogynaecology, pre and post obstetric services, and perimenopause and menopause care.

St. John of God, Dublin

St. John of God is an acute psychiatric inpatient and outpatient hospital for assessment, treatment, rehabilitation, and care.

St. Vincent’s, Dublin

St. Vincent’s is a private acute hospital offering a wide range of consultants and specialist care.

St. Vincent’s Hospital is a specialist Cancer Centre of Care from diagnostics to treatments including chemotherapy, immunotherapy, cancer surgery, and radiology.

St. Vincent’s is an Obesity and Bariatric Centre of Care with weight management care including nutrition and exercise, pharmacotherapy, and surgical therapy.

UPMC

UPMC Healthcare has hospitals in Waterford, Kilkenny, Kildare, and Dublin, as well as UPMC Hillman Cancer Centres in Cork and Waterford, and an outpatient clinic in Carlow.

UPMC Whitfield Hospital in Waterford is an inpatient hospital which specialises in diagnostic imaging, urology, orthopaedics, eye & vision health, heart health, and cancer care. Aut Even Hospital in Kilkenny, and UPMC in Kildare are both inpatient hospitals also.

UPMC Sports Surgery Centre in Dublin is a specialist private orthopaedic hospital.

UPMC Hillman Cancer Centre, in Waterford and Cork, offers specialist and advanced cancer diagnosis and care including medical and surgical cancer treatments, and advanced radiotherapies.

Irish Life private hospital cover

Irish Life cover for a private hospital stay and high-tech hospital stay is available on many of their plans. Irish Life organise their plans into categories:

Example 1

4D Future Plan hospital cover (average priced plan) – €136.40 per month

Example 2

Optimise Platinum with Day-to-day hospital cover – €738.57 per month

VHI private hospital cover

VHI hospital cover is categorised at 4 levels according to the type of hospital accommodation that is provided. You can also choose additional benefits in various areas, such as advanced cardiac care, joint replacement, and ophthalmic procedures, for example.

Example 1

Company Plan Plus Level 3 hospital cover (average priced plan) – €130.00 per month

Example 2

Premium Care hospital cover – €391.99 per month

Laya private hospital cover

Laya offers hospital cover at all levels with their health insurance plans divided into suites. There are 31 suites, each with cover at various levels. Some of Laya’s plans include an inpatient excess of up to €600.

Example 1

Flex250 Explore (average priced plan) hospital cover – €125.27 per month

Example 2

Empower Connect (no excess) – €453.11 per month

How Compare Insurance Works

We compare all insurance options so you can be sure you’re always getting the best deal.

1. Select Your Product

Simply select the insurance product you need a quote for e.g. life, home or health insurance.

2. Online Quote Form

Fill out one of our simple online assessments with your insurance details.

3. Free Quote Consultation

A qualified financial advisor will call you back for your free insurance quotation.

Affordable health insurance private hospital cover

As always when choosing any insurance policy, it pays to shop around. Health insurers have multiple policies even at similar price levels, e.g. VHI has 80+ policies, so do look carefully at what you are being offered in any plan.

Average health insurance policy cost

The average health insurance policy, according to the HIA, is €1,574 (September 2023). It is possible to find a health insurance policy that covers care in a private hospital around that price range. You may not find that you can get cover for inpatient care in high-tech hospitals at this price level, or you may find that you would face a nightly shortfall in choosing high-tech hospital care.

You may find that, if you are willing to choose a policy with less cover for day-to-day expenses, you can get better hospital cover with another health insurer or on a different plan with your current health insurer. Always check if any waiting periods will apply when switching or upgrading your health insurance cover.

You may find that you can find a higher level of cover if you are willing to take on a higher inpatient excess. However, this may mean that you face a high outlay at a stressful and possibly expensive time, so consider the level of excess you choose carefully.

Contact us today.

If you are taking out health insurance for the first time, or switching or upgrading your health insurance cover the number of options available can be overwhelming and a mistake can be costly.

We have qualified advisors who can look at your options with you and find you a policy that suits your requirements. Call us or fill out our online questionnaire and enjoy the peace of mind that you and your family will be protected.