What Does Car Insurance Cover?

Even a minor accident could have a high price tag. Car insurance is designed to protect you financially in case you are liable for damages, injuries, or losses while driving. Insurance in Ireland may assist with the following (depending on the policy you pick):

Damages to other vehicles & property: Third party vehicle and property, including repairs or replacement, when you are responsible for a collision.

Injury claims & vehicle loss: Claims for injuries and legal expenses of other drivers that were injured in the accident.

Damage to your own car: Some policies cover the cost of repairing your car after an accident, depending on the level of cover you have and the terms of the policy.

Fire & theft protection: This covers you if your vehicle is stolen or is damaged due to fire.

Weather or environmental damage: Damage to your car from weather-related or environmental events like thunderstorms or hail.

Choosing The Right Car Insurance in Ireland

There are three basic types of car insurance cover: Third Party Only, Third Party, Fire & Theft, and Comprehensive. The correct type of insurance cover will depend on your vehicle, your driving, your budget, and how much coverage you need.

Comprehensive Cover

Comprehensive Cover provides the most complete type of insurance coverage. It will provide you with an extensive amount of coverage, including your own vehicle should it need to be repaired due to an accident or other damage, as well as any damage caused to or injuries sustained by others. Newer cars or high-value vehicles are typically purchased with comprehensive insurance.

Third Party Only

Third Party Only (TPO) is the lowest level of insurance that is required to drive on the road in Ireland. If you purchase TPO insurance, you will be covered in case you damage someone else’s property or injure them; however, you will not be protected against damage to your own vehicle.

Third Party, Fire & Theft

Third Party, Fire and Theft. This type of insurance is generally recommended for older vehicles or for individuals who do not require all of the protections offered through Comprehensive insurance. This type of insurance provides you with coverage against third-party claims and also protects you if your vehicle is stolen or damaged by fire.

Car Insurance Additional Benefits & Optional Extras

Many Irish motor insurance policies include additional features beyond basic coverage, both standard and optional. The features included and their pricing will depend upon the specific insurance company and type of policy purchased.

How Much Does Car Insurance Cost in Ireland (2026)?

The cost of car insurance in Ireland depends on factors such as your age, driving experience and history, e.g. penalty points, the car you drive, and where you live. Because insurers assess risk differently, prices can vary widely.

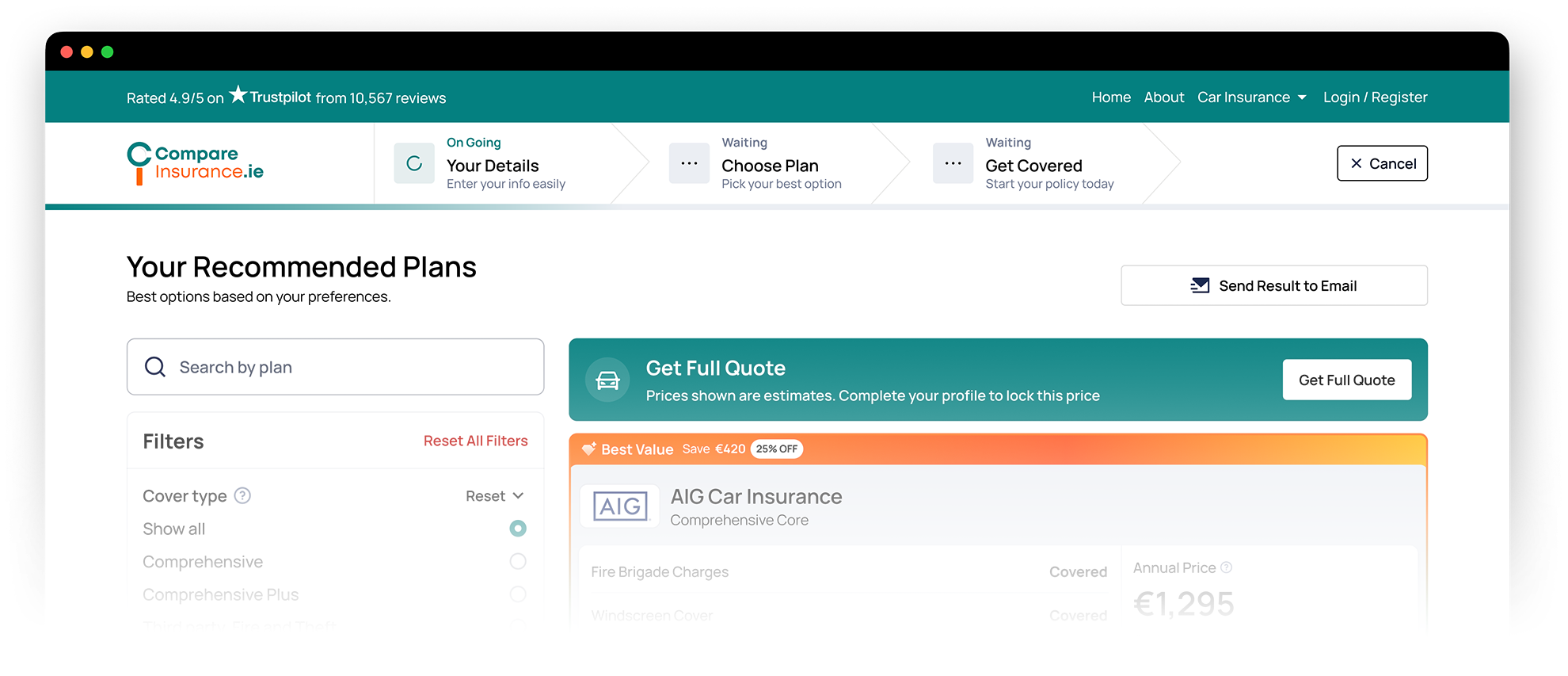

Average prices change over time, which is why comparing car insurance regularly is one of the most effective ways to find better value and avoid paying more than necessary.

Types of Driver Insurance

How To Choose The Right Car Insurance Policy

Choosing car insurance isn’t just about finding the lowest price. Looking at cover levels, excess amounts, and claims support can help ensure you’re properly protected if something goes wrong. While cost is important, the cheapest policy isn’t always the right choice, particularly if you drive a newer car or one with higher repair costs.

Types Of Vehicle Insurance

There are niche types of car insurance more suited to certain vehicles.

Who Offers Car Insurance in Ireland?

There are several insurers offering car insurance in Ireland, with prices and cover varying between providers.

(BoxClever)

(formerly Liberty Insurance)

Car Insurance FAQs

Find answers to common questions about Car Insurance